Annual cash inflows that will arise from two competing inves

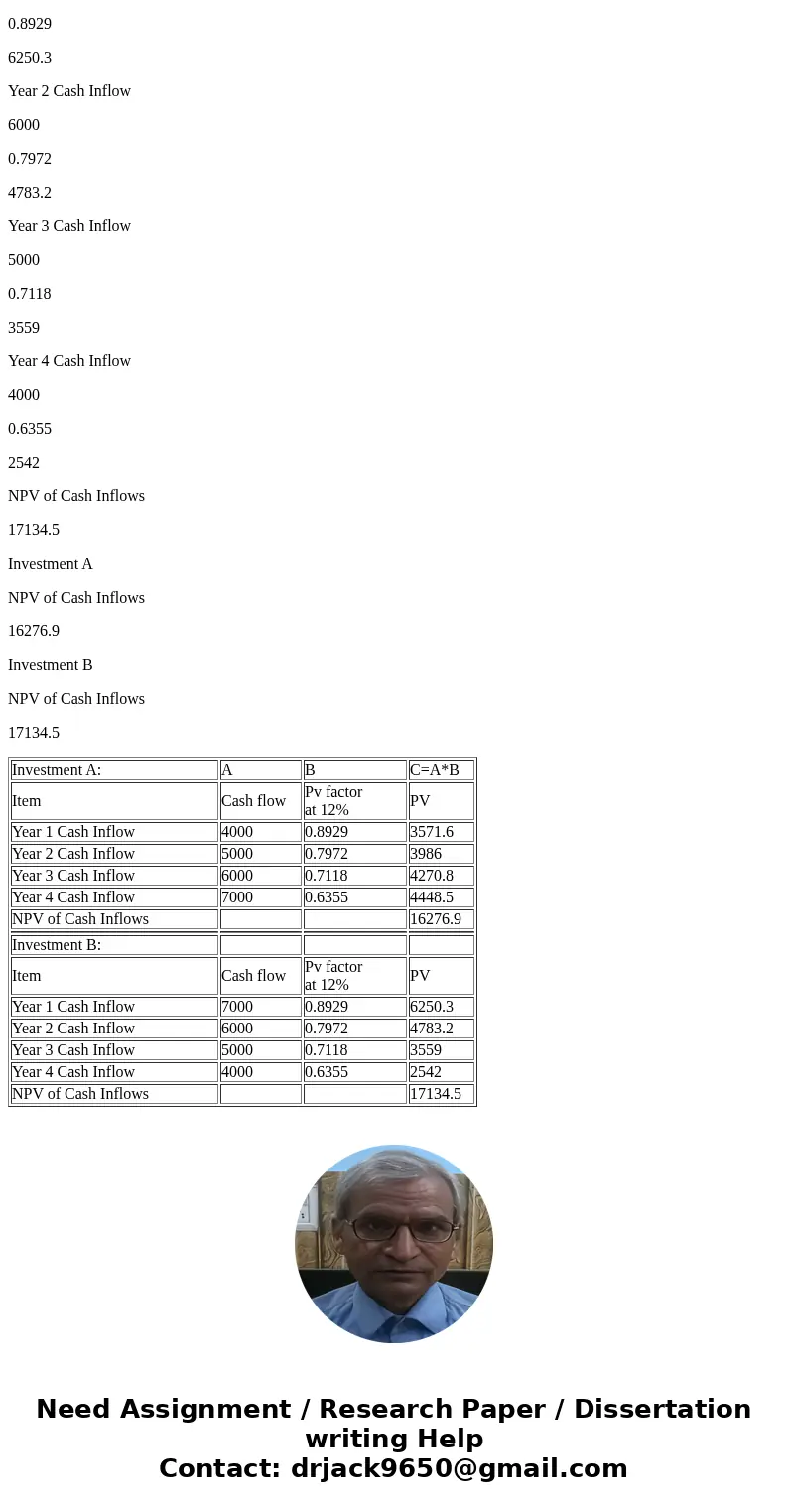

Annual cash inflows that will arise from two competing investment projects are given below:

The discount rate is 12%.

Compute the present value of the cash inflows for each investment. Each investment opportunity will require the same initial investment. (Use Microsoft Excel to calculate present values. Do not round intermediate calculations.)

| Annual cash inflows that will arise from two competing investment projects are given below: |

Solution

Answer:

Investment A:

A

B

C=A*B

Item

Cash flow

Pv factor

at 12%

PV

Year 1 Cash Inflow

4000

0.8929

3571.6

Year 2 Cash Inflow

5000

0.7972

3986

Year 3 Cash Inflow

6000

0.7118

4270.8

Year 4 Cash Inflow

7000

0.6355

4448.5

NPV of Cash Inflows

16276.9

Investment B:

Item

Cash flow

Pv factor

at 12%

PV

Year 1 Cash Inflow

7000

0.8929

6250.3

Year 2 Cash Inflow

6000

0.7972

4783.2

Year 3 Cash Inflow

5000

0.7118

3559

Year 4 Cash Inflow

4000

0.6355

2542

NPV of Cash Inflows

17134.5

Investment A

NPV of Cash Inflows

16276.9

Investment B

NPV of Cash Inflows

17134.5

| Investment A: | A | B | C=A*B |

| Item | Cash flow | Pv factor | PV |

| Year 1 Cash Inflow | 4000 | 0.8929 | 3571.6 |

| Year 2 Cash Inflow | 5000 | 0.7972 | 3986 |

| Year 3 Cash Inflow | 6000 | 0.7118 | 4270.8 |

| Year 4 Cash Inflow | 7000 | 0.6355 | 4448.5 |

| NPV of Cash Inflows | 16276.9 | ||

| Investment B: | |||

| Item | Cash flow | Pv factor | PV |

| Year 1 Cash Inflow | 7000 | 0.8929 | 6250.3 |

| Year 2 Cash Inflow | 6000 | 0.7972 | 4783.2 |

| Year 3 Cash Inflow | 5000 | 0.7118 | 3559 |

| Year 4 Cash Inflow | 4000 | 0.6355 | 2542 |

| NPV of Cash Inflows | 17134.5 |

Homework Sourse

Homework Sourse