ourse Home Content Discussions Assignments My Tools Resource

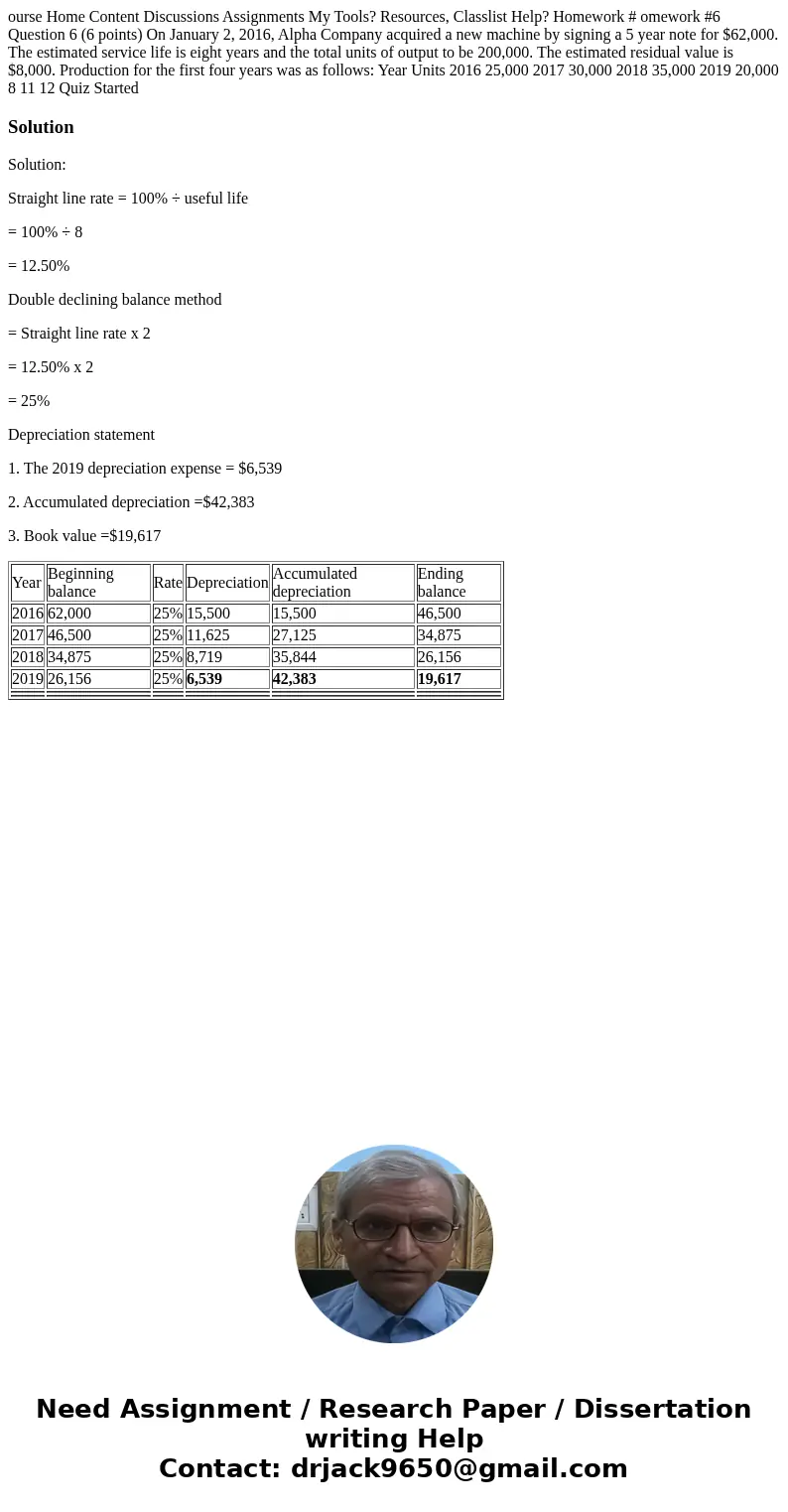

ourse Home Content Discussions Assignments My Tools? Resources, Classlist Help? Homework # omework #6 Question 6 (6 points) On January 2, 2016, Alpha Company acquired a new machine by signing a 5 year note for $62,000. The estimated service life is eight years and the total units of output to be 200,000. The estimated residual value is $8,000. Production for the first four years was as follows: Year Units 2016 25,000 2017 30,000 2018 35,000 2019 20,000 8 11 12 Quiz Started

Solution

Solution:

Straight line rate = 100% ÷ useful life

= 100% ÷ 8

= 12.50%

Double declining balance method

= Straight line rate x 2

= 12.50% x 2

= 25%

Depreciation statement

1. The 2019 depreciation expense = $6,539

2. Accumulated depreciation =$42,383

3. Book value =$19,617

| Year | Beginning balance | Rate | Depreciation | Accumulated depreciation | Ending balance |

| 2016 | 62,000 | 25% | 15,500 | 15,500 | 46,500 |

| 2017 | 46,500 | 25% | 11,625 | 27,125 | 34,875 |

| 2018 | 34,875 | 25% | 8,719 | 35,844 | 26,156 |

| 2019 | 26,156 | 25% | 6,539 | 42,383 | 19,617 |

Homework Sourse

Homework Sourse