cpor E420 Preparing closing entries from an adjusted trial b

Solution

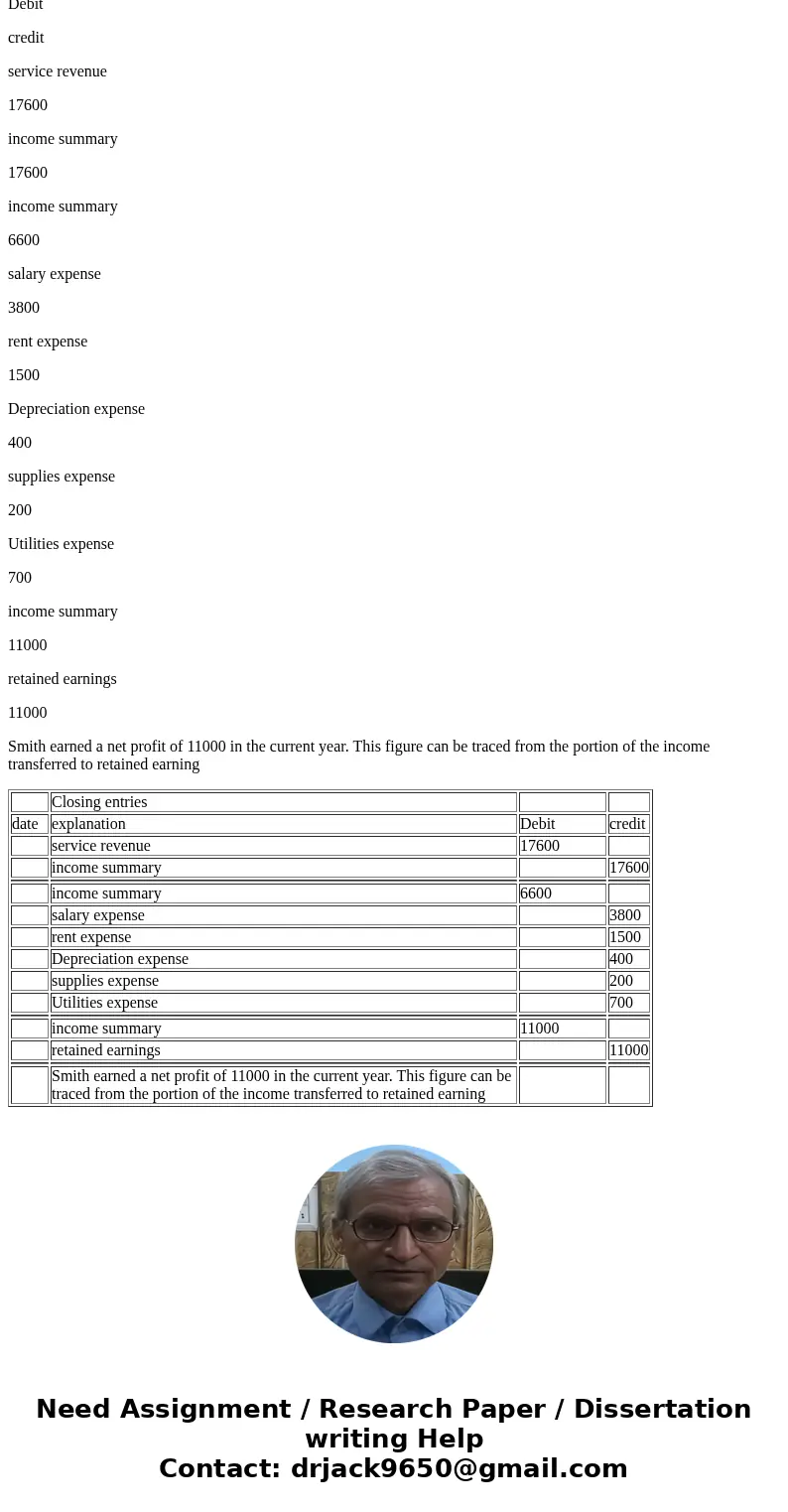

Closing entries

date

explanation

Debit

credit

service revenue

17600

income summary

17600

income summary

6600

salary expense

3800

rent expense

1500

Depreciation expense

400

supplies expense

200

Utilities expense

700

income summary

11000

retained earnings

11000

Smith earned a net profit of 11000 in the current year. This figure can be traced from the portion of the income transferred to retained earning

| Closing entries | |||

| date | explanation | Debit | credit |

| service revenue | 17600 | ||

| income summary | 17600 | ||

| income summary | 6600 | ||

| salary expense | 3800 | ||

| rent expense | 1500 | ||

| Depreciation expense | 400 | ||

| supplies expense | 200 | ||

| Utilities expense | 700 | ||

| income summary | 11000 | ||

| retained earnings | 11000 | ||

| Smith earned a net profit of 11000 in the current year. This figure can be traced from the portion of the income transferred to retained earning |

Homework Sourse

Homework Sourse