Question 1 At the end of 2016 Splish Brothers Inc has accoun

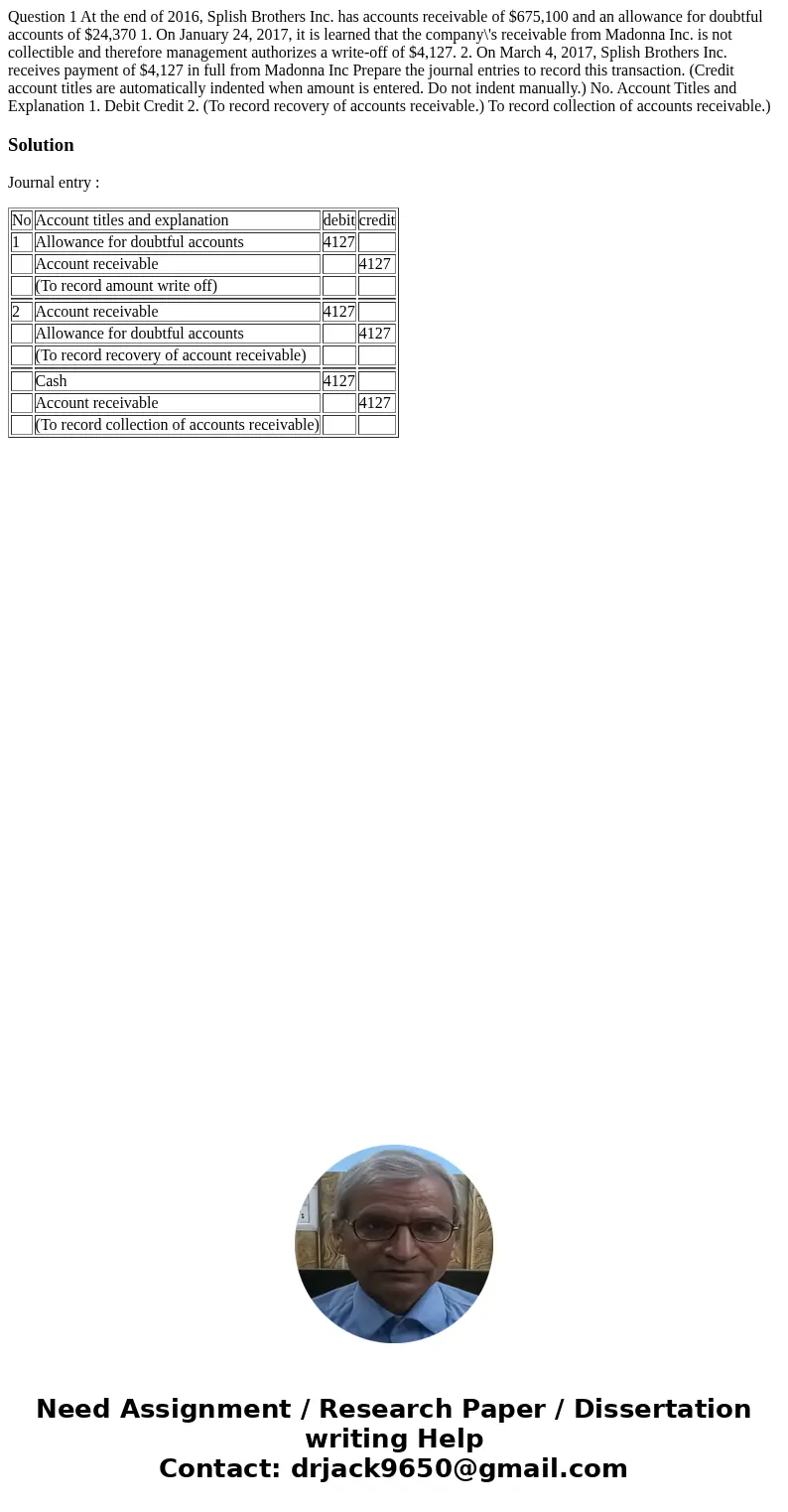

Question 1 At the end of 2016, Splish Brothers Inc. has accounts receivable of $675,100 and an allowance for doubtful accounts of $24,370 1. On January 24, 2017, it is learned that the company\'s receivable from Madonna Inc. is not collectible and therefore management authorizes a write-off of $4,127. 2. On March 4, 2017, Splish Brothers Inc. receives payment of $4,127 in full from Madonna Inc Prepare the journal entries to record this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation 1. Debit Credit 2. (To record recovery of accounts receivable.) To record collection of accounts receivable.)

Solution

Journal entry :

| No | Account titles and explanation | debit | credit |

| 1 | Allowance for doubtful accounts | 4127 | |

| Account receivable | 4127 | ||

| (To record amount write off) | |||

| 2 | Account receivable | 4127 | |

| Allowance for doubtful accounts | 4127 | ||

| (To record recovery of account receivable) | |||

| Cash | 4127 | ||

| Account receivable | 4127 | ||

| (To record collection of accounts receivable) |

Homework Sourse

Homework Sourse