On January 13 at the end of the second weekly pay period of

On January 13, at the end of the second weekly pay period of the year, a company’s payroll register showed that its 27 employees had earned $21,070 of sales salaries and $6,830 of office salaries. Assume withholdings from the employees’ salaries were to include $524.52 of EI, $1,291.09 of CPP, $5,742 of income taxes, $990 of hospital insurance, and $480 of union dues.

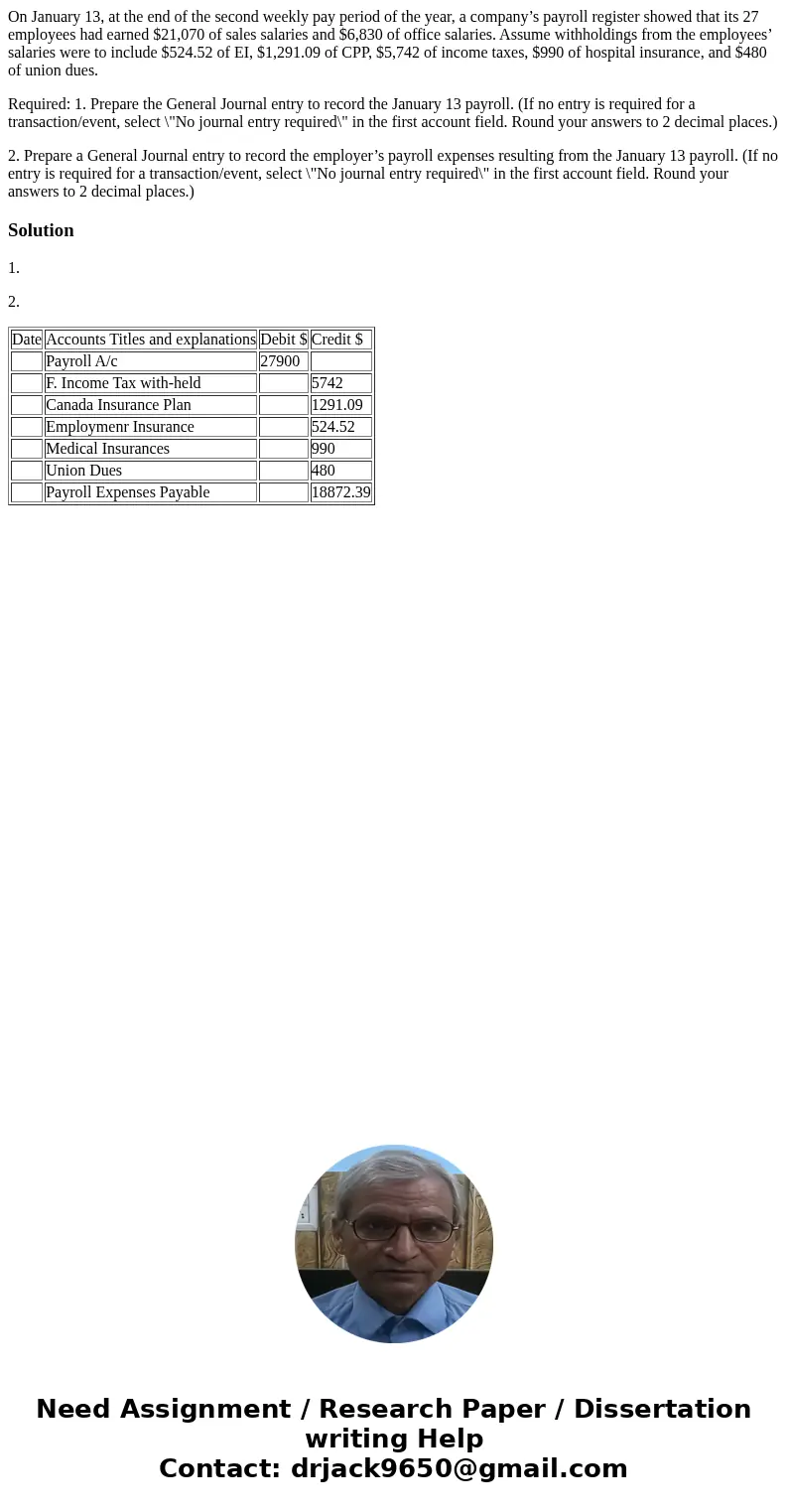

Required: 1. Prepare the General Journal entry to record the January 13 payroll. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field. Round your answers to 2 decimal places.)

2. Prepare a General Journal entry to record the employer’s payroll expenses resulting from the January 13 payroll. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field. Round your answers to 2 decimal places.)

Solution

1.

2.

| Date | Accounts Titles and explanations | Debit $ | Credit $ |

| Payroll A/c | 27900 | ||

| F. Income Tax with-held | 5742 | ||

| Canada Insurance Plan | 1291.09 | ||

| Employmenr Insurance | 524.52 | ||

| Medical Insurances | 990 | ||

| Union Dues | 480 | ||

| Payroll Expenses Payable | 18872.39 |

Homework Sourse

Homework Sourse