please show step by step solutions Incremental operating cas

please show step by step solutions

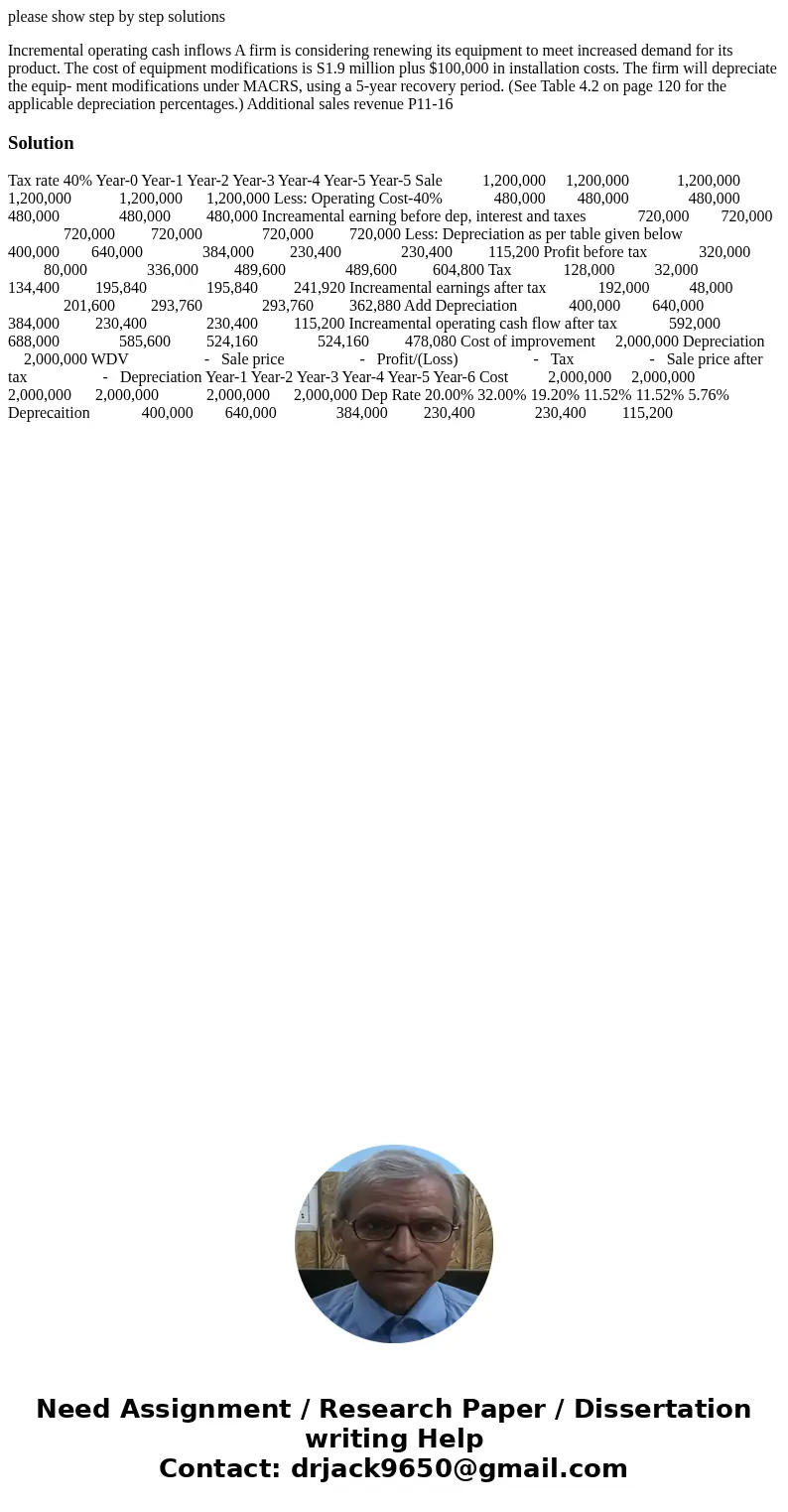

Incremental operating cash inflows A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is S1.9 million plus $100,000 in installation costs. The firm will depreciate the equip- ment modifications under MACRS, using a 5-year recovery period. (See Table 4.2 on page 120 for the applicable depreciation percentages.) Additional sales revenue P11-16Solution

Tax rate 40% Year-0 Year-1 Year-2 Year-3 Year-4 Year-5 Year-5 Sale 1,200,000 1,200,000 1,200,000 1,200,000 1,200,000 1,200,000 Less: Operating Cost-40% 480,000 480,000 480,000 480,000 480,000 480,000 Increamental earning before dep, interest and taxes 720,000 720,000 720,000 720,000 720,000 720,000 Less: Depreciation as per table given below 400,000 640,000 384,000 230,400 230,400 115,200 Profit before tax 320,000 80,000 336,000 489,600 489,600 604,800 Tax 128,000 32,000 134,400 195,840 195,840 241,920 Increamental earnings after tax 192,000 48,000 201,600 293,760 293,760 362,880 Add Depreciation 400,000 640,000 384,000 230,400 230,400 115,200 Increamental operating cash flow after tax 592,000 688,000 585,600 524,160 524,160 478,080 Cost of improvement 2,000,000 Depreciation 2,000,000 WDV - Sale price - Profit/(Loss) - Tax - Sale price after tax - Depreciation Year-1 Year-2 Year-3 Year-4 Year-5 Year-6 Cost 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 Dep Rate 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% Deprecaition 400,000 640,000 384,000 230,400 230,400 115,200

Homework Sourse

Homework Sourse