seed balance e cash account for Amerkan Medical da at April

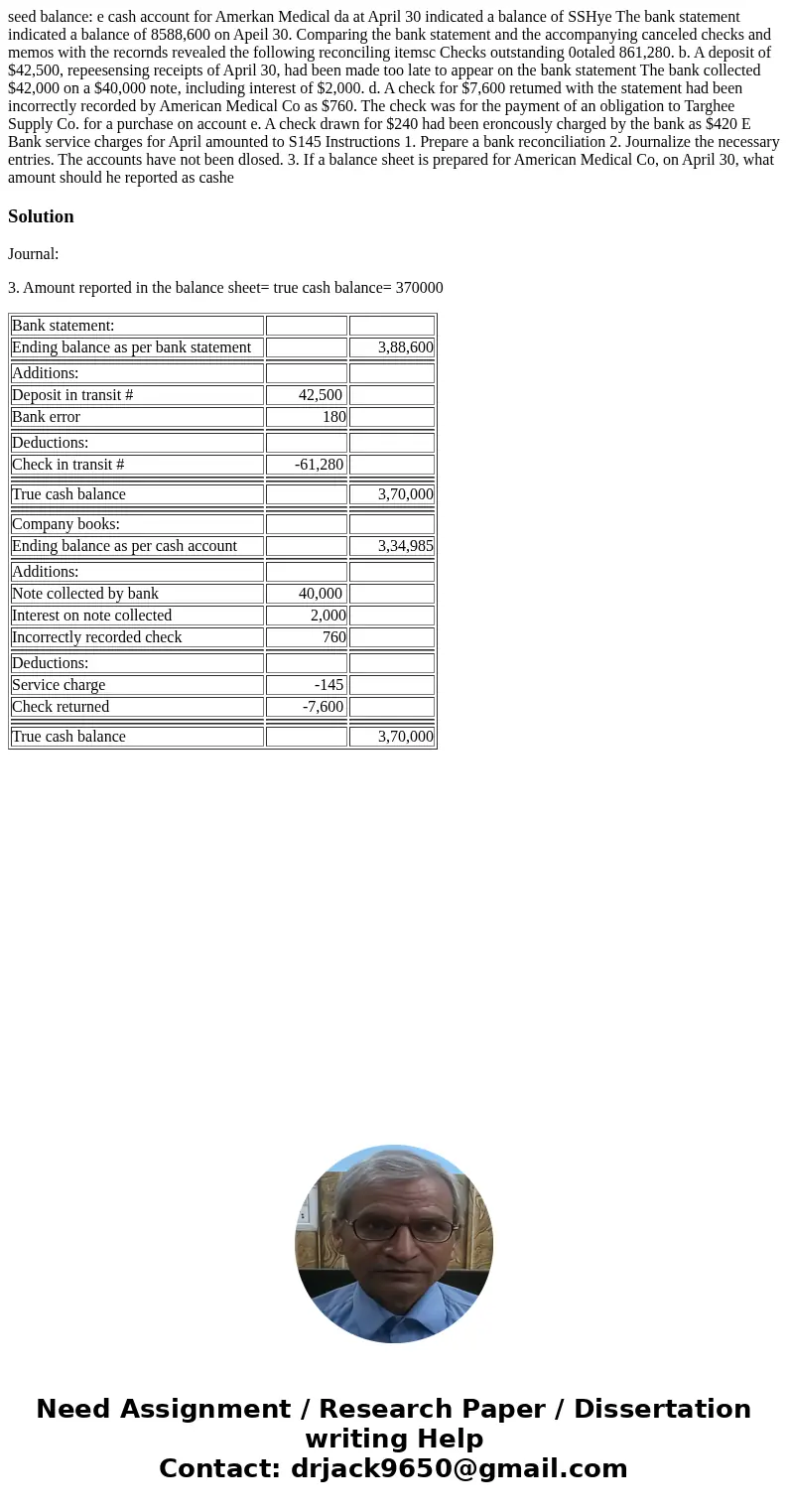

seed balance: e cash account for Amerkan Medical da at April 30 indicated a balance of SSHye The bank statement indicated a balance of 8588,600 on Apeil 30. Comparing the bank statement and the accompanying canceled checks and memos with the recornds revealed the following reconciling itemsc Checks outstanding 0otaled 861,280. b. A deposit of $42,500, repeesensing receipts of April 30, had been made too late to appear on the bank statement The bank collected $42,000 on a $40,000 note, including interest of $2,000. d. A check for $7,600 retumed with the statement had been incorrectly recorded by American Medical Co as $760. The check was for the payment of an obligation to Targhee Supply Co. for a purchase on account e. A check drawn for $240 had been eroncously charged by the bank as $420 E Bank service charges for April amounted to S145 Instructions 1. Prepare a bank reconciliation 2. Journalize the necessary entries. The accounts have not been dlosed. 3. If a balance sheet is prepared for American Medical Co, on April 30, what amount should he reported as cashe

Solution

Journal:

3. Amount reported in the balance sheet= true cash balance= 370000

| Bank statement: | ||

| Ending balance as per bank statement | 3,88,600 | |

| Additions: | ||

| Deposit in transit # | 42,500 | |

| Bank error | 180 | |

| Deductions: | ||

| Check in transit # | -61,280 | |

| True cash balance | 3,70,000 | |

| Company books: | ||

| Ending balance as per cash account | 3,34,985 | |

| Additions: | ||

| Note collected by bank | 40,000 | |

| Interest on note collected | 2,000 | |

| Incorrectly recorded check | 760 | |

| Deductions: | ||

| Service charge | -145 | |

| Check returned | -7,600 | |

| True cash balance | 3,70,000 |

Homework Sourse

Homework Sourse