Cookie Creations 14 Part Level Submission After establishing

Cookie Creations 14 (Part Level Submission) After establishing their company\'s fiscal year-end to be October 31, Natalie and Curtis begin operating Cookie & Coffee Creations Inc. on November 1, 2017. On that date, after the issuance of shares, the paid-in capital section of the company\'s balance sheet is as follows. Paid-in capital Preferred stock, $0.50 noncumulative, no par value, 10,000 shares authorized, 2,000 issued Common stock, no par value, 100,000 shares $10,000 authorized, 25,930 issued 25,930 Cookie & Coffee Creations then has the following selected transactions during its first year of operations. Dec. 1 Issues an additional 800 preferred shares to Natalie\'s brother for $4,000. Apr. 30 Declares a semiannual dividend to the preferred stockholders of record on May 15, payable on June 1 June 30 Repurchases 750 shares of common stock issued to the lawyer, for $500. Recall that these were originally issued for $750. The lawyer had decided to retire and wanted to liquidate all of her assets Oct. 31 The company has had a very successful first year of operations. It earned revenues of $462,500 and incurred operating expenses of $370,000 (including $750 legal fee, but excluding income tax) 31 Records income tax expense. (The company has a 20% income tax rate.) 31 Declares a semiannual dividend to the preferred stockholders of record on November 15, payable on December 1

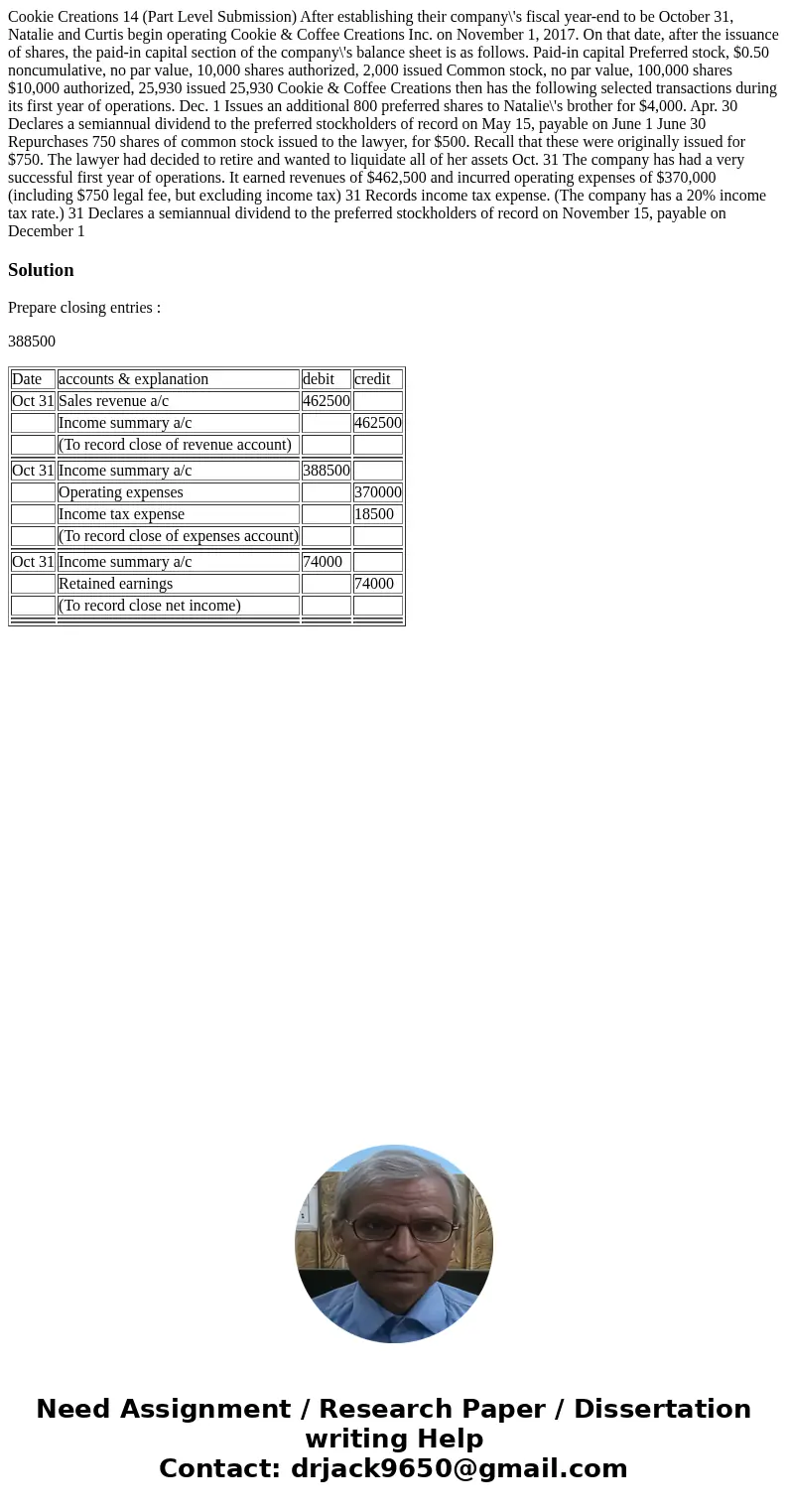

Solution

Prepare closing entries :

388500

| Date | accounts & explanation | debit | credit |

| Oct 31 | Sales revenue a/c | 462500 | |

| Income summary a/c | 462500 | ||

| (To record close of revenue account) | |||

| Oct 31 | Income summary a/c | 388500 | |

| Operating expenses | 370000 | ||

| Income tax expense | 18500 | ||

| (To record close of expenses account) | |||

| Oct 31 | Income summary a/c | 74000 | |

| Retained earnings | 74000 | ||

| (To record close net income) | |||

Homework Sourse

Homework Sourse