Geary Machine Shop is considering a fouryear project to impr

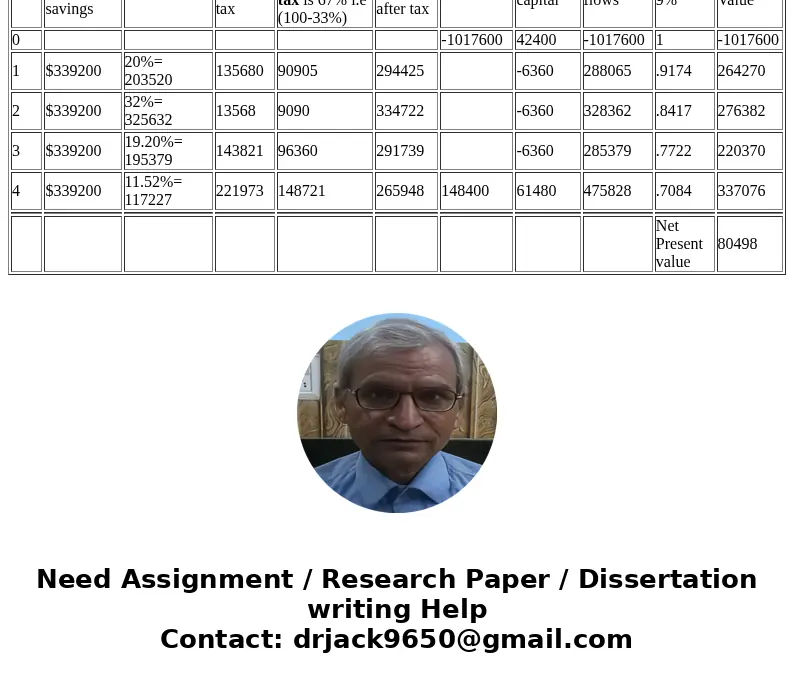

Geary Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $1,017,600 is estimated to result in $339,200 in annual pretax cost savings. The press falls in the MACRS five-year class (MACRS Table), and it will have a salvage value at the end of the project of $148,400. The press also requires an initial investment in spare parts inventory of $42,400, along with an additional $6,360 in inventory for each succeeding year of the project. If the shop\'s tax rate is 33 percent and its discount rate is 9 percent, what is the NPV for this project?

Solution

Year

Annual Pretax cost savings

Depreciation

Profits before tax

Tax rate 33%. Profit after tax is 67% i.e (100-33%)

Cash flows after tax

Investment

Working capital

Total cash flows

PV at 9%

Presnt Value

0

-1017600

42400

-1017600

1

-1017600

1

$339200

20%= 203520

135680

90905

294425

-6360

288065

.9174

264270

2

$339200

32%= 325632

13568

9090

334722

-6360

328362

.8417

276382

3

$339200

19.20%= 195379

143821

96360

291739

-6360

285379

.7722

220370

4

$339200

11.52%= 117227

221973

148721

265948

148400

61480

475828

.7084

337076

Net Present value

80498

| Year | Annual Pretax cost savings | Depreciation | Profits before tax | Tax rate 33%. Profit after tax is 67% i.e (100-33%) | Cash flows after tax | Investment | Working capital | Total cash flows | PV at 9% | Presnt Value |

| 0 | -1017600 | 42400 | -1017600 | 1 | -1017600 | |||||

| 1 | $339200 | 20%= 203520 | 135680 | 90905 | 294425 | -6360 | 288065 | .9174 | 264270 | |

| 2 | $339200 | 32%= 325632 | 13568 | 9090 | 334722 | -6360 | 328362 | .8417 | 276382 | |

| 3 | $339200 | 19.20%= 195379 | 143821 | 96360 | 291739 | -6360 | 285379 | .7722 | 220370 | |

| 4 | $339200 | 11.52%= 117227 | 221973 | 148721 | 265948 | 148400 | 61480 | 475828 | .7084 | 337076 |

| Net Present value | 80498 |

Homework Sourse

Homework Sourse