uestion 3 Normalize Earnings The following table presents th

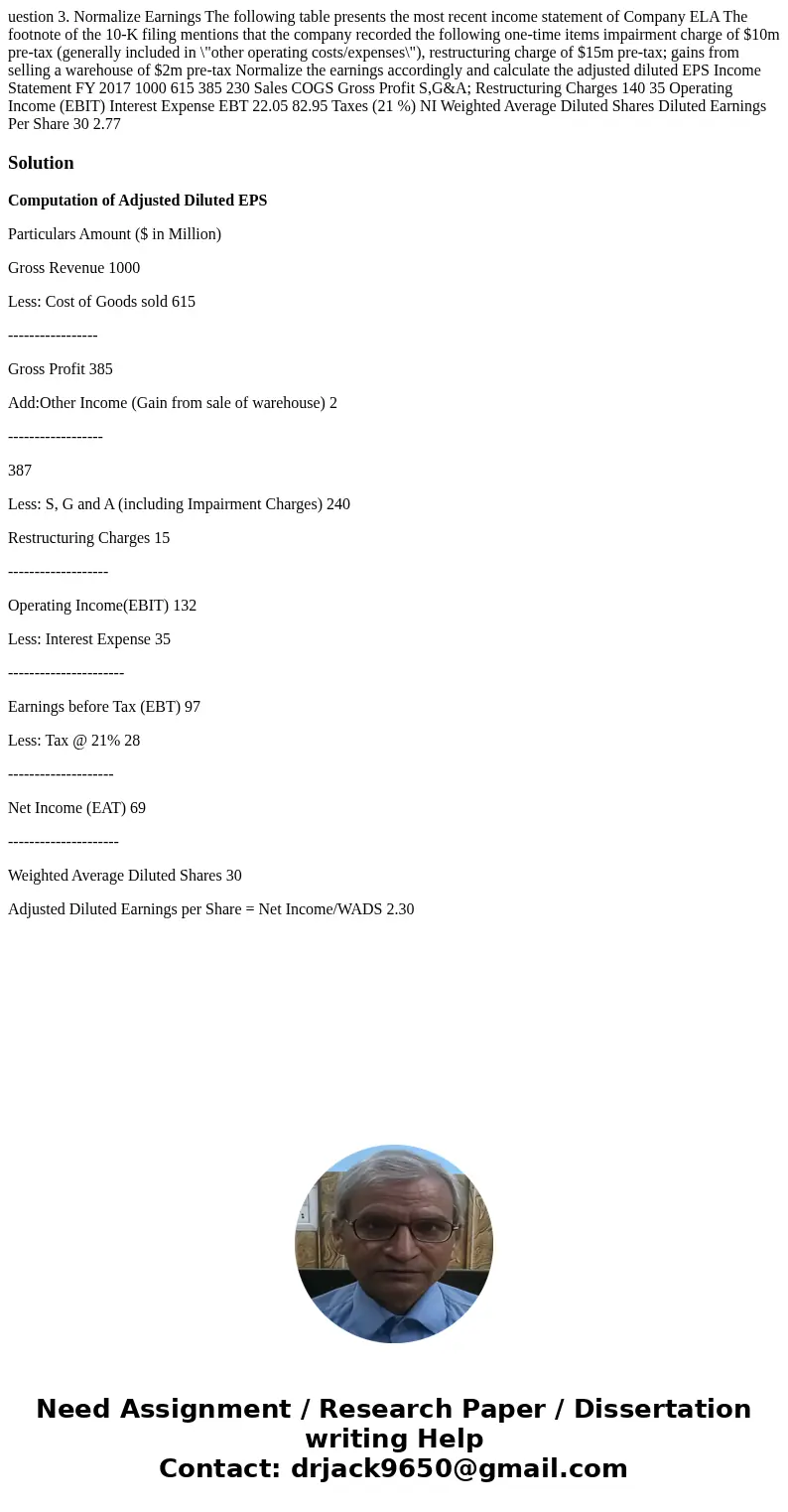

uestion 3. Normalize Earnings The following table presents the most recent income statement of Company ELA The footnote of the 10-K filing mentions that the company recorded the following one-time items impairment charge of $10m pre-tax (generally included in \"other operating costs/expenses\"), restructuring charge of $15m pre-tax; gains from selling a warehouse of $2m pre-tax Normalize the earnings accordingly and calculate the adjusted diluted EPS Income Statement FY 2017 1000 615 385 230 Sales COGS Gross Profit S,G&A; Restructuring Charges 140 35 Operating Income (EBIT) Interest Expense EBT 22.05 82.95 Taxes (21 %) NI Weighted Average Diluted Shares Diluted Earnings Per Share 30 2.77

Solution

Computation of Adjusted Diluted EPS

Particulars Amount ($ in Million)

Gross Revenue 1000

Less: Cost of Goods sold 615

-----------------

Gross Profit 385

Add:Other Income (Gain from sale of warehouse) 2

------------------

387

Less: S, G and A (including Impairment Charges) 240

Restructuring Charges 15

-------------------

Operating Income(EBIT) 132

Less: Interest Expense 35

----------------------

Earnings before Tax (EBT) 97

Less: Tax @ 21% 28

--------------------

Net Income (EAT) 69

---------------------

Weighted Average Diluted Shares 30

Adjusted Diluted Earnings per Share = Net Income/WADS 2.30

Homework Sourse

Homework Sourse