The table below contains some data for two countries Italy a

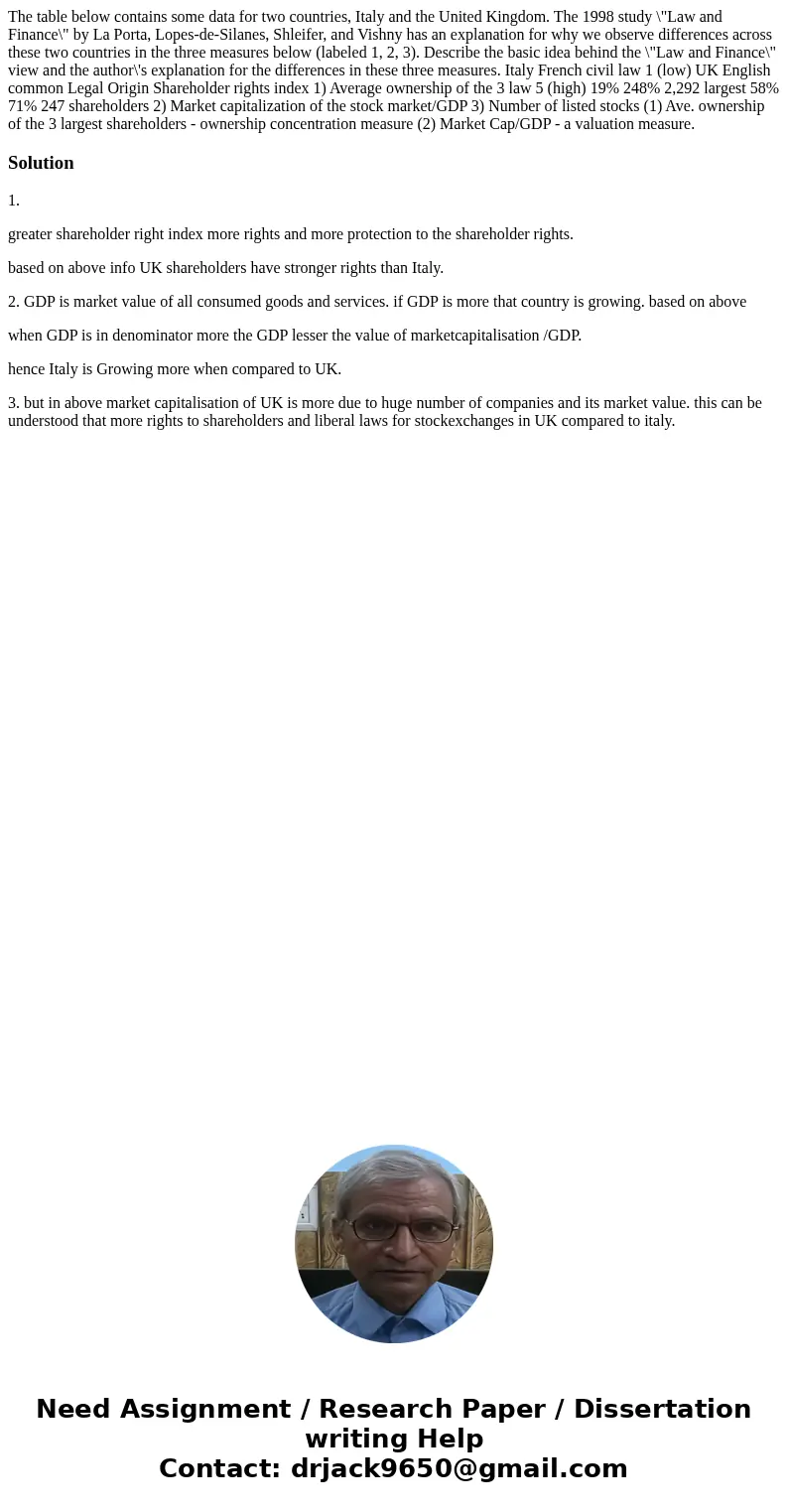

The table below contains some data for two countries, Italy and the United Kingdom. The 1998 study \"Law and Finance\" by La Porta, Lopes-de-Silanes, Shleifer, and Vishny has an explanation for why we observe differences across these two countries in the three measures below (labeled 1, 2, 3). Describe the basic idea behind the \"Law and Finance\" view and the author\'s explanation for the differences in these three measures. Italy French civil law 1 (low) UK English common Legal Origin Shareholder rights index 1) Average ownership of the 3 law 5 (high) 19% 248% 2,292 largest 58% 71% 247 shareholders 2) Market capitalization of the stock market/GDP 3) Number of listed stocks (1) Ave. ownership of the 3 largest shareholders - ownership concentration measure (2) Market Cap/GDP - a valuation measure.

Solution

1.

greater shareholder right index more rights and more protection to the shareholder rights.

based on above info UK shareholders have stronger rights than Italy.

2. GDP is market value of all consumed goods and services. if GDP is more that country is growing. based on above

when GDP is in denominator more the GDP lesser the value of marketcapitalisation /GDP.

hence Italy is Growing more when compared to UK.

3. but in above market capitalisation of UK is more due to huge number of companies and its market value. this can be understood that more rights to shareholders and liberal laws for stockexchanges in UK compared to italy.

Homework Sourse

Homework Sourse