Question vatue 1000 points The following selected transacti

Solution

Explanation:

2016

Jan 13= No entry is made for a line of credit until a loan actually is made. It would be described in a disclosure note.

May 1 = Interest expense ($6,200,000 × 13% × 3/12) = $201,500

Notes payable (face amount) = $6,200,000

Cash ($6,200,000 + $201,500) = $6,401,500

Dec. 1 = Cash (difference) = $13,559,000

Discount on notes payable ($14,900,000 × 12% × 9/12) = $1,341,000

Notes payable (face amount) = $14,900,000

Dec. 31 = The effective interest rate is 13.19% ($1,341,000 ÷ $13559000) × 12/9. So, properly, interest should be recorded at that rateoutstanding balance times one-twelfth of a year:

Interest expense ($13,559,000 × 13.19% × 1/12) = $149036

Discount on notes payable = $149000

However the same results are achieved if interest is recorded at the discount rate times the maturity amount times one-twelfth of a Interest expense ($14,900,000 × 12% × 1/12) = $147,000

Discount on notes payable = $149,000

2017

Sept. 1 = Interest expense ($14,900,000 × 12% × 8/12)* = $1,192,000

Discount on notes payable = $1,192,000

Notes payable (balance) = $14,900,000

Cash (maturity amount) = $14,900,000

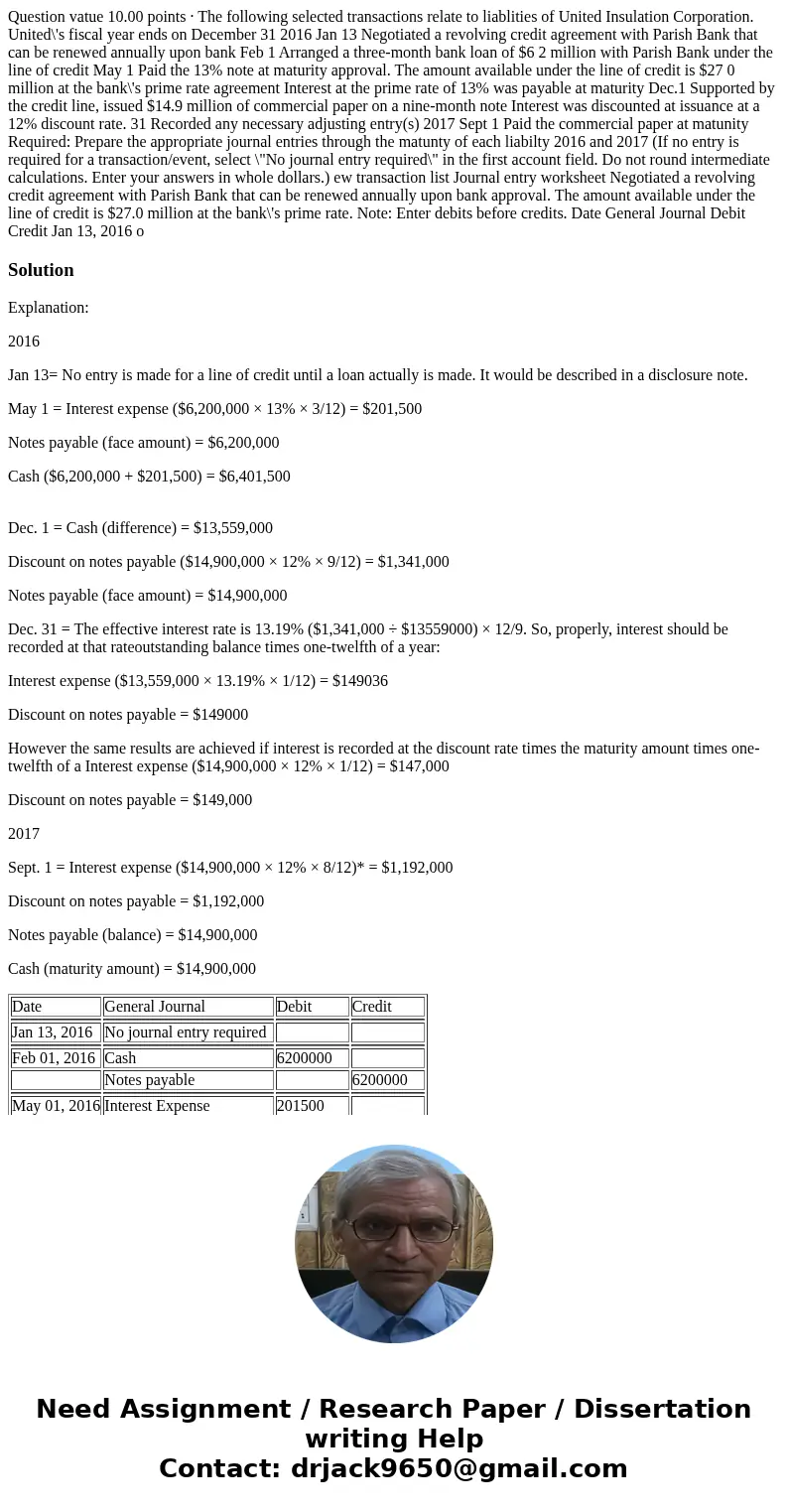

| Date | General Journal | Debit | Credit |

| Jan 13, 2016 | No journal entry required | ||

| Feb 01, 2016 | Cash | 6200000 | |

| Notes payable | 6200000 | ||

| May 01, 2016 | Interest Expense | 201500 | |

| Notes payable | 6200000 | ||

| Cash | 6,401,500 | ||

| Dec 01, 2016 | Cash | 13,559,000 | |

| Discount on notes payable | 1341000 | ||

| Notes payable | 14900000 | ||

| Dec 31, 2016 | Interest Expense | 149000 | |

| Discount on notes payable | 149000 | ||

| Sep 01, 2017 | Interest Expense | 1192000 | |

| Discount on notes payable | 1192000 | ||

| Sep 01, 2017 | Notes payable | 14,900,000 | |

| Cash | 14,900,000 |

Homework Sourse

Homework Sourse