Happy Times Inc wants to expand its party stores into the So

Solution

(A)Valuation of Joe Company using Free Cash Flow Approach:-

Free Cash Flow for Firm = NOPAT – [Capital Spending + Changes in Working Capital – Depreciation]

NOPAT = EBIT * (1-Tax Rate)

Important Note;- In the question, Net working Capital is given as % of EBIT. We need the change in Working Capital. So, we assume the opening working capital for First year to be NIL.

The language mentioned in questioned can in no way be treated as change in working Capital

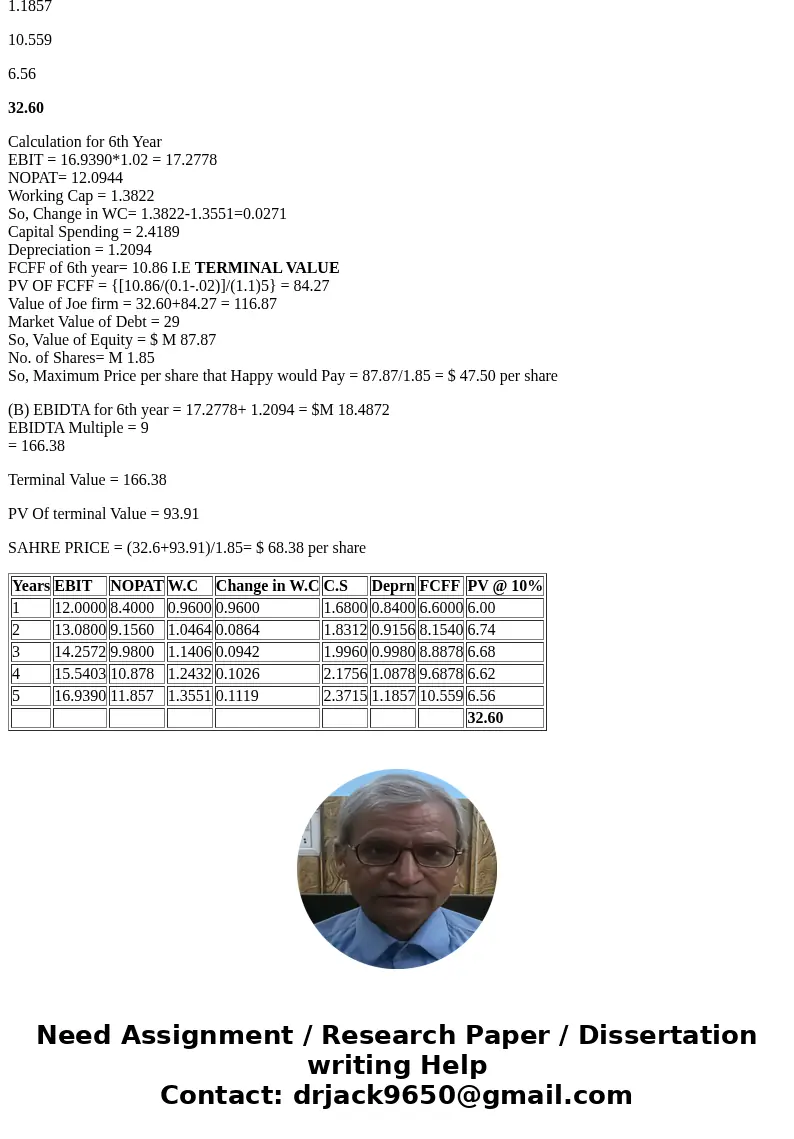

Calculation of Free Cash Flow for the First 5 years

Years

EBIT

NOPAT

W.C

Change in W.C

C.S

Deprn

FCFF

PV @ 10%

1

12.0000

8.4000

0.9600

0.9600

1.6800

0.8400

6.6000

6.00

2

13.0800

9.1560

1.0464

0.0864

1.8312

0.9156

8.1540

6.74

3

14.2572

9.9800

1.1406

0.0942

1.9960

0.9980

8.8878

6.68

4

15.5403

10.878

1.2432

0.1026

2.1756

1.0878

9.6878

6.62

5

16.9390

11.857

1.3551

0.1119

2.3715

1.1857

10.559

6.56

32.60

Calculation for 6th Year

EBIT = 16.9390*1.02 = 17.2778

NOPAT= 12.0944

Working Cap = 1.3822

So, Change in WC= 1.3822-1.3551=0.0271

Capital Spending = 2.4189

Depreciation = 1.2094

FCFF of 6th year= 10.86 I.E TERMINAL VALUE

PV OF FCFF = {[10.86/(0.1-.02)]/(1.1)5} = 84.27

Value of Joe firm = 32.60+84.27 = 116.87

Market Value of Debt = 29

So, Value of Equity = $ M 87.87

No. of Shares= M 1.85

So, Maximum Price per share that Happy would Pay = 87.87/1.85 = $ 47.50 per share

(B) EBIDTA for 6th year = 17.2778+ 1.2094 = $M 18.4872

EBIDTA Multiple = 9

= 166.38

Terminal Value = 166.38

PV Of terminal Value = 93.91

SAHRE PRICE = (32.6+93.91)/1.85= $ 68.38 per share

| Years | EBIT | NOPAT | W.C | Change in W.C | C.S | Deprn | FCFF | PV @ 10% |

| 1 | 12.0000 | 8.4000 | 0.9600 | 0.9600 | 1.6800 | 0.8400 | 6.6000 | 6.00 |

| 2 | 13.0800 | 9.1560 | 1.0464 | 0.0864 | 1.8312 | 0.9156 | 8.1540 | 6.74 |

| 3 | 14.2572 | 9.9800 | 1.1406 | 0.0942 | 1.9960 | 0.9980 | 8.8878 | 6.68 |

| 4 | 15.5403 | 10.878 | 1.2432 | 0.1026 | 2.1756 | 1.0878 | 9.6878 | 6.62 |

| 5 | 16.9390 | 11.857 | 1.3551 | 0.1119 | 2.3715 | 1.1857 | 10.559 | 6.56 |

| 32.60 |

Homework Sourse

Homework Sourse