Benkart Inc is considering a new threeyear expansion project

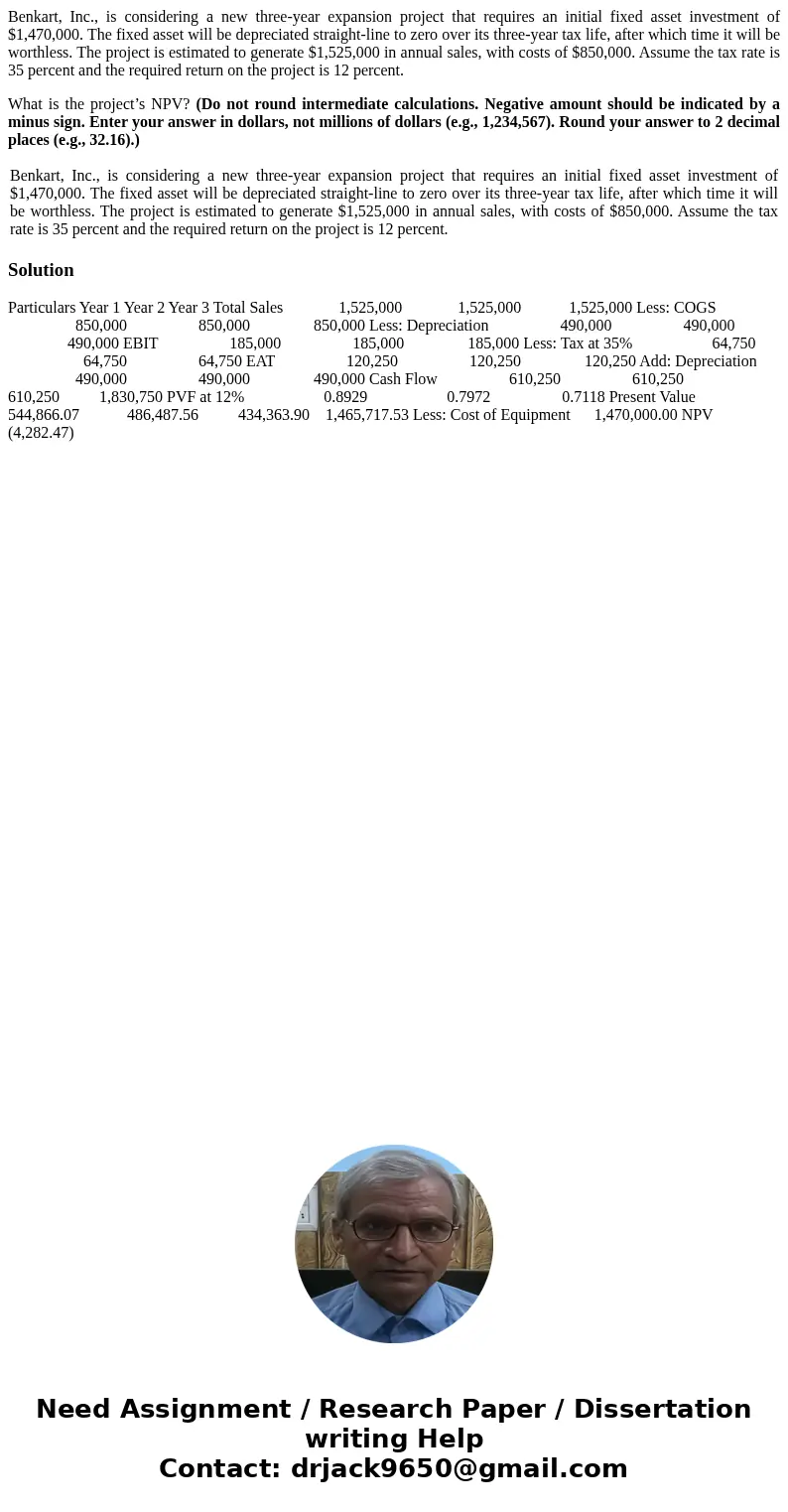

Benkart, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $1,470,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1,525,000 in annual sales, with costs of $850,000. Assume the tax rate is 35 percent and the required return on the project is 12 percent.

What is the project’s NPV? (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Enter your answer in dollars, not millions of dollars (e.g., 1,234,567). Round your answer to 2 decimal places (e.g., 32.16).)

| Benkart, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $1,470,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1,525,000 in annual sales, with costs of $850,000. Assume the tax rate is 35 percent and the required return on the project is 12 percent. |

Solution

Particulars Year 1 Year 2 Year 3 Total Sales 1,525,000 1,525,000 1,525,000 Less: COGS 850,000 850,000 850,000 Less: Depreciation 490,000 490,000 490,000 EBIT 185,000 185,000 185,000 Less: Tax at 35% 64,750 64,750 64,750 EAT 120,250 120,250 120,250 Add: Depreciation 490,000 490,000 490,000 Cash Flow 610,250 610,250 610,250 1,830,750 PVF at 12% 0.8929 0.7972 0.7118 Present Value 544,866.07 486,487.56 434,363.90 1,465,717.53 Less: Cost of Equipment 1,470,000.00 NPV (4,282.47)

Homework Sourse

Homework Sourse