Haver Company currently produces component RX5 for its sole

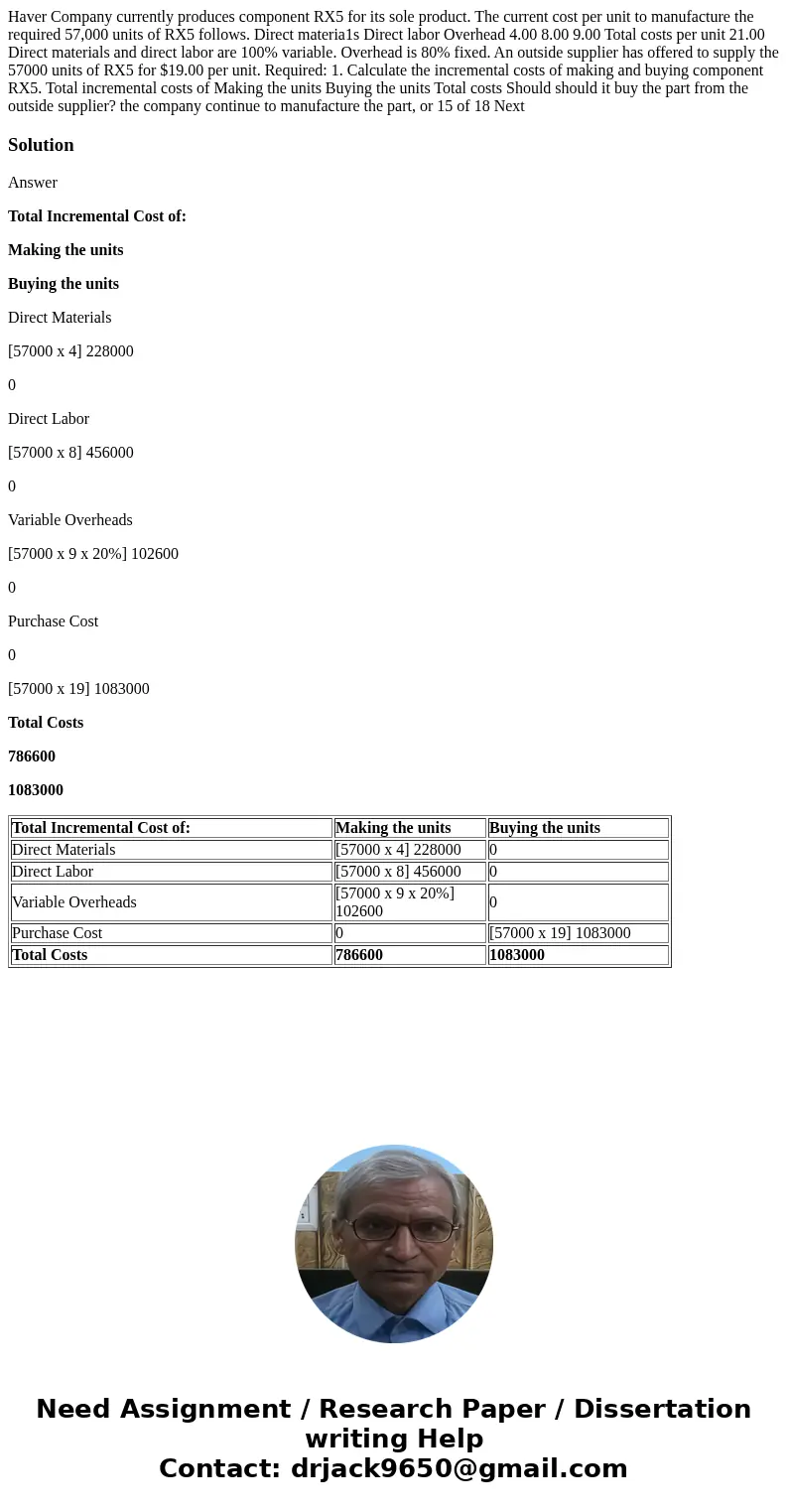

Haver Company currently produces component RX5 for its sole product. The current cost per unit to manufacture the required 57,000 units of RX5 follows. Direct materia1s Direct labor Overhead 4.00 8.00 9.00 Total costs per unit 21.00 Direct materials and direct labor are 100% variable. Overhead is 80% fixed. An outside supplier has offered to supply the 57000 units of RX5 for $19.00 per unit. Required: 1. Calculate the incremental costs of making and buying component RX5. Total incremental costs of Making the units Buying the units Total costs Should should it buy the part from the outside supplier? the company continue to manufacture the part, or 15 of 18 Next

Solution

Answer

Total Incremental Cost of:

Making the units

Buying the units

Direct Materials

[57000 x 4] 228000

0

Direct Labor

[57000 x 8] 456000

0

Variable Overheads

[57000 x 9 x 20%] 102600

0

Purchase Cost

0

[57000 x 19] 1083000

Total Costs

786600

1083000

| Total Incremental Cost of: | Making the units | Buying the units |

| Direct Materials | [57000 x 4] 228000 | 0 |

| Direct Labor | [57000 x 8] 456000 | 0 |

| Variable Overheads | [57000 x 9 x 20%] 102600 | 0 |

| Purchase Cost | 0 | [57000 x 19] 1083000 |

| Total Costs | 786600 | 1083000 |

Homework Sourse

Homework Sourse