Partial Solution Question 3 Cash Flew Statement Cash Flow fr

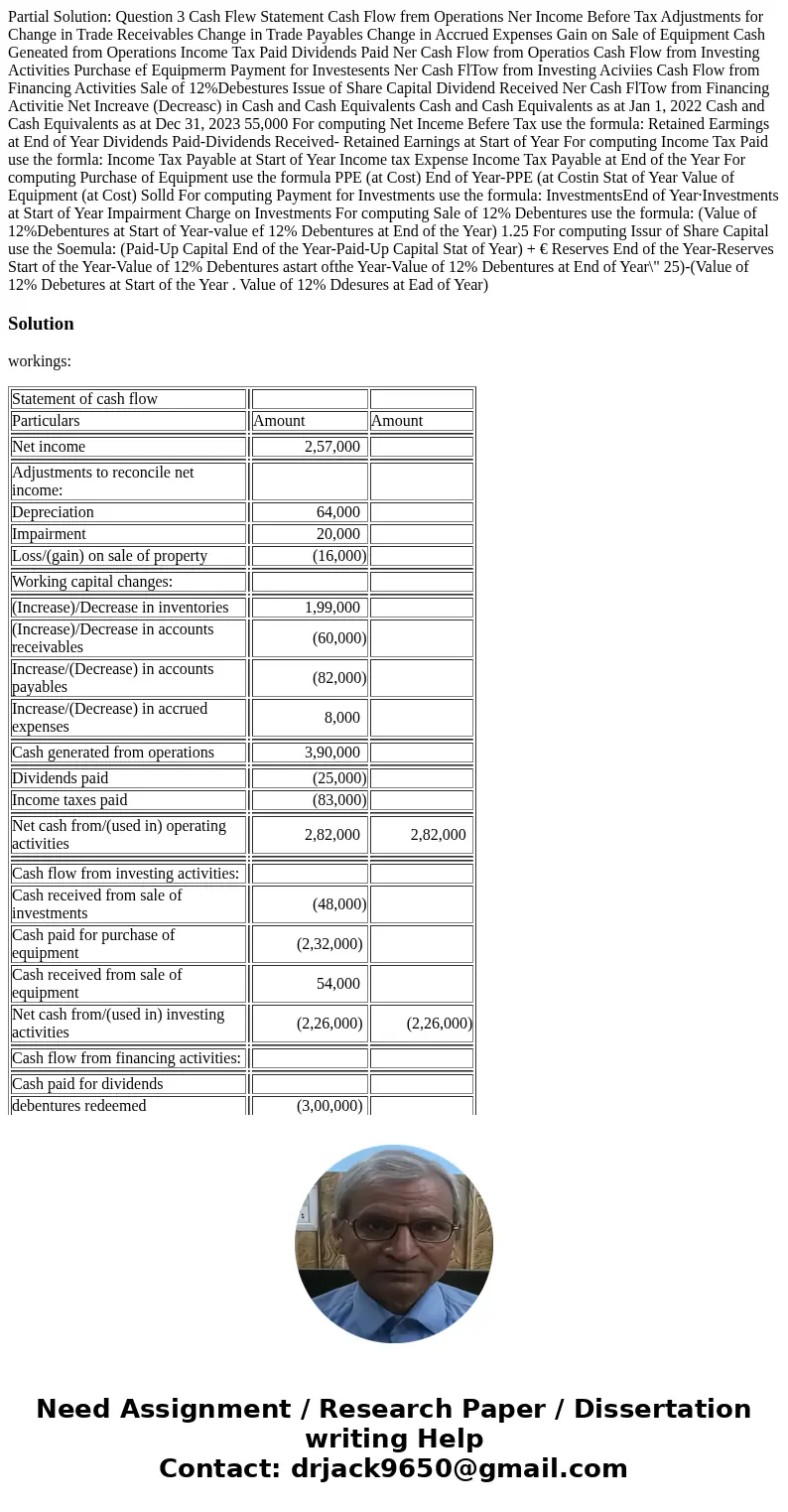

Partial Solution: Question 3 Cash Flew Statement Cash Flow frem Operations Ner Income Before Tax Adjustments for Change in Trade Receivables Change in Trade Payables Change in Accrued Expenses Gain on Sale of Equipment Cash Geneated from Operations Income Tax Paid Dividends Paid Ner Cash Flow from Operatios Cash Flow from Investing Activities Purchase ef Equipmerm Payment for Investesents Ner Cash FlTow from Investing Aciviies Cash Flow from Financing Activities Sale of 12%Debestures Issue of Share Capital Dividend Received Ner Cash FlTow from Financing Activitie Net Increave (Decreasc) in Cash and Cash Equivalents Cash and Cash Equivalents as at Jan 1, 2022 Cash and Cash Equivalents as at Dec 31, 2023 55,000 For computing Net Inceme Befere Tax use the formula: Retained Earmings at End of Year Dividends Paid-Dividends Received- Retained Earnings at Start of Year For computing Income Tax Paid use the formla: Income Tax Payable at Start of Year Income tax Expense Income Tax Payable at End of the Year For computing Purchase of Equipment use the formula PPE (at Cost) End of Year-PPE (at Costin Stat of Year Value of Equipment (at Cost) Solld For computing Payment for Investments use the formula: InvestmentsEnd of Year·Investments at Start of Year Impairment Charge on Investments For computing Sale of 12% Debentures use the formula: (Value of 12%Debentures at Start of Year-value ef 12% Debentures at End of the Year) 1.25 For computing Issur of Share Capital use the Soemula: (Paid-Up Capital End of the Year-Paid-Up Capital Stat of Year) + € Reserves End of the Year-Reserves Start of the Year-Value of 12% Debentures astart ofthe Year-Value of 12% Debentures at End of Year\" 25)-(Value of 12% Debetures at Start of the Year . Value of 12% Ddesures at Ead of Year)

Solution

workings:

| Statement of cash flow | |||

| Particulars | Amount | Amount | |

| Net income | 2,57,000 | ||

| Adjustments to reconcile net income: | |||

| Depreciation | 64,000 | ||

| Impairment | 20,000 | ||

| Loss/(gain) on sale of property | (16,000) | ||

| Working capital changes: | |||

| (Increase)/Decrease in inventories | 1,99,000 | ||

| (Increase)/Decrease in accounts receivables | (60,000) | ||

| Increase/(Decrease) in accounts payables | (82,000) | ||

| Increase/(Decrease) in accrued expenses | 8,000 | ||

| Cash generated from operations | 3,90,000 | ||

| Dividends paid | (25,000) | ||

| Income taxes paid | (83,000) | ||

| Net cash from/(used in) operating activities | 2,82,000 | 2,82,000 | |

| Cash flow from investing activities: | |||

| Cash received from sale of investments | (48,000) | ||

| Cash paid for purchase of equipment | (2,32,000) | ||

| Cash received from sale of equipment | 54,000 | ||

| Net cash from/(used in) investing activities | (2,26,000) | (2,26,000) | |

| Cash flow from financing activities: | |||

| Cash paid for dividends | |||

| debentures redeemed | (3,00,000) | ||

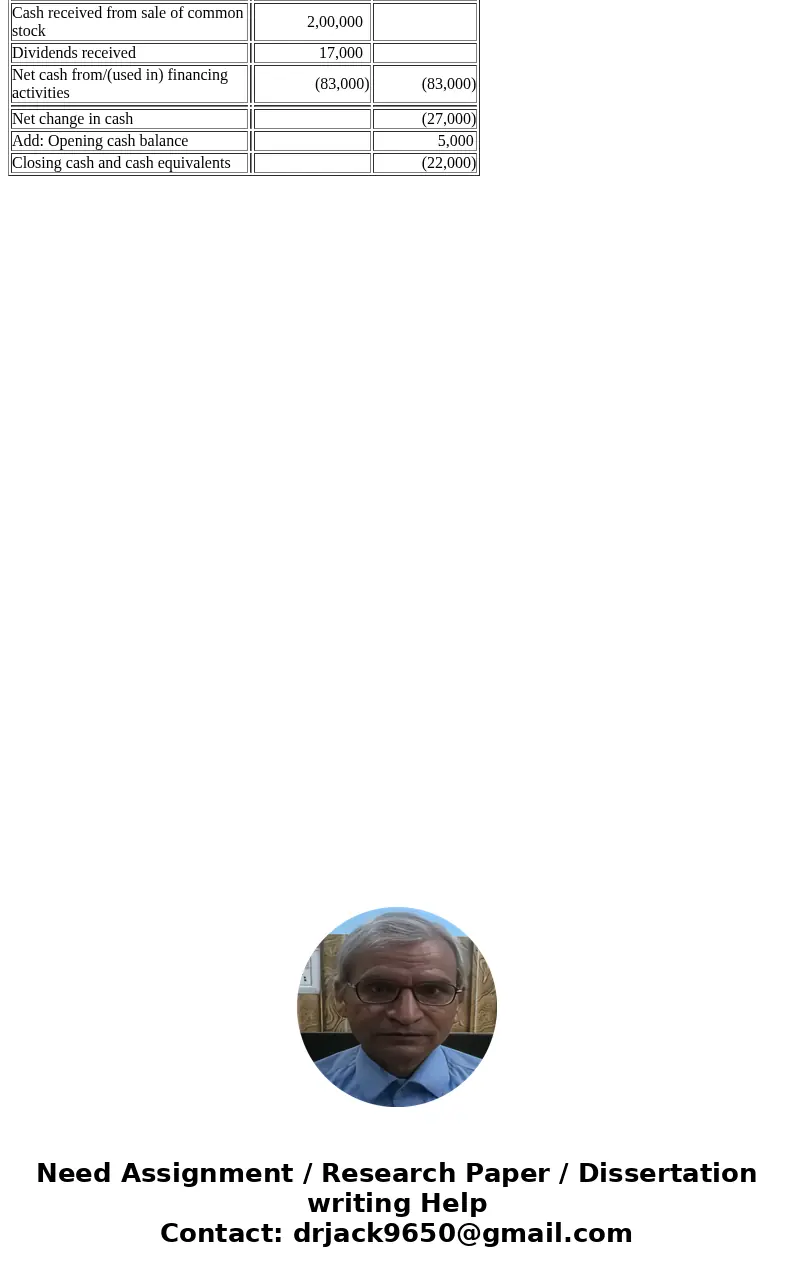

| Cash received from sale of common stock | 2,00,000 | ||

| Dividends received | 17,000 | ||

| Net cash from/(used in) financing activities | (83,000) | (83,000) | |

| Net change in cash | (27,000) | ||

| Add: Opening cash balance | 5,000 | ||

| Closing cash and cash equivalents | (22,000) |

Homework Sourse

Homework Sourse