A contractor is considering the purchase of a new 40000 truc

A contractor is considering the purchase of a new $40,000 truck, which has an estimated useful life of 8 years. He believes that he can sell the used truck for $8,000 at the end of the 8 years. Annual operating costs are estimated to be $2,000 per year. As an alternative, the contractor can purchase a used truck for $20,000 with an estimated useful life of 4 years. Annual operating costs for the used truck are estimated to be $2,800 per year, and the salvage value should be $2,000 at the end of the 4 years. At an interest rate of 8%, which alternative should the contractor select?

Solution

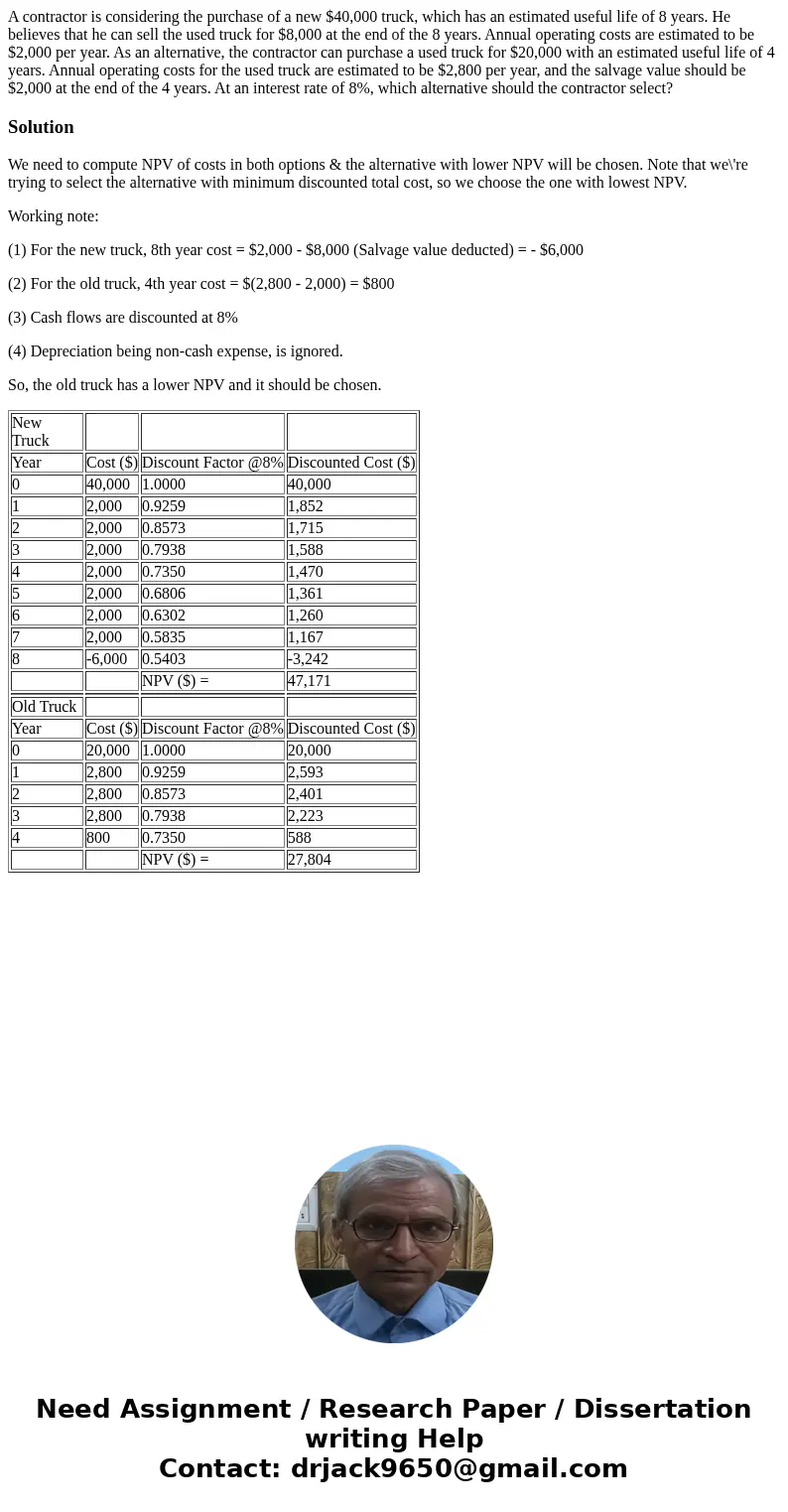

We need to compute NPV of costs in both options & the alternative with lower NPV will be chosen. Note that we\'re trying to select the alternative with minimum discounted total cost, so we choose the one with lowest NPV.

Working note:

(1) For the new truck, 8th year cost = $2,000 - $8,000 (Salvage value deducted) = - $6,000

(2) For the old truck, 4th year cost = $(2,800 - 2,000) = $800

(3) Cash flows are discounted at 8%

(4) Depreciation being non-cash expense, is ignored.

So, the old truck has a lower NPV and it should be chosen.

| New Truck | |||

| Year | Cost ($) | Discount Factor @8% | Discounted Cost ($) |

| 0 | 40,000 | 1.0000 | 40,000 |

| 1 | 2,000 | 0.9259 | 1,852 |

| 2 | 2,000 | 0.8573 | 1,715 |

| 3 | 2,000 | 0.7938 | 1,588 |

| 4 | 2,000 | 0.7350 | 1,470 |

| 5 | 2,000 | 0.6806 | 1,361 |

| 6 | 2,000 | 0.6302 | 1,260 |

| 7 | 2,000 | 0.5835 | 1,167 |

| 8 | -6,000 | 0.5403 | -3,242 |

| NPV ($) = | 47,171 | ||

| Old Truck | |||

| Year | Cost ($) | Discount Factor @8% | Discounted Cost ($) |

| 0 | 20,000 | 1.0000 | 20,000 |

| 1 | 2,800 | 0.9259 | 2,593 |

| 2 | 2,800 | 0.8573 | 2,401 |

| 3 | 2,800 | 0.7938 | 2,223 |

| 4 | 800 | 0.7350 | 588 |

| NPV ($) = | 27,804 |

Homework Sourse

Homework Sourse