In addition to priceweighted and valueweighted indexes on eq

In addition to price-weighted and value-weighted indexes, on equally weighted index is one in which the indexc value is computed from the averoge rote of return of the stocks comprising the index. Equally weighted indexes are frequently used by financial researchers to measure portfolio performance. Suppose the following three defense stocks are to be combined into a stock index in January 2016 (perhapsa portfolio manager believes these stocks are an appropriste benchmark for his or her performance): Price Shares 1/16 1/1/17 1//18 (millions) Douglas McDonnell Dynamics General 49 78 43 67 57 81 455 Intermational Rockwel 290 What is the percentage rate of return on this index for the year ending December 31, 2016? Round your answer to 2 decimal places. Omit the\"% sign in your response.)

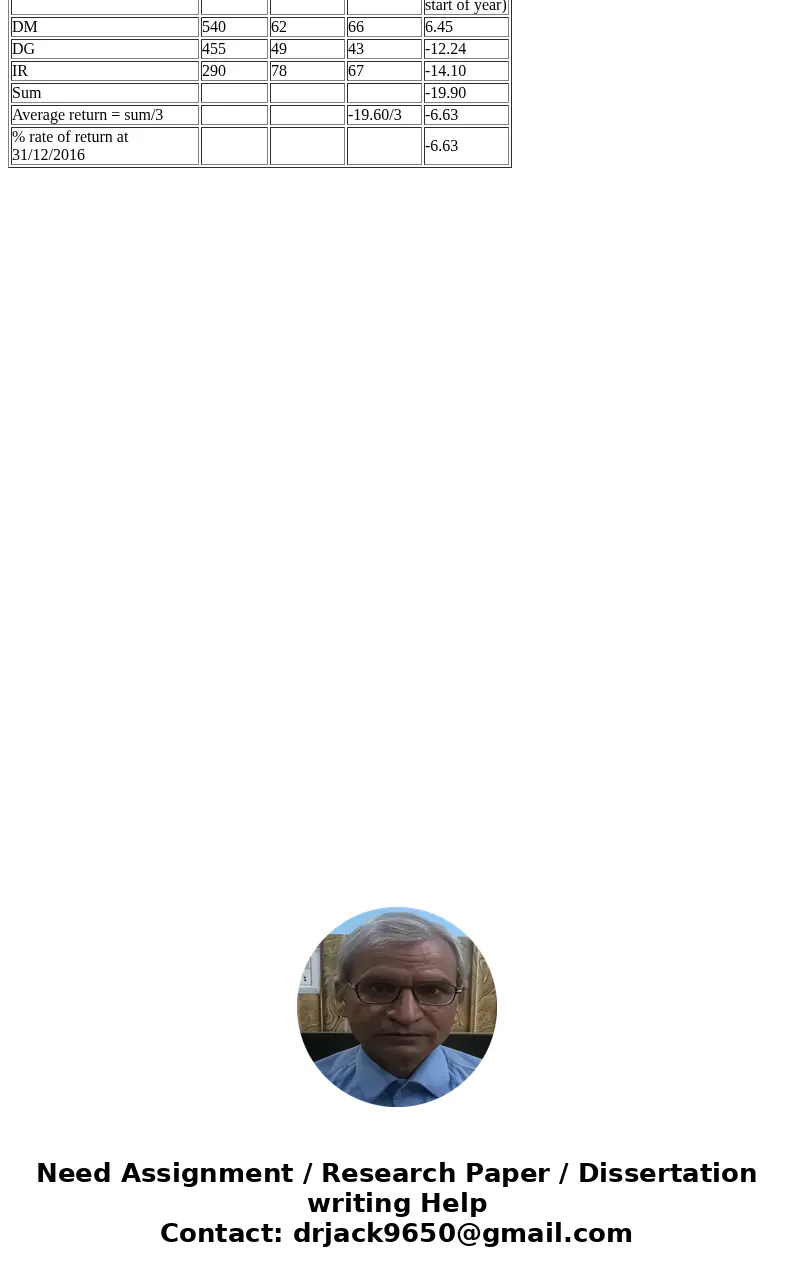

Solution

Price at 01/01/2016

price at 31/01/2016

% change (price at year end/price at start of year)

DM

540

62

66

6.45

DG

455

49

43

-12.24

IR

290

78

67

-14.10

Sum

-19.90

Average return = sum/3

-19.60/3

-6.63

% rate of return at 31/12/2016

-6.63

| Price at 01/01/2016 | price at 31/01/2016 | % change (price at year end/price at start of year) | ||

| DM | 540 | 62 | 66 | 6.45 |

| DG | 455 | 49 | 43 | -12.24 |

| IR | 290 | 78 | 67 | -14.10 |

| Sum | -19.90 | |||

| Average return = sum/3 | -19.60/3 | -6.63 | ||

| % rate of return at 31/12/2016 | -6.63 |

Homework Sourse

Homework Sourse