pr is en a e ir 5 ee th oeda de ti e 4 ldn ul pl 8 0 3 Solut

Solution

equipment a/c

to old equipment

to cash

to gain on sale old equipment

( being old equipment traded for old equipment)

63000

104000

8000

cash a/c

notes receivables a/c

to building

* book value of building =640000-100000-5000( depreciation to be charged) 640000-240000/40=10000 ( full year),

=535000

( being building sold)

115000

420000

land & building a/c

to cash

( being land and building purchased for cash)

* fixed assets is shown at historical cost not at the market values.

depreciation a/c

to equipment

* {1/4*200%}=50%on cost

175000*50%=87500

depreciation a/c

to land and building

*(320000-32000/40)*2/12=1200

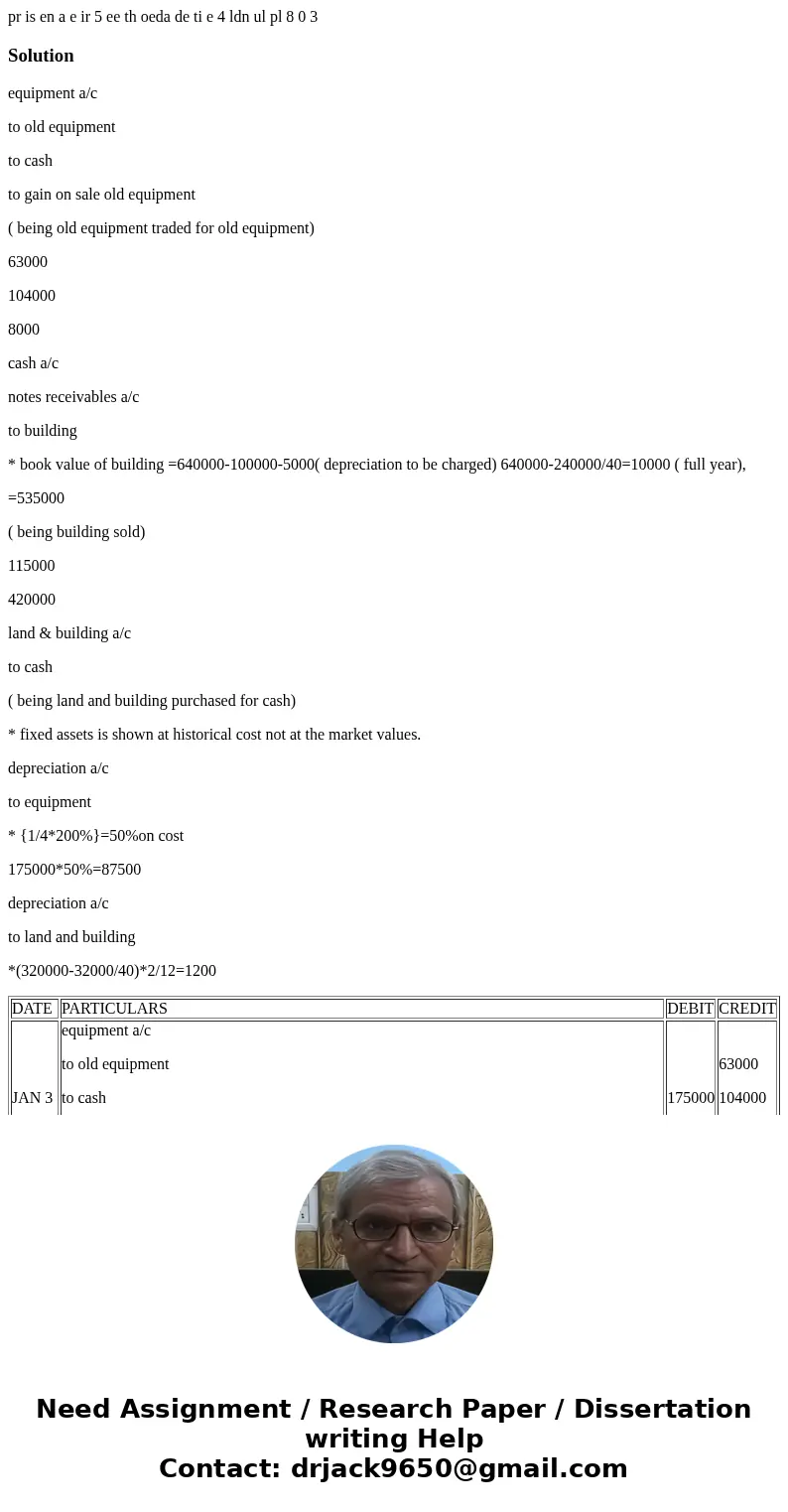

| DATE | PARTICULARS | DEBIT | CREDIT |

| JAN 3 | equipment a/c to old equipment to cash to gain on sale old equipment ( being old equipment traded for old equipment) | 175000 | 63000 104000 8000 |

| june 30 | cash a/c notes receivables a/c to building * book value of building =640000-100000-5000( depreciation to be charged) 640000-240000/40=10000 ( full year), =535000 ( being building sold) | 115000 420000 | 535000 |

| oct 31 | land & building a/c to cash ( being land and building purchased for cash) * fixed assets is shown at historical cost not at the market values. | 320000 | 320000 |

| dec 31 | depreciation a/c to equipment * {1/4*200%}=50%on cost 175000*50%=87500 | 87500 | 87500 |

| dec 31 | depreciation a/c to land and building *(320000-32000/40)*2/12=1200 | 1200 | 1200 |

Homework Sourse

Homework Sourse