All else constant if the correlation of a stocks returns wit

All else constant, if the correlation of a stock\'s returns with market returns increases, the stock\'s beta will .

A-increase

B-Decrease

Solution

Correct option is > A. Increase

The Beta of stock or portfolio increases with increase in correlation.

Sd Market = Standard deviation of Market return

Sd Stock = Standard deviation of Stock return.

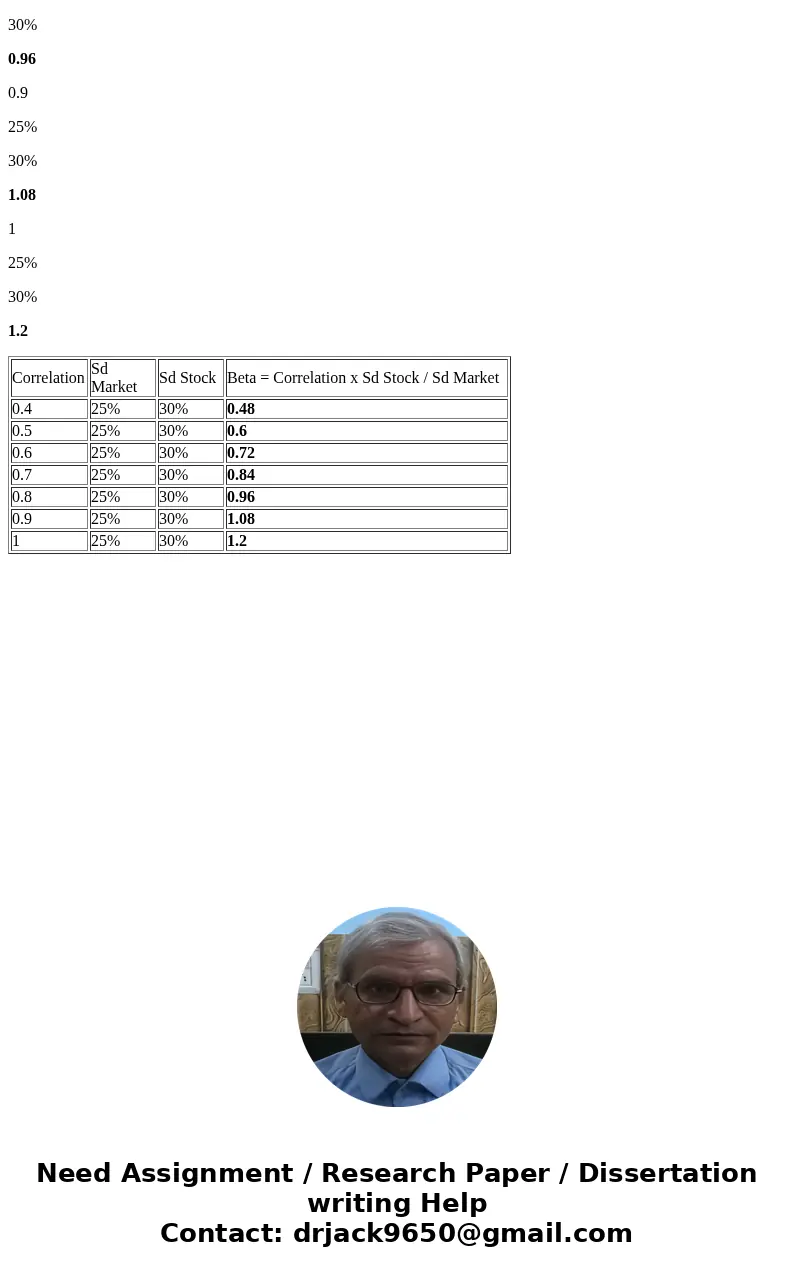

Beta = correlation x sd stock / sd market

Working:

Correlation

Sd Market

Sd Stock

Beta = Correlation x Sd Stock / Sd Market

0.4

25%

30%

0.48

0.5

25%

30%

0.6

0.6

25%

30%

0.72

0.7

25%

30%

0.84

0.8

25%

30%

0.96

0.9

25%

30%

1.08

1

25%

30%

1.2

| Correlation | Sd Market | Sd Stock | Beta = Correlation x Sd Stock / Sd Market |

| 0.4 | 25% | 30% | 0.48 |

| 0.5 | 25% | 30% | 0.6 |

| 0.6 | 25% | 30% | 0.72 |

| 0.7 | 25% | 30% | 0.84 |

| 0.8 | 25% | 30% | 0.96 |

| 0.9 | 25% | 30% | 1.08 |

| 1 | 25% | 30% | 1.2 |

Homework Sourse

Homework Sourse