Dimar sells today for 46 and the last dividends paid were 12

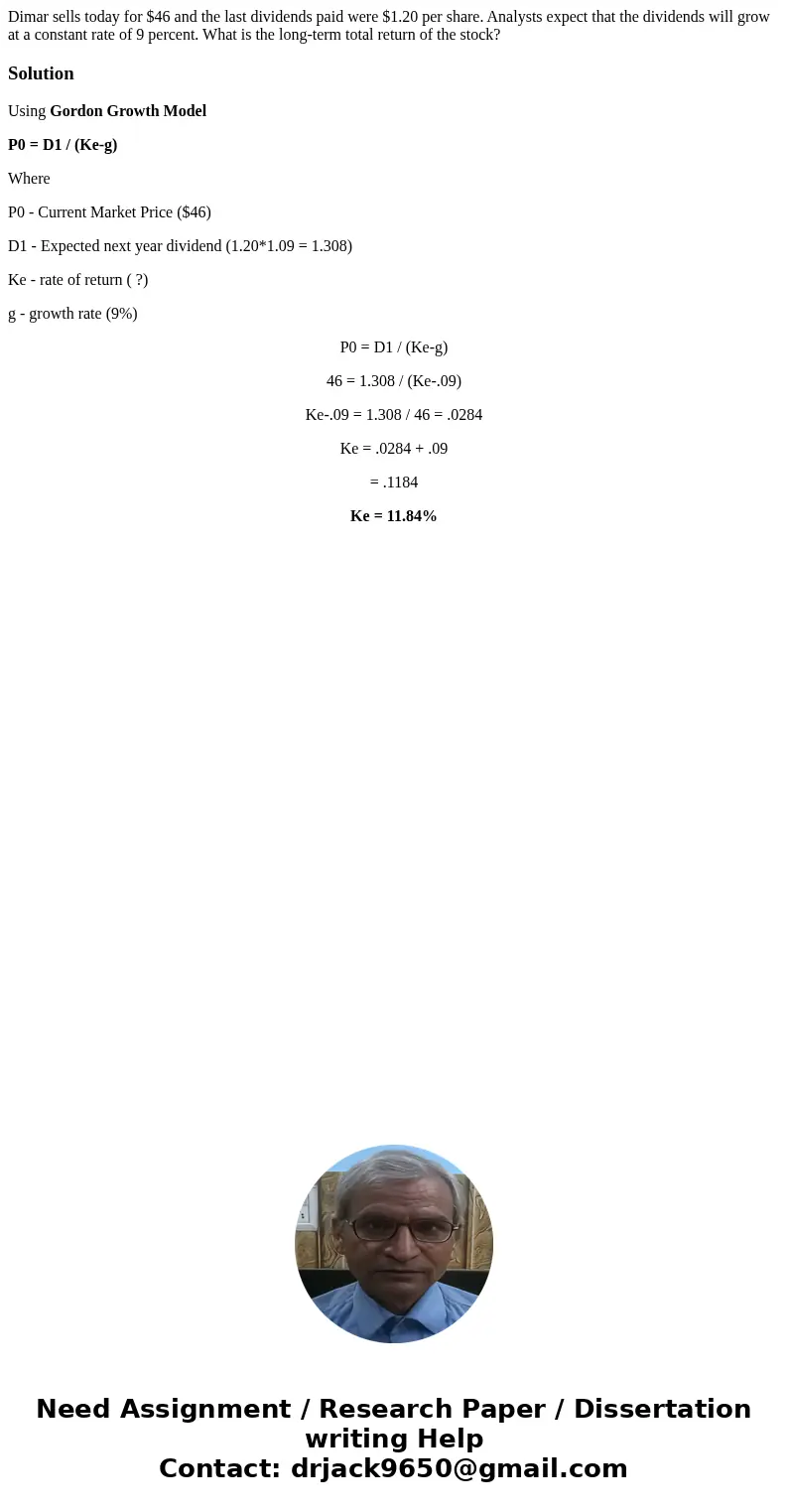

Dimar sells today for $46 and the last dividends paid were $1.20 per share. Analysts expect that the dividends will grow at a constant rate of 9 percent. What is the long-term total return of the stock?

Solution

Using Gordon Growth Model

P0 = D1 / (Ke-g)

Where

P0 - Current Market Price ($46)

D1 - Expected next year dividend (1.20*1.09 = 1.308)

Ke - rate of return ( ?)

g - growth rate (9%)

P0 = D1 / (Ke-g)

46 = 1.308 / (Ke-.09)

Ke-.09 = 1.308 / 46 = .0284

Ke = .0284 + .09

= .1184

Ke = 11.84%

Homework Sourse

Homework Sourse