Consider the following information for Presidio Incs most re

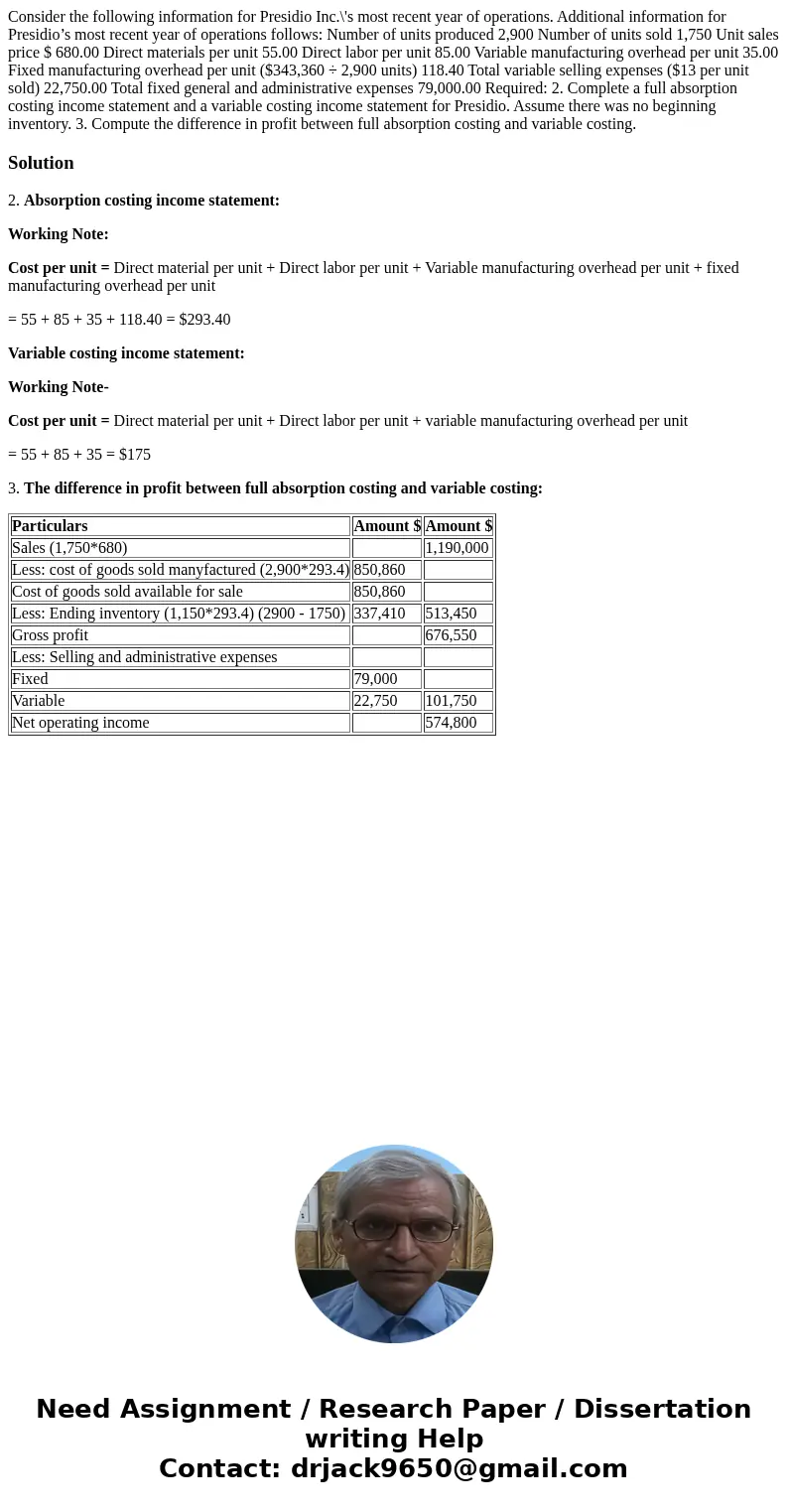

Consider the following information for Presidio Inc.\'s most recent year of operations. Additional information for Presidio’s most recent year of operations follows: Number of units produced 2,900 Number of units sold 1,750 Unit sales price $ 680.00 Direct materials per unit 55.00 Direct labor per unit 85.00 Variable manufacturing overhead per unit 35.00 Fixed manufacturing overhead per unit ($343,360 ÷ 2,900 units) 118.40 Total variable selling expenses ($13 per unit sold) 22,750.00 Total fixed general and administrative expenses 79,000.00 Required: 2. Complete a full absorption costing income statement and a variable costing income statement for Presidio. Assume there was no beginning inventory. 3. Compute the difference in profit between full absorption costing and variable costing.

Solution

2. Absorption costing income statement:

Working Note:

Cost per unit = Direct material per unit + Direct labor per unit + Variable manufacturing overhead per unit + fixed manufacturing overhead per unit

= 55 + 85 + 35 + 118.40 = $293.40

Variable costing income statement:

Working Note-

Cost per unit = Direct material per unit + Direct labor per unit + variable manufacturing overhead per unit

= 55 + 85 + 35 = $175

3. The difference in profit between full absorption costing and variable costing:

| Particulars | Amount $ | Amount $ |

| Sales (1,750*680) | 1,190,000 | |

| Less: cost of goods sold manyfactured (2,900*293.4) | 850,860 | |

| Cost of goods sold available for sale | 850,860 | |

| Less: Ending inventory (1,150*293.4) (2900 - 1750) | 337,410 | 513,450 |

| Gross profit | 676,550 | |

| Less: Selling and administrative expenses | ||

| Fixed | 79,000 | |

| Variable | 22,750 | 101,750 |

| Net operating income | 574,800 |

Homework Sourse

Homework Sourse