Problem 154 Pronghorn Corporations charter authorized issuan

Solution

No.

Account titles and explanation

debit

Credit

1.

Cash

9200

Discount on bonds payable

105

Bonds payable

9200

Preferred stock

50

Preferred Stock (Excess of Par Paid-In Capital) (balancing figure)

55

2.

Equipment (540*16)

8640

Common Stock (540*10)

5400

Common Stock (Excess of Par Paid-In Capital) (540*6)

3240

3.

Cash

9700

Preferred stock

5500

Preferred Stock (Excess of Par Paid-In Capital)

20

Common Stock

3630

Common Stock (Excess of Par Paid-In Capital)

550

4.

Equipment

6200

Preferred stock

860

Preferred Stock (Excess of Par Paid-In Capital)

2300

Common Stock

1900

Common Stock (Excess of Par Paid-In Capital)

1140

Explanation for 3

FMV

Allocation

par

APIC

Common stock

5082(363*14)

4180 (9700*(5082/(5082+6710)))

3630(363*10)

550 (4180-3630)

Preferred stock

6710(110*61)

5520(9700*(6710/(5082+6710)))

5500 (110*50)

20 (5520-5500)

Explanation for 4

Allocation of FMV for common stock = 190*16 = 3040

Par common stock = 190*10 = 1900

APIC common stock = 190*6 = 1140

Allocation of FMV for preferred stock = 6200-3040 = 3160

Par preferred stock = 46*50 = 2300

APIC preferred stock = 3160-2300 = 860

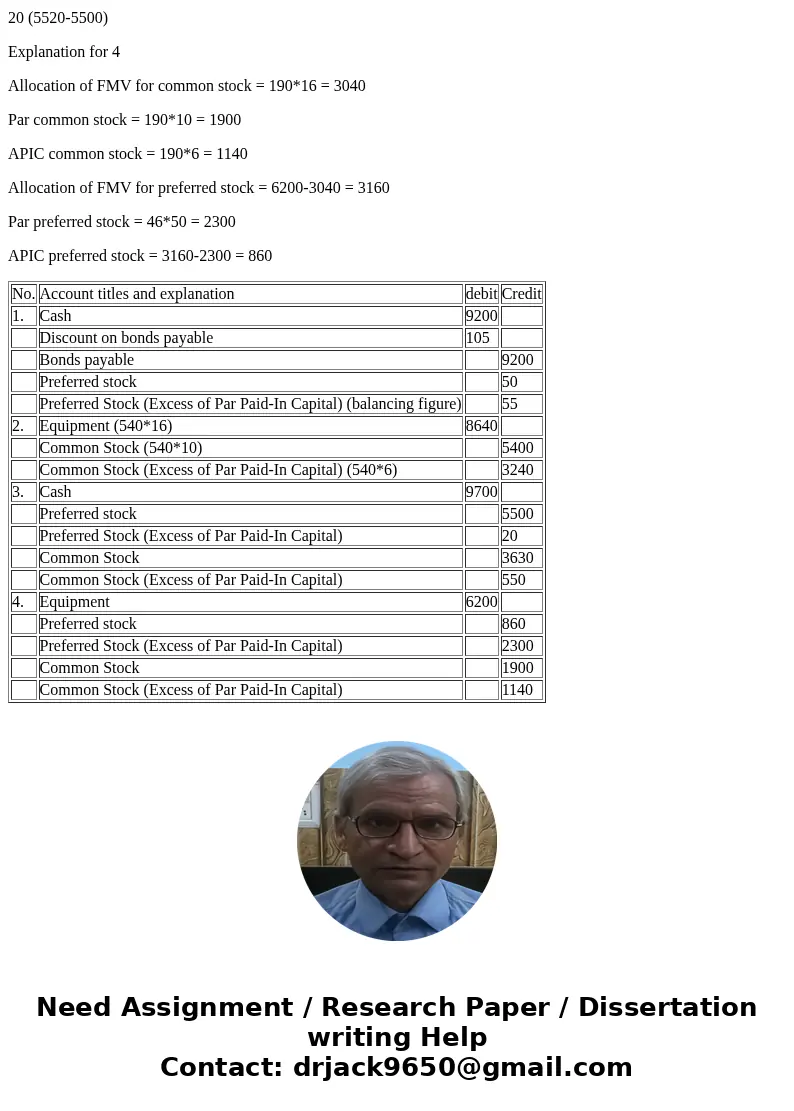

| No. | Account titles and explanation | debit | Credit |

| 1. | Cash | 9200 | |

| Discount on bonds payable | 105 | ||

| Bonds payable | 9200 | ||

| Preferred stock | 50 | ||

| Preferred Stock (Excess of Par Paid-In Capital) (balancing figure) | 55 | ||

| 2. | Equipment (540*16) | 8640 | |

| Common Stock (540*10) | 5400 | ||

| Common Stock (Excess of Par Paid-In Capital) (540*6) | 3240 | ||

| 3. | Cash | 9700 | |

| Preferred stock | 5500 | ||

| Preferred Stock (Excess of Par Paid-In Capital) | 20 | ||

| Common Stock | 3630 | ||

| Common Stock (Excess of Par Paid-In Capital) | 550 | ||

| 4. | Equipment | 6200 | |

| Preferred stock | 860 | ||

| Preferred Stock (Excess of Par Paid-In Capital) | 2300 | ||

| Common Stock | 1900 | ||

| Common Stock (Excess of Par Paid-In Capital) | 1140 |

Homework Sourse

Homework Sourse