Project red Industries after an expansion program A large lo

Project red Industries after an expansion program. A large loss occurred in 2016, rather than the expected profit. As a result, its investors, board of directors, and managers concern about the firm’s survival.

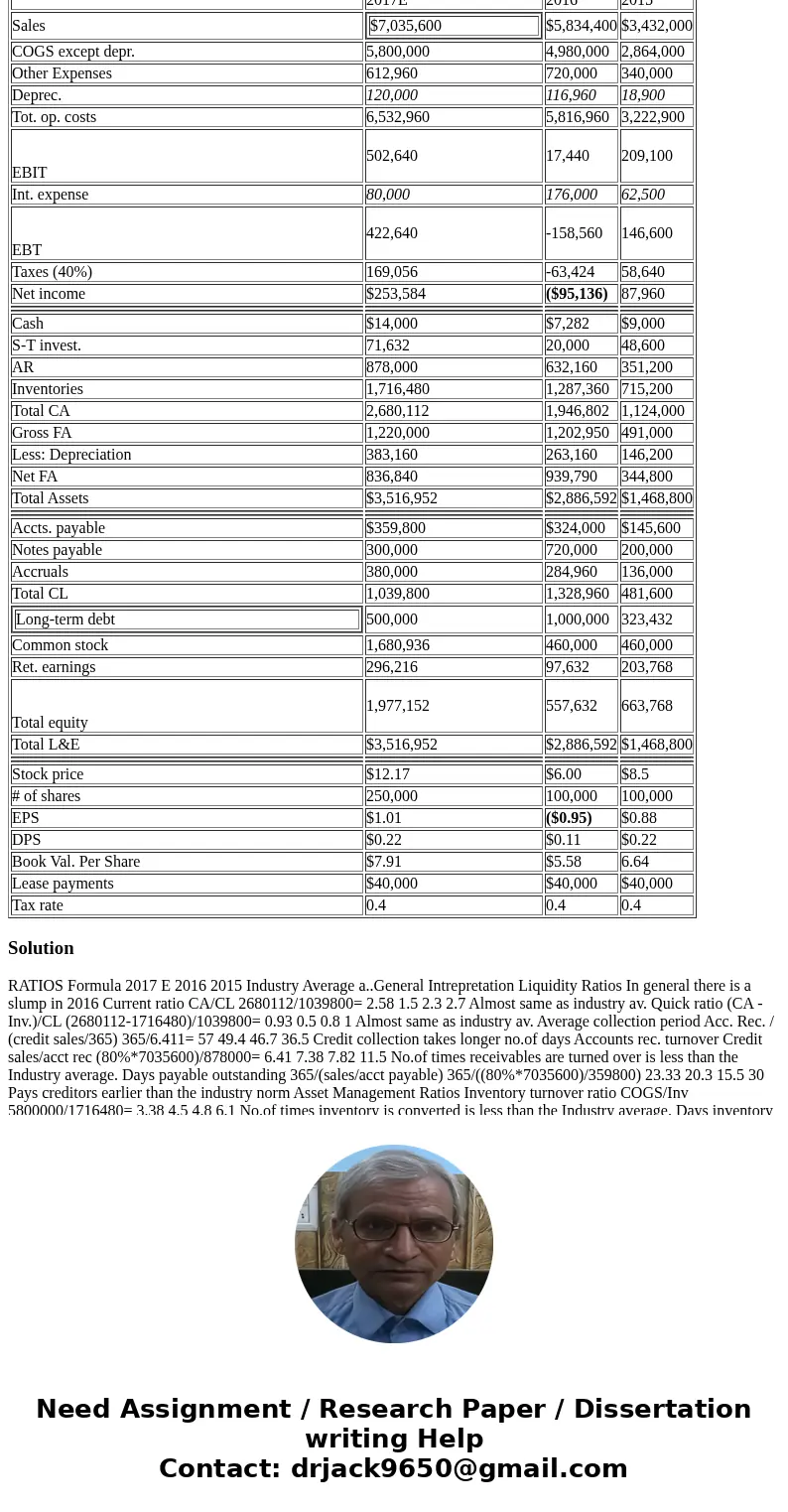

You are brought in as assistant to the Project red\'s chairman, who had the task of getting the company back into a sound financial position. Project\'s red 2015 and 2016 balance sheets and income statements, together with projections for 2017, are shown in the following tables. The tables also show the 2015 and 2016 financial ratios, along with industry average data. The 2017 projected financial statement data represent CFO’s best guess for 2017 results, assuming that some new financing is arranged to get the company “over the hump.”

COGS except depr.

Deprec.

Tot. op. costs

EBIT

Int. expense

EBT

S-T invest.

Less: Depreciation

Accts. payable

Notes payable

Accruals

Common stock

Ret. earnings

Total equity

You must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions should be taken. Your assignment is to help her answer the following questions. Provide clear explanations, not yes or no answers.

a. Calculate the following financial ratios for 2017E. Assume 80% sales are credit sales. This step is very important to note for credit sales.

(CA - Inv.)/CL

Acc. Rec. / (credit sales/365)

After filling out the 2017 above, help her answer the following questions. Where is the company now and how it can get better. Provide clear explanations, not yes or no answers. Based on the data gathered from the 5 sections, Liquidity ratios, Asset mangement ratios, Debt mangement ratios, profitability ratios, and market value ratios, what you would suggest in each section to improve the company.

b) General Interpretation and suggestion you would provide based on the analysis for - LIQUIDITY RATIOS:

c) General Interpretation and suggestion you would provide based on the analysis for - ASSET MANAGEMENT RATIOS:

d) General Interpretation and suggestion you would provide based on the analysis for - DEBT MANAGEMENT RATIOS:

e) General Interpretation and suggestion you would provide based on the analysis for - PROFITABILITY RATIOS:

f) General Interpretation and suggestion you would provide based on the analysis for - MARKET VALUE RATIOS:

| 2017E | 2016 | 2015 | ||

| Sales |

| $5,834,400 | $3,432,000 | |

| COGS except depr. | 5,800,000 | 4,980,000 | 2,864,000 | |

| Other Expenses | 612,960 | 720,000 | 340,000 | |

| Deprec. | 120,000 | 116,960 | 18,900 | |

| Tot. op. costs | 6,532,960 | 5,816,960 | 3,222,900 | |

| EBIT | 502,640 | 17,440 | 209,100 | |

| Int. expense | 80,000 | 176,000 | 62,500 | |

| EBT | 422,640 | -158,560 | 146,600 | |

| Taxes (40%) | 169,056 | -63,424 | 58,640 | |

| Net income | $253,584 | ($95,136) | 87,960 | |

| Cash | $14,000 | $7,282 | $9,000 | |

| S-T invest. | 71,632 | 20,000 | 48,600 | |

| AR | 878,000 | 632,160 | 351,200 | |

| Inventories | 1,716,480 | 1,287,360 | 715,200 | |

| Total CA | 2,680,112 | 1,946,802 | 1,124,000 | |

| Gross FA | 1,220,000 | 1,202,950 | 491,000 | |

| Less: Depreciation | 383,160 | 263,160 | 146,200 | |

| Net FA | 836,840 | 939,790 | 344,800 | |

| Total Assets | $3,516,952 | $2,886,592 | $1,468,800 | |

| Accts. payable | $359,800 | $324,000 | $145,600 | |

| Notes payable | 300,000 | 720,000 | 200,000 | |

| Accruals | 380,000 | 284,960 | 136,000 | |

| Total CL | 1,039,800 | 1,328,960 | 481,600 | |

| 500,000 | 1,000,000 | 323,432 | |

| Common stock | 1,680,936 | 460,000 | 460,000 | |

| Ret. earnings | 296,216 | 97,632 | 203,768 | |

| Total equity | 1,977,152 | 557,632 | 663,768 | |

| Total L&E | $3,516,952 | $2,886,592 | $1,468,800 | |

| Stock price | $12.17 | $6.00 | $8.5 | |

| # of shares | 250,000 | 100,000 | 100,000 | |

| EPS | $1.01 | ($0.95) | $0.88 | |

| DPS | $0.22 | $0.11 | $0.22 | |

| Book Val. Per Share | $7.91 | $5.58 | 6.64 | |

| Lease payments | $40,000 | $40,000 | $40,000 | |

| Tax rate | 0.4 | 0.4 | 0.4 |

Solution

RATIOS Formula 2017 E 2016 2015 Industry Average a..General Intrepretation Liquidity Ratios In general there is a slump in 2016 Current ratio CA/CL 2680112/1039800= 2.58 1.5 2.3 2.7 Almost same as industry av. Quick ratio (CA - Inv.)/CL (2680112-1716480)/1039800= 0.93 0.5 0.8 1 Almost same as industry av. Average collection period Acc. Rec. / (credit sales/365) 365/6.411= 57 49.4 46.7 36.5 Credit collection takes longer no.of days Accounts rec. turnover Credit sales/acct rec (80%*7035600)/878000= 6.41 7.38 7.82 11.5 No.of times receivables are turned over is less than the Industry average. Days payable outstanding 365/(sales/acct payable) 365/((80%*7035600)/359800) 23.33 20.3 15.5 30 Pays creditors earlier than the industry norm Asset Management Ratios Inventory turnover ratio COGS/Inv 5800000/1716480= 3.38 4.5 4.8 6.1 No.of times inventory is converted is less than the Industry average. Days inventory held 365/Inv turnover 365/3.38= 108 81.1 76 40 Inventory takes longer no.of days to get converted to sales. Days sales outstanding Acct Rec/(sales/365) 878000/((80%*7035600)/365)= 57 39.6 37.3 32 Credit collection takes longer no.of days Fixed assets turnover Sales/FA 7035600/836840= 8.41 6.2 10 7 Fixed Asset utilisation (conversion to sales) is improving & better than industry av. Total assets turnover Sales/TA 7035600/3516952= 2.00 2 2.3 2.5 With respect to total assets ,efficiency in conversion to $ sales is reduced because of inventory & receivables Debt Management Ratios Debt Ratio (Note payable + LT Debt)/TA (300000+500000)/3516952= 22.75% 59.59% 35.64% 32% Has lower level of debt to total assets Liabilities ratio TL/TA 1539800/3516952= 0.44 80.7 54.80% 50.00% Has lower level of debt to total assets Time interest earned EBIT/Int Exp 502640/80000= 6.28 0.1 3.3 6.2 No.of times interest expenses are covered is almost the same EBIDTA Coverage (EBIT + Dep + Lease)/(Int exp + Lease + loan payment) (502640+120000+40000)/(80000+40000)= 5.52 0.8 2.6 8 No.of times of coverage is improving ,but still below industry norm. Profitability Ratios Profit margin NI / Sales 253584/7035600= 3.60% -1.60% 2.60% 3.60% Profitability is almost same Operating margin EBIT / Sales 502640/7035600= 7.14% 0.30% 6.09% 7.10% Profitability is almost same Gross profit margin (sales-COGS) / Sales (7035600-5800000)/7035600= 17.56% 14.60% 16.60% 15.50% Gross Profit % is better than ind.av. Basic earning power EBIT / TA 502640/3516952= 14.29% 0.60% 14.20% 17.80% Slight decrease Return on assets NI / TA 253584/3516952= 7.21% -3.30% 6% 9% ROA is less than industry av. ,but improving over the 3 yrs. Return on equity NI / Common equity 253584/1977152= 12.83% -17.10% 13.30% 18% ROE is also less than industry av. ,but improving over the 3 yrs. Operating ROA EBIT / TA 502640/3516952= 14.29% Market value ratios Price/earnings ratio Share price / EPS 12.17/1.01= 12.05 -6.3 9.7 14.2 Share price has increased but still below industry level Price/cash flow ratio Share price / [(NI + Depr.) / shares outstanding] 12.17/((253584+120000)/250000)= 8.14 27.50% 8 7.6 Cash flow is greater in all the 3 yrs. Market/ Book ratio Market share price per share / book value per share 12.17/7.91= 1.54 1.10% 1.3 2.9 M/B has always been less than industry average. b. Liquidity Needs faster credit collections Reduce inventory levels to the optimum ,without affecting sales demands Advantage to be taken of the full credit period offered by the suppliers --to maintain cash flow within the business c. Asset Efficiency: Both Receivables & inventory need revision in policies as to the level to be maintained for better cash flow Fixed assets are being utilised comparatively more efficiently than in the overall industry. It is because of the 2 components of current assets-- receivables & inventory that the total turnover has decreased. D. Debt management Can marginally increase the level of debt ,upto the industry level, so as to take tax-advantages of interest expenses & to bring down the cost of total capital. e. Profitability: All the Profitabilty ratios have reached the industry average . When compared with total assets , EBIT/net income is decreasing ,as the inventory & receivables in the total assets are stagnating.Pruning them will improve the ratio. The total ROA is less for the same reason. ROE has to be improved ,to improve EPS . f. Market value Market value can be improved by improving the EPS to the level prevalent in the market. Better working capital management, especially receivables & inventory , will improve cash flows within the business--- which in turn will improve the market prices.

Homework Sourse

Homework Sourse