Return to question bin Companys relevant range of producion

Solution

Solution - Calculation of Product and period cost

Product cost = Product cost are manufacturing cost incurred in producing the goods.

Product costs is directly related to production which includes material, labour, Manufacturing overhead (Variable and fixed)

Period Cost = Period Cost are non manufacturing cost incurred indirectly and are not related to production.

Period costs are selling expenses and adninistrative expenses

Note 1 - Fixed Manufacturing overhead = $5.5*17250 units = $94875

Note 2 - Fixed Selling expenses = $4*17250 = $69000

Note 3 - Fixed Administrative expenses = $3*17250 = $51750

20500 Units Product cost

$287000

($14*20500)

$94875 (Note 1)

(Fixed cost does not change with the change in the units of production. Fixed cost remains same)

$21000

($1.5*14000)

$14000

($1*14000)

$69000

(Note 2)

(Fixed cost does not change with the change in units of production. It remain constant)

$51750

(Note 3)

(Fixed cost does not change with the change in the unit of production. It remain constant)

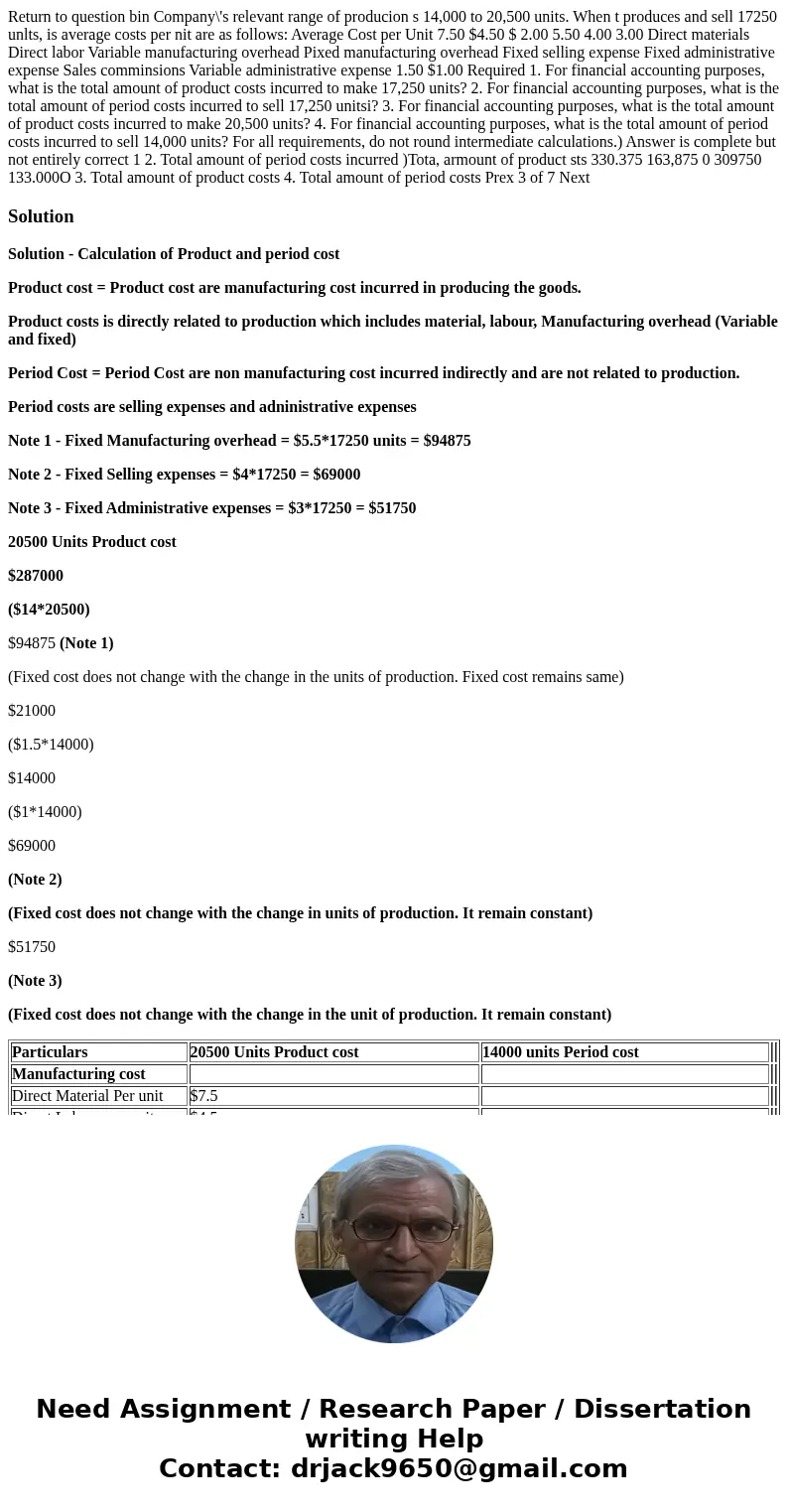

| Particulars | 20500 Units Product cost | 14000 units Period cost | ||

| Manufacturing cost | ||||

| Direct Material Per unit | $7.5 | |||

| Direct Labour per unit | $4.5 | |||

| Variable overhead per unit | $2.0 | |||

| Total Variable cost ($7.5 + $4.5 + $2) = $14 | $287000 ($14*20500) | |||

| Fixed Manufacturing Overhead | $94875 (Note 1) (Fixed cost does not change with the change in the units of production. Fixed cost remains same) | |||

| Non Manufacturing cost | ||||

| Variable Sales commission expenses | $21000 ($1.5*14000) | |||

| Variable administrative expenses | $14000 ($1*14000) | |||

| Fixed selling expenses | $69000 (Note 2) (Fixed cost does not change with the change in units of production. It remain constant) | |||

| Fixed administrative expenses | $51750 (Note 3) (Fixed cost does not change with the change in the unit of production. It remain constant) | |||

| Total Cost | $381875 | $155750 |

Homework Sourse

Homework Sourse