Using sampling and Sampling Distributions A financial instit

Using sampling and Sampling Distributions

A financial institution sells several kinds of investment products - a stock fund, a bond fund, and a tax-deferred annuity. The company is examining whether customer satisfaction depends on the type of investment product purchased. To do this, 100 clients are randomly selected from the population of clients who have purchased shares in exactly one of the funds. The company records the fund type purchased by these clients and asks each sampled client to rate his/her level of satisfaction with the fund as either high, medium, or low. Analyze this data and summarize your results.

FundType

SRating

BOND

HIGH

STOCK

HIGH

TAXDEF

MED

TAXDEF

MED

STOCK

LOW

STOCK

HIGH

STOCK

HIGH

BOND

MED

TAXDEF

LOW

TAXDEF

LOW

STOCK

MED

BOND

LOW

STOCK

HIGH

TAXDEF

MED

TAXDEF

MED

TAXDEF

LOW

STOCK

HIGH

BOND

HIGH

BOND

MED

TAXDEF

MED

TAXDEF

MED

BOND

HIGH

TAXDEF

MED

TAXDEF

LOW

STOCK

HIGH

BOND

HIGH

TAXDEF

LOW

BOND

MED

STOCK

HIGH

STOCK

HIGH

BOND

MED

TAXDEF

MED

BOND

HIGH

STOCK

MED

STOCK

HIGH

BOND

MED

TAXDEF

MED

TAXDEF

LOW

STOCK

HIGH

TAXDEF

MED

BOND

HIGH

BOND

HIGH

BOND

LOW

TAXDEF

LOW

STOCK

HIGH

BOND

HIGH

BOND

MED

STOCK

HIGH

TAXDEF

MED

TAXDEF

MED

STOCK

HIGH

TAXDEF

MED

STOCK

HIGH

TAXDEF

MED

STOCK

LOW

BOND

HIGH

STOCK

HIGH

BOND

MED

TAXDEF

LOW

TAXDEF

LOW

STOCK

MED

BOND

LOW

STOCK

HIGH

TAXDEF

MED

TAXDEF

MED

TAXDEF

LOW

STOCK

HIGH

BOND

HIGH

BOND

MED

TAXDEF

MED

TAXDEF

MED

BOND

HIGH

TAXDEF

MED

TAXDEF

LOW

STOCK

HIGH

BOND

HIGH

TAXDEF

LOW

BOND

MED

STOCK

HIGH

STOCK

HIGH

BOND

MED

TAXDEF

MED

BOND

HIGH

STOCK

MED

STOCK

HIGH

BOND

MED

TAXDEF

MED

TAXDEF

LOW

STOCK

HIGH

TAXDEF

MED

BOND

HIGH

TAXDEF

HIGH

TAXDEF

LOW

TAXDEF

LOW

STOCK

HIGH

BOND

HIGH

BOND

MED

STOCK

HIGH

TAXDEF

MED

TAXDEF

MED

| FundType | SRating |

| BOND | HIGH |

| STOCK | HIGH |

| TAXDEF | MED |

| TAXDEF | MED |

| STOCK | LOW |

| STOCK | HIGH |

| STOCK | HIGH |

| BOND | MED |

| TAXDEF | LOW |

| TAXDEF | LOW |

| STOCK | MED |

| BOND | LOW |

| STOCK | HIGH |

| TAXDEF | MED |

| TAXDEF | MED |

| TAXDEF | LOW |

| STOCK | HIGH |

| BOND | HIGH |

| BOND | MED |

| TAXDEF | MED |

| TAXDEF | MED |

| BOND | HIGH |

| TAXDEF | MED |

| TAXDEF | LOW |

| STOCK | HIGH |

| BOND | HIGH |

| TAXDEF | LOW |

| BOND | MED |

| STOCK | HIGH |

| STOCK | HIGH |

| BOND | MED |

| TAXDEF | MED |

| BOND | HIGH |

| STOCK | MED |

| STOCK | HIGH |

| BOND | MED |

| TAXDEF | MED |

| TAXDEF | LOW |

| STOCK | HIGH |

| TAXDEF | MED |

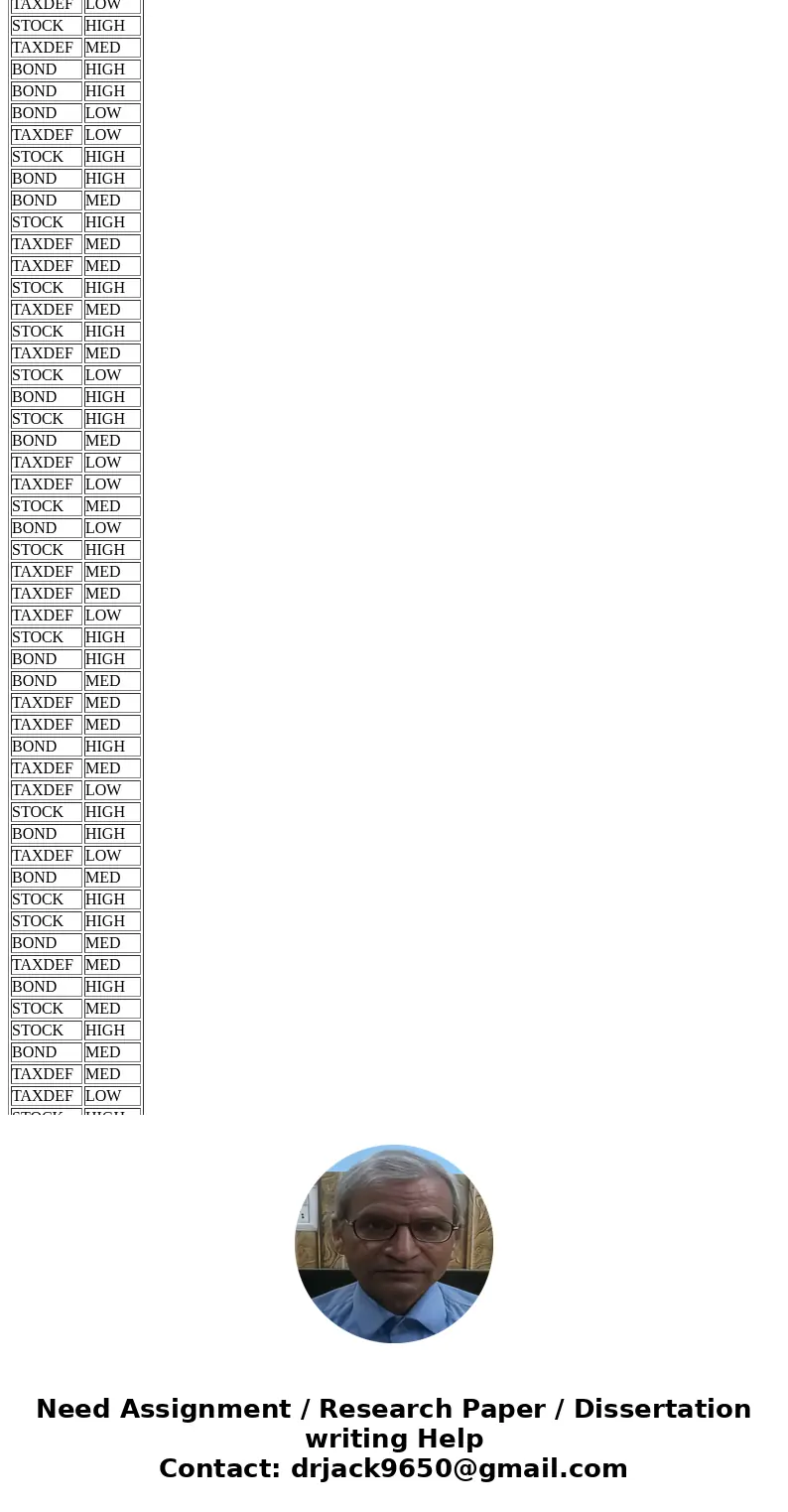

| BOND | HIGH |

| BOND | HIGH |

| BOND | LOW |

| TAXDEF | LOW |

| STOCK | HIGH |

| BOND | HIGH |

| BOND | MED |

| STOCK | HIGH |

| TAXDEF | MED |

| TAXDEF | MED |

| STOCK | HIGH |

| TAXDEF | MED |

| STOCK | HIGH |

| TAXDEF | MED |

| STOCK | LOW |

| BOND | HIGH |

| STOCK | HIGH |

| BOND | MED |

| TAXDEF | LOW |

| TAXDEF | LOW |

| STOCK | MED |

| BOND | LOW |

| STOCK | HIGH |

| TAXDEF | MED |

| TAXDEF | MED |

| TAXDEF | LOW |

| STOCK | HIGH |

| BOND | HIGH |

| BOND | MED |

| TAXDEF | MED |

| TAXDEF | MED |

| BOND | HIGH |

| TAXDEF | MED |

| TAXDEF | LOW |

| STOCK | HIGH |

| BOND | HIGH |

| TAXDEF | LOW |

| BOND | MED |

| STOCK | HIGH |

| STOCK | HIGH |

| BOND | MED |

| TAXDEF | MED |

| BOND | HIGH |

| STOCK | MED |

| STOCK | HIGH |

| BOND | MED |

| TAXDEF | MED |

| TAXDEF | LOW |

| STOCK | HIGH |

| TAXDEF | MED |

| BOND | HIGH |

| TAXDEF | HIGH |

| TAXDEF | LOW |

| TAXDEF | LOW |

| STOCK | HIGH |

| BOND | HIGH |

| BOND | MED |

| STOCK | HIGH |

| TAXDEF | MED |

| TAXDEF | MED |

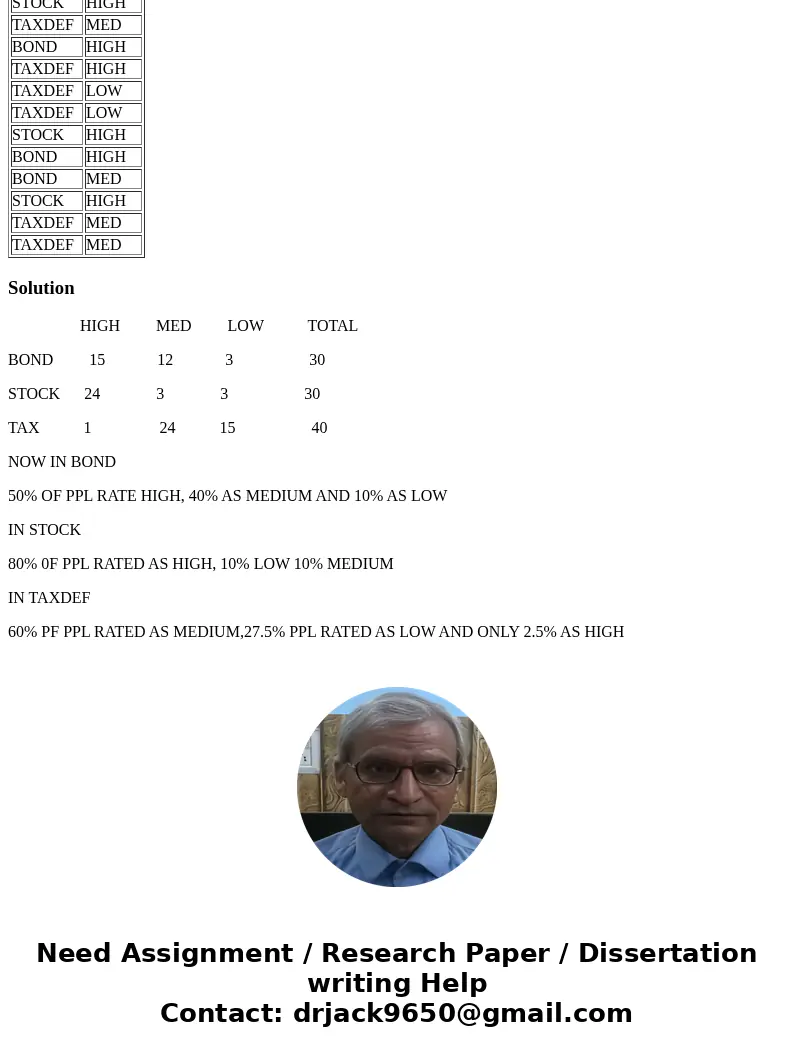

Solution

HIGH MED LOW TOTAL

BOND 15 12 3 30

STOCK 24 3 3 30

TAX 1 24 15 40

NOW IN BOND

50% OF PPL RATE HIGH, 40% AS MEDIUM AND 10% AS LOW

IN STOCK

80% 0F PPL RATED AS HIGH, 10% LOW 10% MEDIUM

IN TAXDEF

60% PF PPL RATED AS MEDIUM,27.5% PPL RATED AS LOW AND ONLY 2.5% AS HIGH

Homework Sourse

Homework Sourse