On January 2 2018 Stewart Company purchased land that cost 6

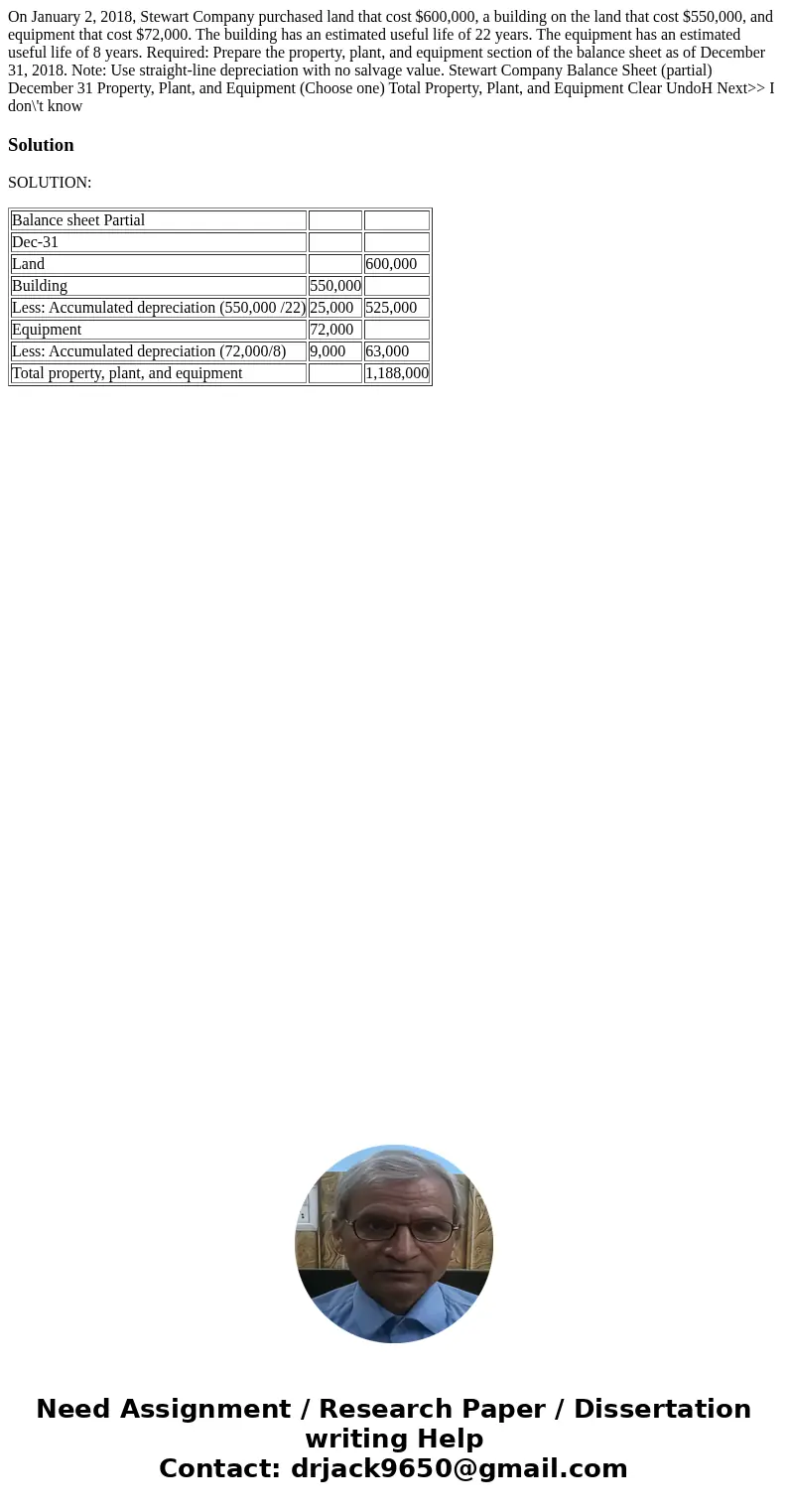

On January 2, 2018, Stewart Company purchased land that cost $600,000, a building on the land that cost $550,000, and equipment that cost $72,000. The building has an estimated useful life of 22 years. The equipment has an estimated useful life of 8 years. Required: Prepare the property, plant, and equipment section of the balance sheet as of December 31, 2018. Note: Use straight-line depreciation with no salvage value. Stewart Company Balance Sheet (partial) December 31 Property, Plant, and Equipment (Choose one) Total Property, Plant, and Equipment Clear UndoH Next>> I don\'t know

Solution

SOLUTION:

| Balance sheet Partial | ||

| Dec-31 | ||

| Land | 600,000 | |

| Building | 550,000 | |

| Less: Accumulated depreciation (550,000 /22) | 25,000 | 525,000 |

| Equipment | 72,000 | |

| Less: Accumulated depreciation (72,000/8) | 9,000 | 63,000 |

| Total property, plant, and equipment | 1,188,000 |

Homework Sourse

Homework Sourse