Prepare the journal entry at the date of the bond purchase C

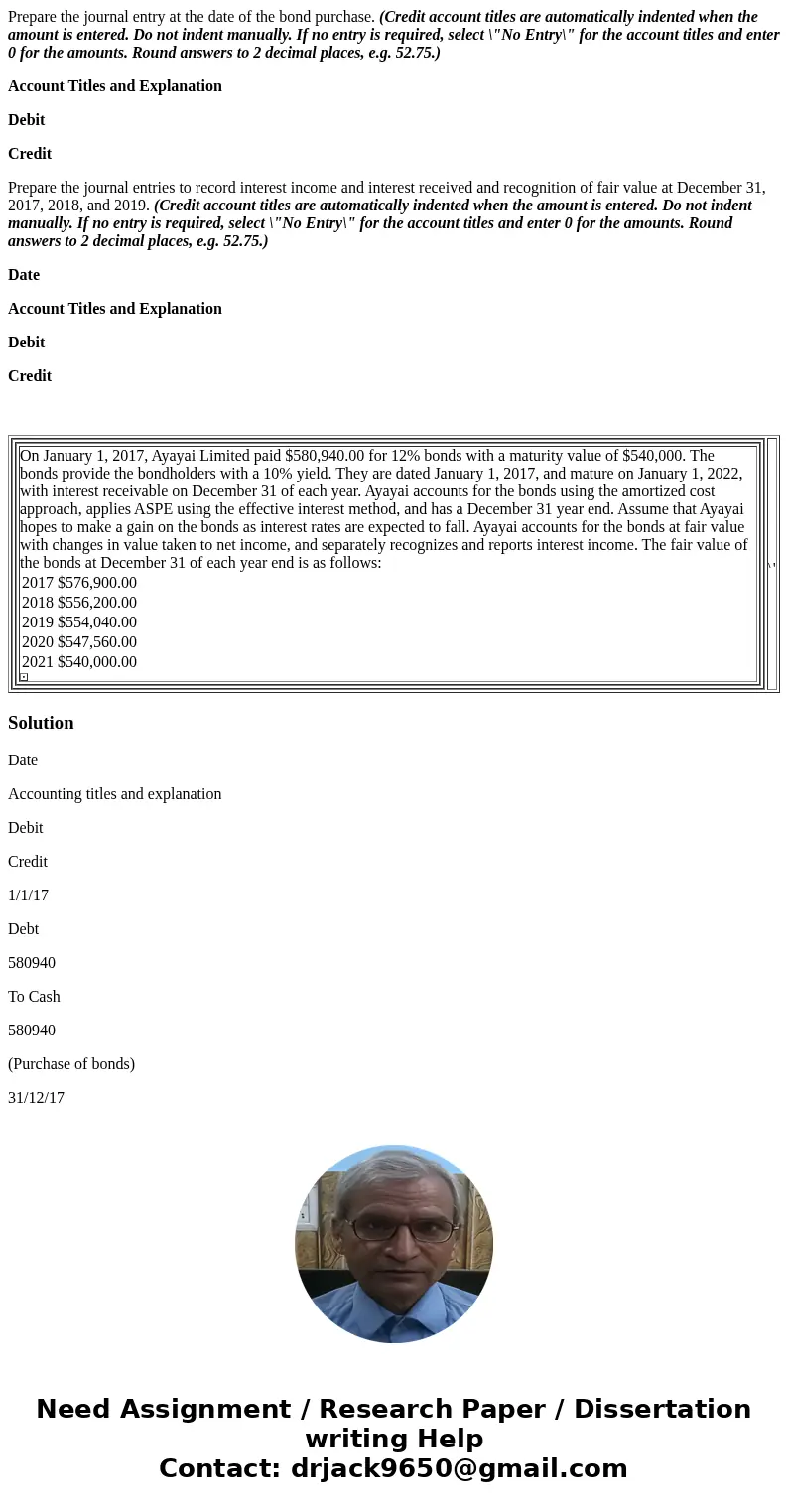

Prepare the journal entry at the date of the bond purchase. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Round answers to 2 decimal places, e.g. 52.75.)

Account Titles and Explanation

Debit

Credit

Prepare the journal entries to record interest income and interest received and recognition of fair value at December 31, 2017, 2018, and 2019. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Round answers to 2 decimal places, e.g. 52.75.)

Date

Account Titles and Explanation

Debit

Credit

|

Solution

Date

Accounting titles and explanation

Debit

Credit

1/1/17

Debt

580940

To Cash

580940

(Purchase of bonds)

31/12/17

Cash (540000*12%)

64800

To Debt (Premium amortized)

6706

To Interest income (580940*10%)

58094

(Interest income and interest received)

31/12/17

Fair Value Adjustment (Fair value - Bond Value)

2666

To Unrealised Holding Gain or Loss - Income

2666

(To bring investment to fair value - Refer to working table for all calculations)

31/12/18

Cash (540000*12%)

64800

To Debt (Premium amortized)

7376.60

To Interest income (574234*10%)

57423.40

(Interest income and interest received)

31/12/18

Unrealised Holding Gain or Loss - Income

-13323.4

To Fair Value Adjustment

-13323.4

(To bring investment to fair value - Refer to working table for all calculations)

31/12/19

Cash (540000*12%)

64800

To Debt (Premium amortized)

8114.26

To Interest income (566857.40*10%)

56685.74

(Interest income and interest received)

31/12/19

Fair Value Adjustment

5954.26

To Unrealised Holding Gain or Loss - Income

5954.26

(To bring investment to fair value - Refer to working table for all calculations)

Working table:

Date

Cash Received

Interest Revenue

Amortized premium

Amount of Bonds

Fair Value

Fair Value Adjustment

Yearly adjustment

1/1/17

580940

31/12/17

64800

58094

6706

574234

576900

2666

2666

31/12/18

64800

57423.4

7376.6

566857.4

556200

-10657.4

-13323.4

31/12/19

64800

56685.74

8114.26

558743.14

554040

-4703.14

5954.26

31/12/20

64800

55875.31

8924.69

549818.45

547560

-2258.45

2444.69

31/12/21

64800

54981.55

9818.45

540000

540000

0

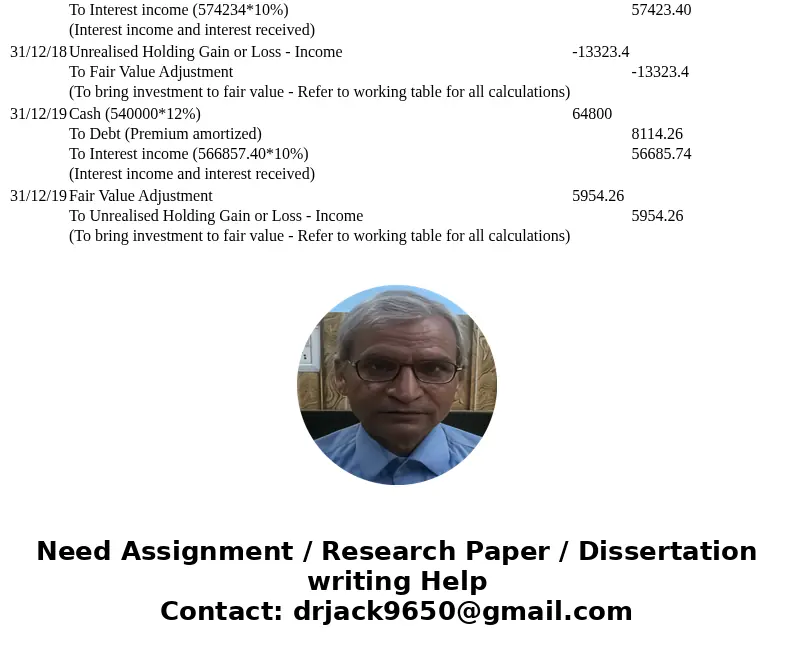

| Date | Accounting titles and explanation | Debit | Credit |

| 1/1/17 | Debt | 580940 | |

| To Cash | 580940 | ||

| (Purchase of bonds) | |||

| 31/12/17 | Cash (540000*12%) | 64800 | |

| To Debt (Premium amortized) | 6706 | ||

| To Interest income (580940*10%) | 58094 | ||

| (Interest income and interest received) | |||

| 31/12/17 | Fair Value Adjustment (Fair value - Bond Value) | 2666 | |

| To Unrealised Holding Gain or Loss - Income | 2666 | ||

| (To bring investment to fair value - Refer to working table for all calculations) | |||

| 31/12/18 | Cash (540000*12%) | 64800 | |

| To Debt (Premium amortized) | 7376.60 | ||

| To Interest income (574234*10%) | 57423.40 | ||

| (Interest income and interest received) | |||

| 31/12/18 | Unrealised Holding Gain or Loss - Income | -13323.4 | |

| To Fair Value Adjustment | -13323.4 | ||

| (To bring investment to fair value - Refer to working table for all calculations) | |||

| 31/12/19 | Cash (540000*12%) | 64800 | |

| To Debt (Premium amortized) | 8114.26 | ||

| To Interest income (566857.40*10%) | 56685.74 | ||

| (Interest income and interest received) | |||

| 31/12/19 | Fair Value Adjustment | 5954.26 | |

| To Unrealised Holding Gain or Loss - Income | 5954.26 | ||

| (To bring investment to fair value - Refer to working table for all calculations) |

Homework Sourse

Homework Sourse