Thanks Assume a world without inflation Janice Lewisberg 38

Solution

Answer )

Current Age = 38 years , retirement age = 68 years, life expectancy = 90 years, Periodic annuity amount (P) = $35,000,

investment terms (t) = 68-38= 30 years

Annuity payment term (n) = 90-68 = 22 years at beginning of each year.

Return rate (r) = 6%

Value of annuity (A) = (P (1- (1 + r)^-n) / r)) * (1 + r) ------- eq(1)

where, P = periodic payment , n = no of periods

Answer a)

Using eq(1) , Retirement corpus = ( 35000*(1- (1+0.06)^-22)/ 0.06)* (1.06) = $ 446742.7

Answer B)

To calculate the annual investment made by investors , ( at the end of year)

FV of annuity = P [ ((1+r)^t -1) /r)

=> periodic payment (P) = FV / [ ((1+r)^t -1) /r) ]

Here, in the question , the FV = $ 446,742.7 , r = 6% , t= 30 years

P = 446742.7 / (((1+6%)^30) - 1) / 6% = $ 5,650.81 each year

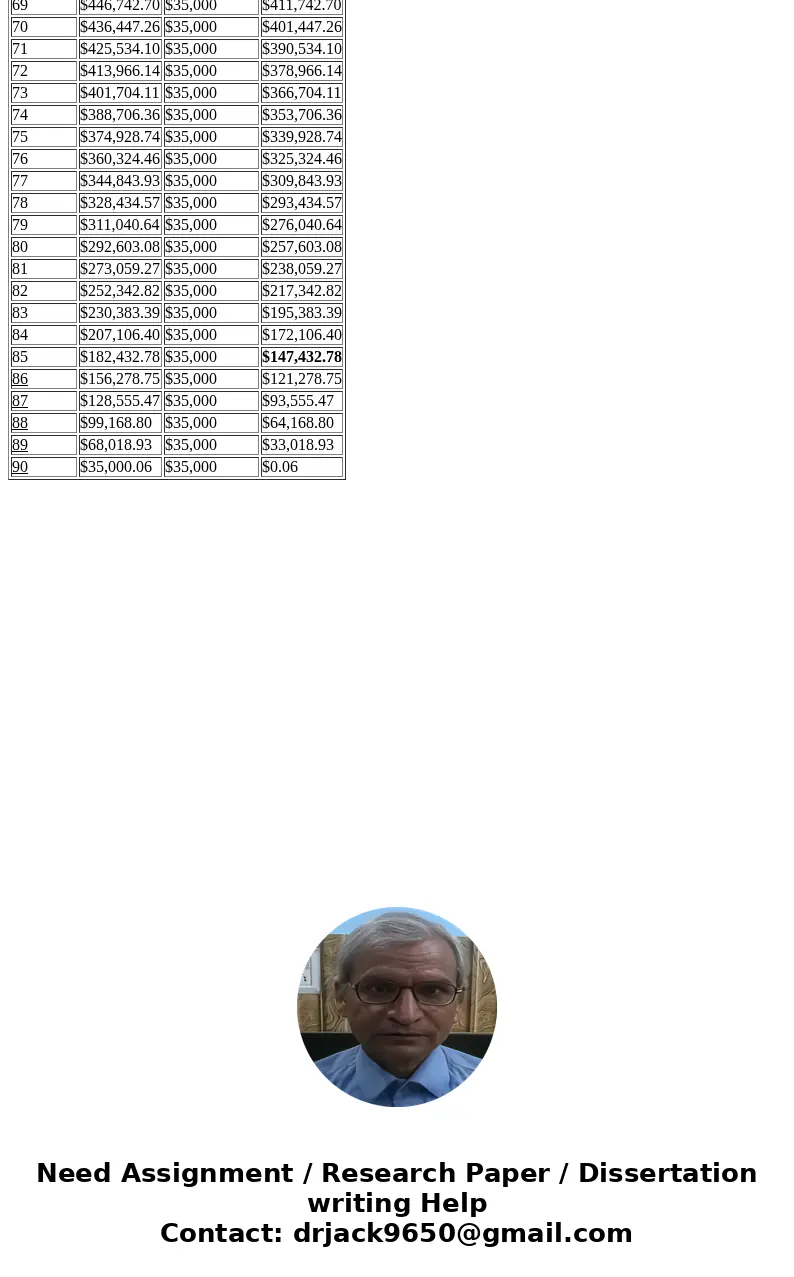

Answer (C)

If he dies at age of 85 , it means will not recieve the annuity payment due at beginning of age 86 .

Balance transfer to her estate = $ 147,432.78

Answer D )

Now all calculation at r= 8%

Using eq(1) , Retirement corpus = ( 35000*(1- (1+0.08)^-22)/ 0.08)* (1.08) = $ 385588.1

Amount to be saved each year ,

periodic payment (P) = FV / [ ((1+r)^t -1) /r) ]

=>P = 385588.1 / (((1+8%)^30) - 1) / 8% =$ 3403.76

The calculation of balance payment transfer to her Estate.

Remaining balance = $ 139,744.82

calculated below

| Age | Annuity value | Annuity Paid | Balance end of year |

| 69 | $446,742.70 | $35,000 | $411,742.70 |

| 70 | $436,447.26 | $35,000 | $401,447.26 |

| 71 | $425,534.10 | $35,000 | $390,534.10 |

| 72 | $413,966.14 | $35,000 | $378,966.14 |

| 73 | $401,704.11 | $35,000 | $366,704.11 |

| 74 | $388,706.36 | $35,000 | $353,706.36 |

| 75 | $374,928.74 | $35,000 | $339,928.74 |

| 76 | $360,324.46 | $35,000 | $325,324.46 |

| 77 | $344,843.93 | $35,000 | $309,843.93 |

| 78 | $328,434.57 | $35,000 | $293,434.57 |

| 79 | $311,040.64 | $35,000 | $276,040.64 |

| 80 | $292,603.08 | $35,000 | $257,603.08 |

| 81 | $273,059.27 | $35,000 | $238,059.27 |

| 82 | $252,342.82 | $35,000 | $217,342.82 |

| 83 | $230,383.39 | $35,000 | $195,383.39 |

| 84 | $207,106.40 | $35,000 | $172,106.40 |

| 85 | $182,432.78 | $35,000 | $147,432.78 |

| 86 | $156,278.75 | $35,000 | $121,278.75 |

| 87 | $128,555.47 | $35,000 | $93,555.47 |

| 88 | $99,168.80 | $35,000 | $64,168.80 |

| 89 | $68,018.93 | $35,000 | $33,018.93 |

| 90 | $35,000.06 | $35,000 | $0.06 |

Homework Sourse

Homework Sourse