Attempts Score 8 20 Capital Budgeting Decision Criteria NPV

Attempts Score: /8 20. Capital Budgeting Decision Criteria: NPV Capital Budgeting Decision Criteria: NPV The net present value (NPV) method estimates how much a potential project will coneribute to Select velue means aSeectstock price. In equation form, the NPV is defined as: selection criterion. The Serect- the NPV, the more valve the project adds; and added cash fiow in Period t, r is the preject\'s risk-adjusted cost of capital, and cash outhiows CPt is the expected adjusted Seec- When the the project with the are treated as negative cash flows. The NPV calculatien assumes that cash infiws can be reinvested at the project\'s risk- ??? firm is considering independe, prends, , the proedt\'s ?? \"xceeds hero the nmn thoug is when the firm is considering mutualily exclusive prejects, the firm should accept Seec NPV Quantitative Problem: Bellinger industries is considening I two projects for inclusion in es f capital budget, and you have been asked to do the analysx. Both prejects\' ater-tax cash Nows are shown on the time ine salvage values, net operating working captal requirements, and tax effects are al ieclubed in these cast projects have 4 year lives, and they have risk characteristios simlar to the K\'s average What is Project A\'s NaV? Round your answer to the nearest cent. Do not your intermesiate what is Project 8\'s NPV? Round your answer to the nearest cent. De not round vour itermedate were indesendent, which prejectcs) would be accepted? the projects were mutualy echaive, which prejeonts) would be acceosed

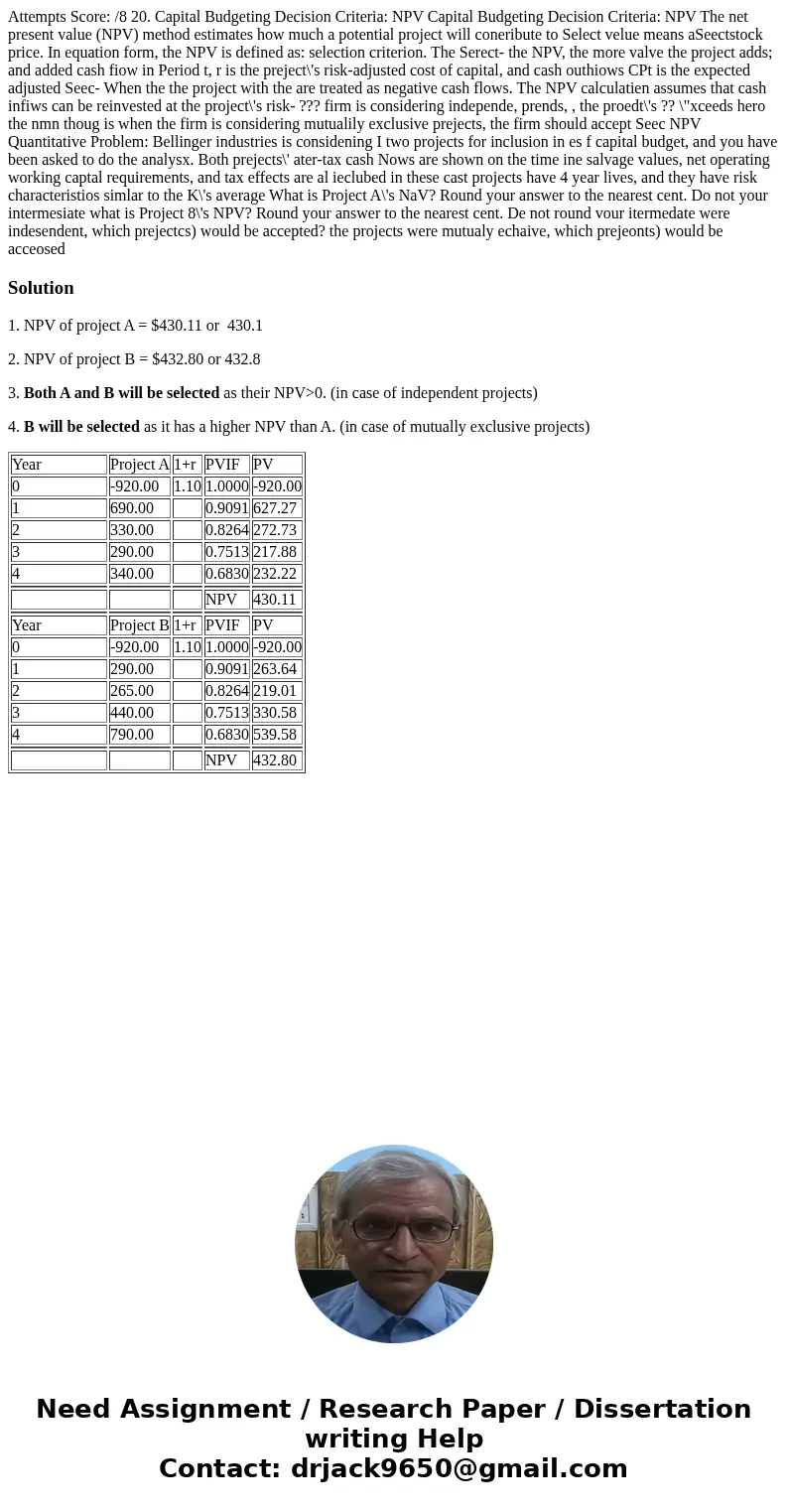

Solution

1. NPV of project A = $430.11 or 430.1

2. NPV of project B = $432.80 or 432.8

3. Both A and B will be selected as their NPV>0. (in case of independent projects)

4. B will be selected as it has a higher NPV than A. (in case of mutually exclusive projects)

| Year | Project A | 1+r | PVIF | PV |

| 0 | -920.00 | 1.10 | 1.0000 | -920.00 |

| 1 | 690.00 | 0.9091 | 627.27 | |

| 2 | 330.00 | 0.8264 | 272.73 | |

| 3 | 290.00 | 0.7513 | 217.88 | |

| 4 | 340.00 | 0.6830 | 232.22 | |

| NPV | 430.11 | |||

| Year | Project B | 1+r | PVIF | PV |

| 0 | -920.00 | 1.10 | 1.0000 | -920.00 |

| 1 | 290.00 | 0.9091 | 263.64 | |

| 2 | 265.00 | 0.8264 | 219.01 | |

| 3 | 440.00 | 0.7513 | 330.58 | |

| 4 | 790.00 | 0.6830 | 539.58 | |

| NPV | 432.80 |

Homework Sourse

Homework Sourse