Marin Company owes 208000 plus 18700 of accrued interest to

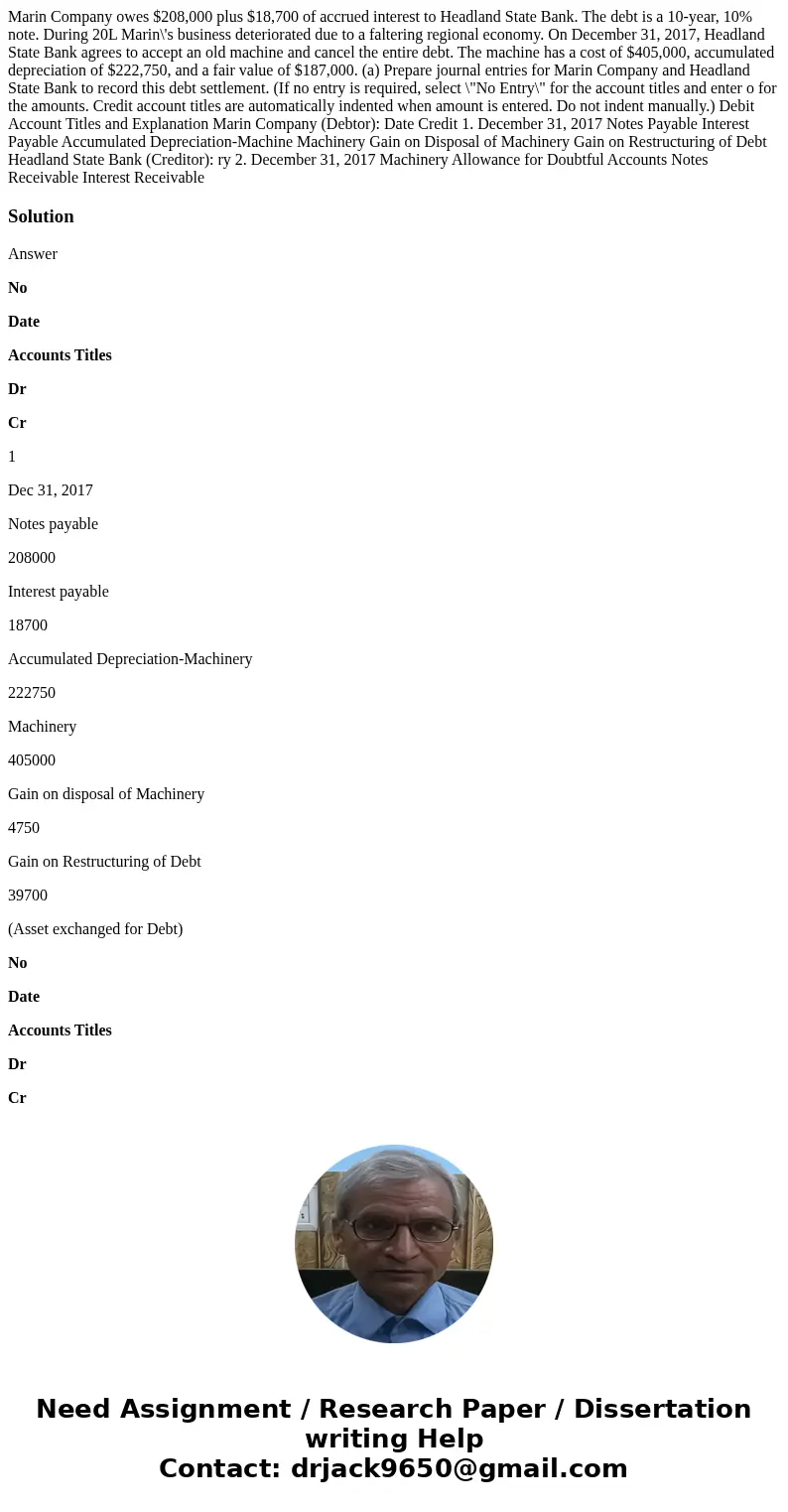

Marin Company owes $208,000 plus $18,700 of accrued interest to Headland State Bank. The debt is a 10-year, 10% note. During 20L Marin\'s business deteriorated due to a faltering regional economy. On December 31, 2017, Headland State Bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of $405,000, accumulated depreciation of $222,750, and a fair value of $187,000. (a) Prepare journal entries for Marin Company and Headland State Bank to record this debt settlement. (If no entry is required, select \"No Entry\" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Account Titles and Explanation Marin Company (Debtor): Date Credit 1. December 31, 2017 Notes Payable Interest Payable Accumulated Depreciation-Machine Machinery Gain on Disposal of Machinery Gain on Restructuring of Debt Headland State Bank (Creditor): ry 2. December 31, 2017 Machinery Allowance for Doubtful Accounts Notes Receivable Interest Receivable

Solution

Answer

No

Date

Accounts Titles

Dr

Cr

1

Dec 31, 2017

Notes payable

208000

Interest payable

18700

Accumulated Depreciation-Machinery

222750

Machinery

405000

Gain on disposal of Machinery

4750

Gain on Restructuring of Debt

39700

(Asset exchanged for Debt)

No

Date

Accounts Titles

Dr

Cr

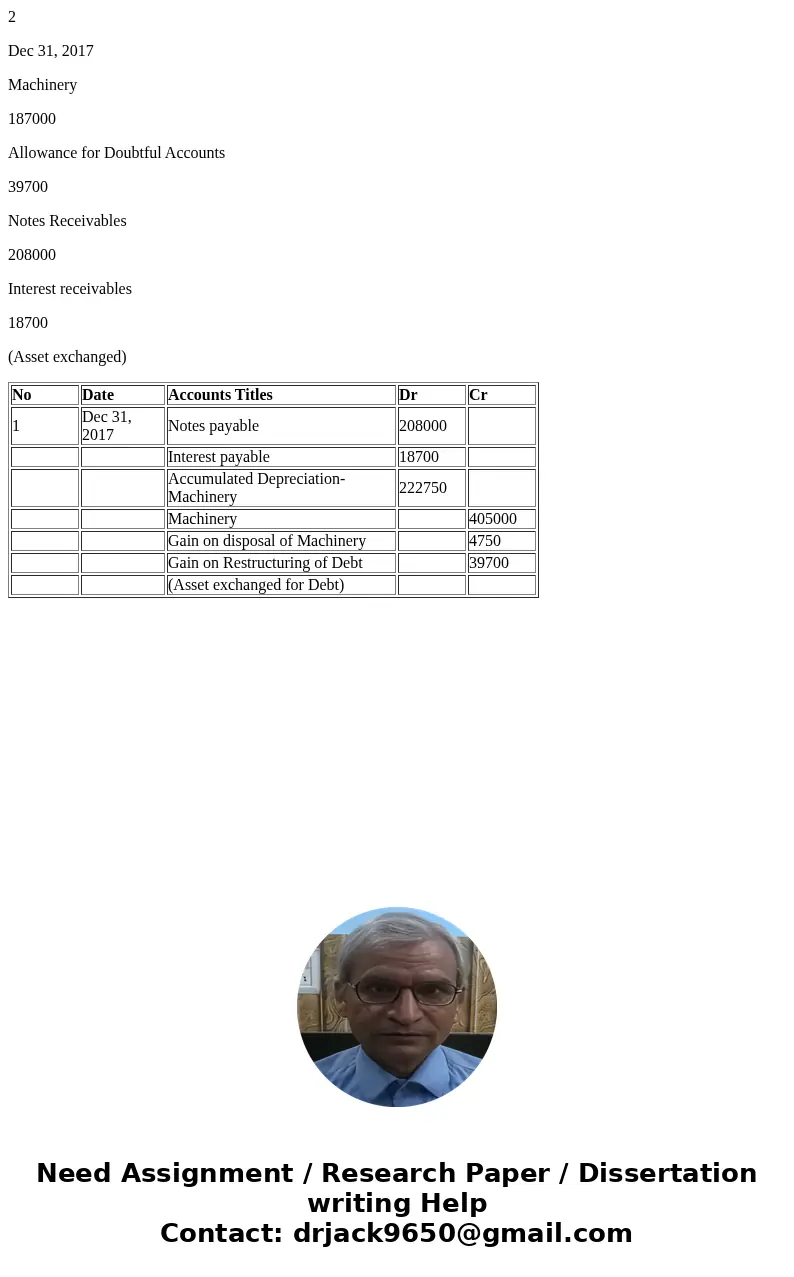

2

Dec 31, 2017

Machinery

187000

Allowance for Doubtful Accounts

39700

Notes Receivables

208000

Interest receivables

18700

(Asset exchanged)

| No | Date | Accounts Titles | Dr | Cr |

| 1 | Dec 31, 2017 | Notes payable | 208000 | |

| Interest payable | 18700 | |||

| Accumulated Depreciation-Machinery | 222750 | |||

| Machinery | 405000 | |||

| Gain on disposal of Machinery | 4750 | |||

| Gain on Restructuring of Debt | 39700 | |||

| (Asset exchanged for Debt) |

Homework Sourse

Homework Sourse