2 ACC 100 Homework for Chapter 1Shaw Repair Business Objecti

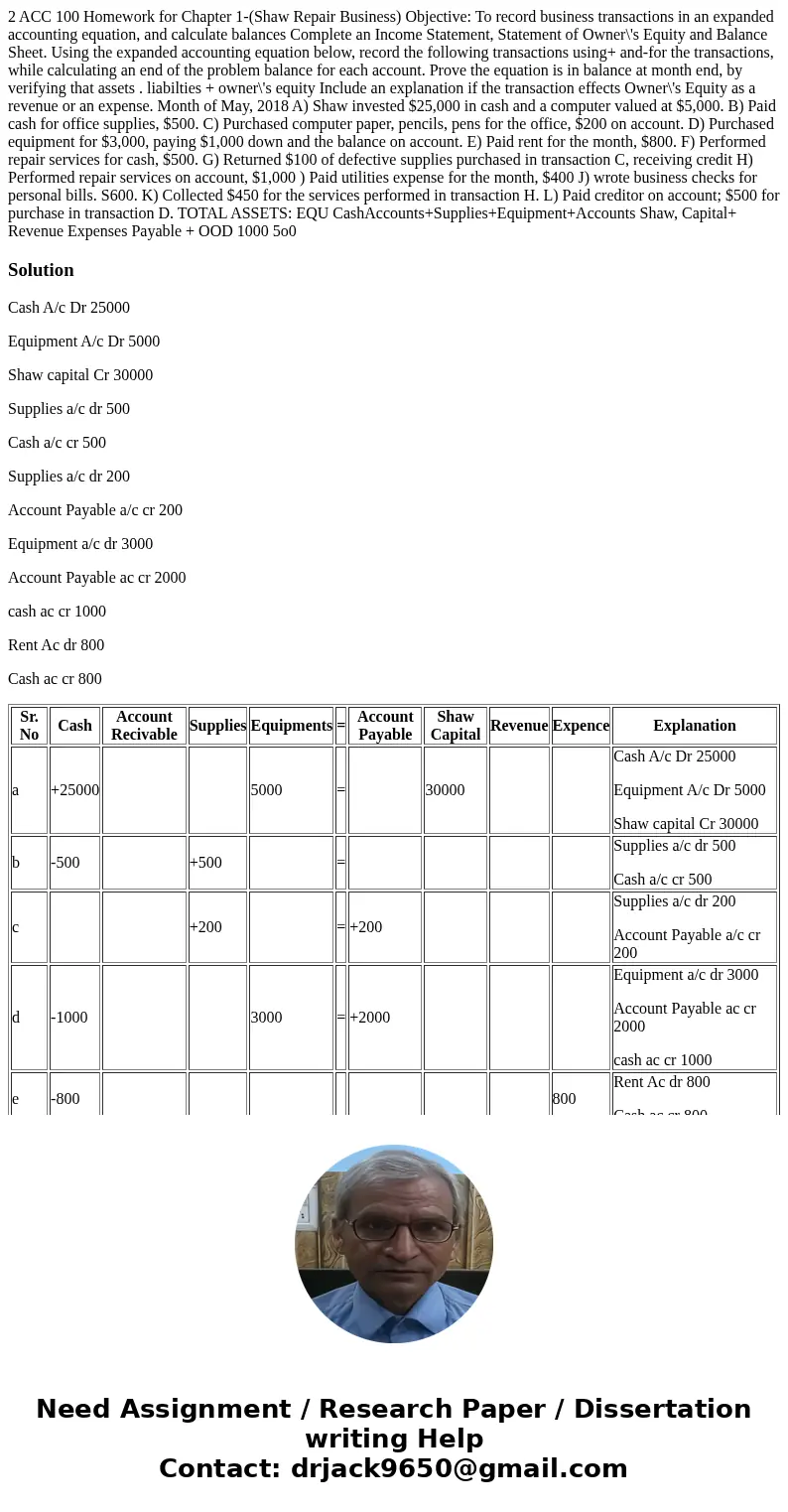

2 ACC 100 Homework for Chapter 1-(Shaw Repair Business) Objective: To record business transactions in an expanded accounting equation, and calculate balances Complete an Income Statement, Statement of Owner\'s Equity and Balance Sheet. Using the expanded accounting equation below, record the following transactions using+ and-for the transactions, while calculating an end of the problem balance for each account. Prove the equation is in balance at month end, by verifying that assets . liabilties + owner\'s equity Include an explanation if the transaction effects Owner\'s Equity as a revenue or an expense. Month of May, 2018 A) Shaw invested $25,000 in cash and a computer valued at $5,000. B) Paid cash for office supplies, $500. C) Purchased computer paper, pencils, pens for the office, $200 on account. D) Purchased equipment for $3,000, paying $1,000 down and the balance on account. E) Paid rent for the month, $800. F) Performed repair services for cash, $500. G) Returned $100 of defective supplies purchased in transaction C, receiving credit H) Performed repair services on account, $1,000 ) Paid utilities expense for the month, $400 J) wrote business checks for personal bills. S600. K) Collected $450 for the services performed in transaction H. L) Paid creditor on account; $500 for purchase in transaction D. TOTAL ASSETS: EQU CashAccounts+Supplies+Equipment+Accounts Shaw, Capital+ Revenue Expenses Payable + OOD 1000 5o0

Solution

Cash A/c Dr 25000

Equipment A/c Dr 5000

Shaw capital Cr 30000

Supplies a/c dr 500

Cash a/c cr 500

Supplies a/c dr 200

Account Payable a/c cr 200

Equipment a/c dr 3000

Account Payable ac cr 2000

cash ac cr 1000

Rent Ac dr 800

Cash ac cr 800

| Sr. No | Cash | Account Recivable | Supplies | Equipments | = | Account Payable | Shaw Capital | Revenue | Expence | Explanation |

|---|---|---|---|---|---|---|---|---|---|---|

| a | +25000 | 5000 | = | 30000 | Cash A/c Dr 25000 Equipment A/c Dr 5000 Shaw capital Cr 30000 | |||||

| b | -500 | +500 | = | Supplies a/c dr 500 Cash a/c cr 500 | ||||||

| c | +200 | = | +200 | Supplies a/c dr 200 Account Payable a/c cr 200 | ||||||

| d | -1000 | 3000 | = | +2000 | Equipment a/c dr 3000 Account Payable ac cr 2000 cash ac cr 1000 | |||||

| e | -800 | 800 | Rent Ac dr 800 Cash ac cr 800 | |||||||

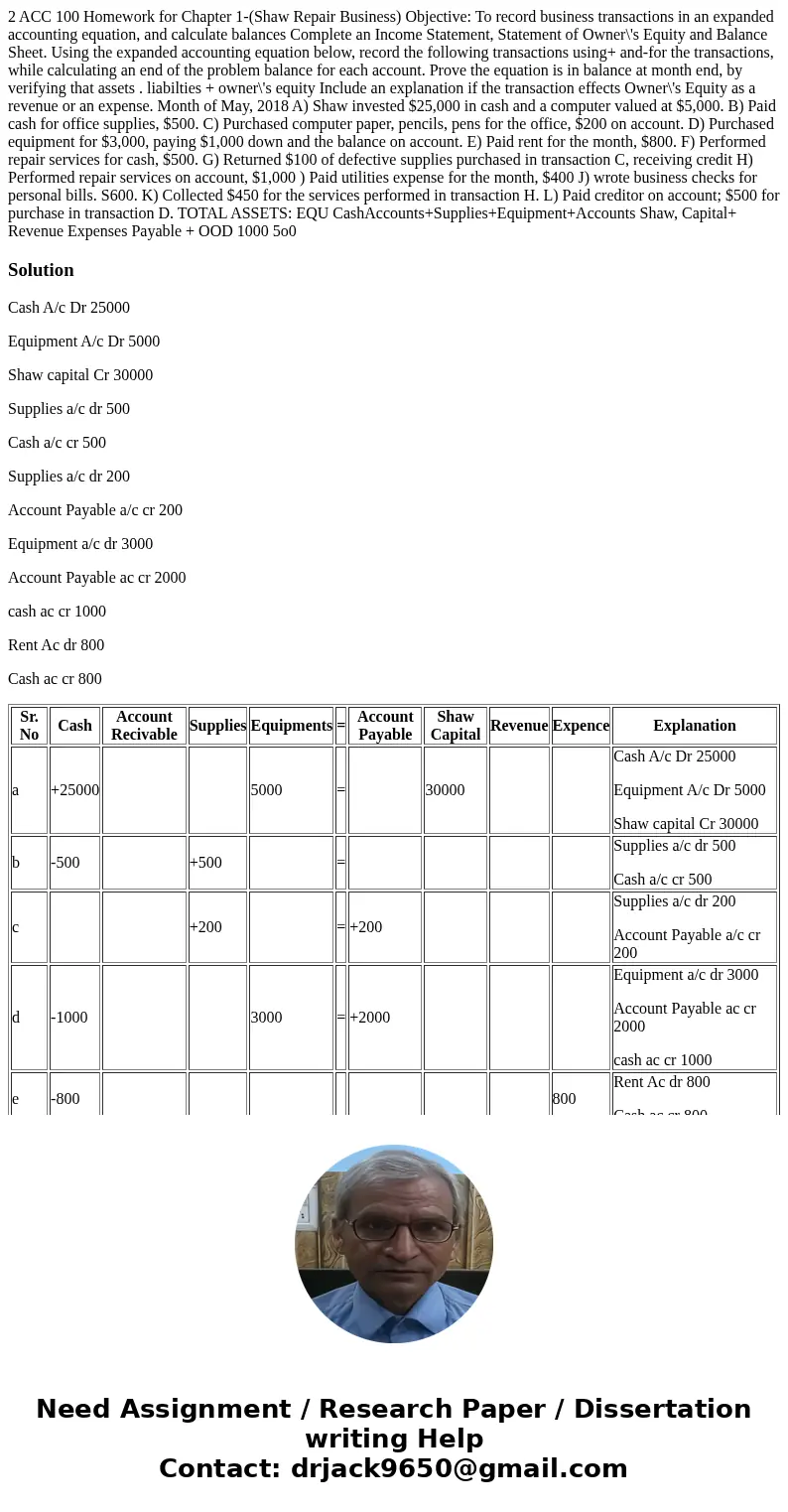

| f | +500 | +500 | Cash Ac dr 500 Repair ac credit 500 | |||||||

| g | -100 | = | -100 | Account Payable debit by 100 and Suppiles by 100 | ||||||

| h | 1000 | = | 1000 | Account Rec debit by 1000 and Repair credit by 1000 | ||||||

| I | -400 | = | +400 | Expence ac debit by 400 and cash credit by 400 | ||||||

| J | +600 | -600 | Shaw capital debit by 600 and account Payable credit by 600 | |||||||

| K | +450 | -450 | = | Cash Ac debit by 450 and Account Rec credit by 450 | ||||||

| L | -500 | = | -500 | Account Payable debit By 500 and CAsh credit by 500 | ||||||

| Total | 22750 | 550 | 600 | 8000 | = | 2200 | 29400 | 1500 | 1200 | TOTAL 31900 |

Homework Sourse

Homework Sourse