Milani Inc acquired 10 percent of Seida Corporation on Janua

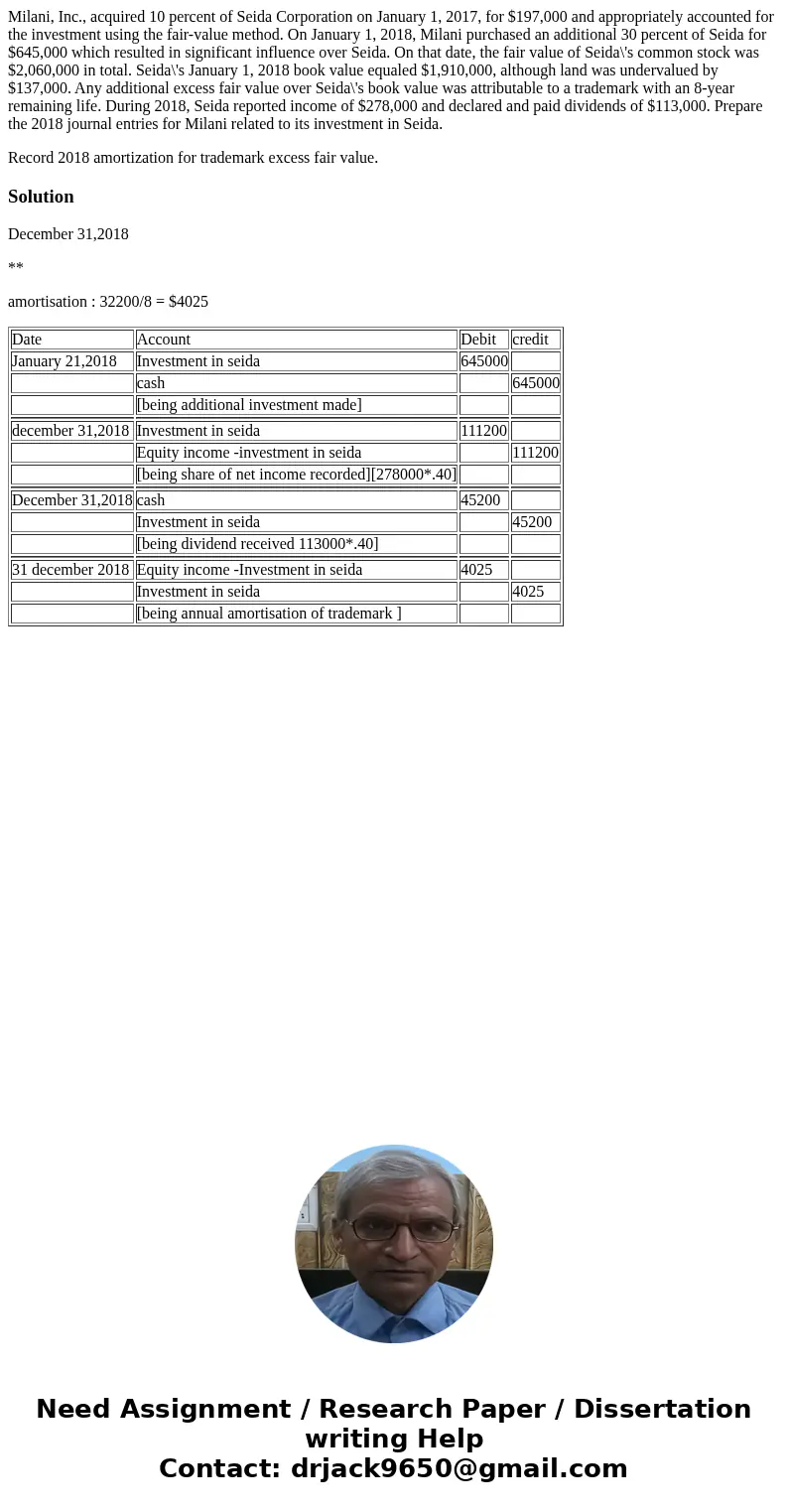

Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2017, for $197,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2018, Milani purchased an additional 30 percent of Seida for $645,000 which resulted in significant influence over Seida. On that date, the fair value of Seida\'s common stock was $2,060,000 in total. Seida\'s January 1, 2018 book value equaled $1,910,000, although land was undervalued by $137,000. Any additional excess fair value over Seida\'s book value was attributable to a trademark with an 8-year remaining life. During 2018, Seida reported income of $278,000 and declared and paid dividends of $113,000. Prepare the 2018 journal entries for Milani related to its investment in Seida.

Record 2018 amortization for trademark excess fair value.

Solution

December 31,2018

**

amortisation : 32200/8 = $4025

| Date | Account | Debit | credit |

| January 21,2018 | Investment in seida | 645000 | |

| cash | 645000 | ||

| [being additional investment made] | |||

| december 31,2018 | Investment in seida | 111200 | |

| Equity income -investment in seida | 111200 | ||

| [being share of net income recorded][278000*.40] | |||

| December 31,2018 | cash | 45200 | |

| Investment in seida | 45200 | ||

| [being dividend received 113000*.40] | |||

| 31 december 2018 | Equity income -Investment in seida | 4025 | |

| Investment in seida | 4025 | ||

| [being annual amortisation of trademark ] |

Homework Sourse

Homework Sourse