M5 Watson Activity Watson Inc is a manufacturing firm Its ow

Solution

1)Absorption costing method is used for inventory in case of gross margin method.under absorption costing ,Fixed manufacturing overhead is considered as product cost.

2)

3)

300000/15000

=$20

300000/12000

=$ 25

300000/1000

=$ 300

[15000*10]+300000

150000+300000

450000

[12000*10]+300000

120000+300000

420000

[1000*10]+300000

10000+300000

310000

450000/15000= $ 30

310000/1000

=$ 310

**Total production cost =[unit produced*variable manufacturing cost per unit]+fixed manufacturing overhead

4)under LIFO,method units acquired last are sold first ,so ending inventory in every quarter are left out of initial balance (initial quarter balance)

[5000*30]from quarter 2 +[4000*35] from quarter 3 =150000+140000

=290000

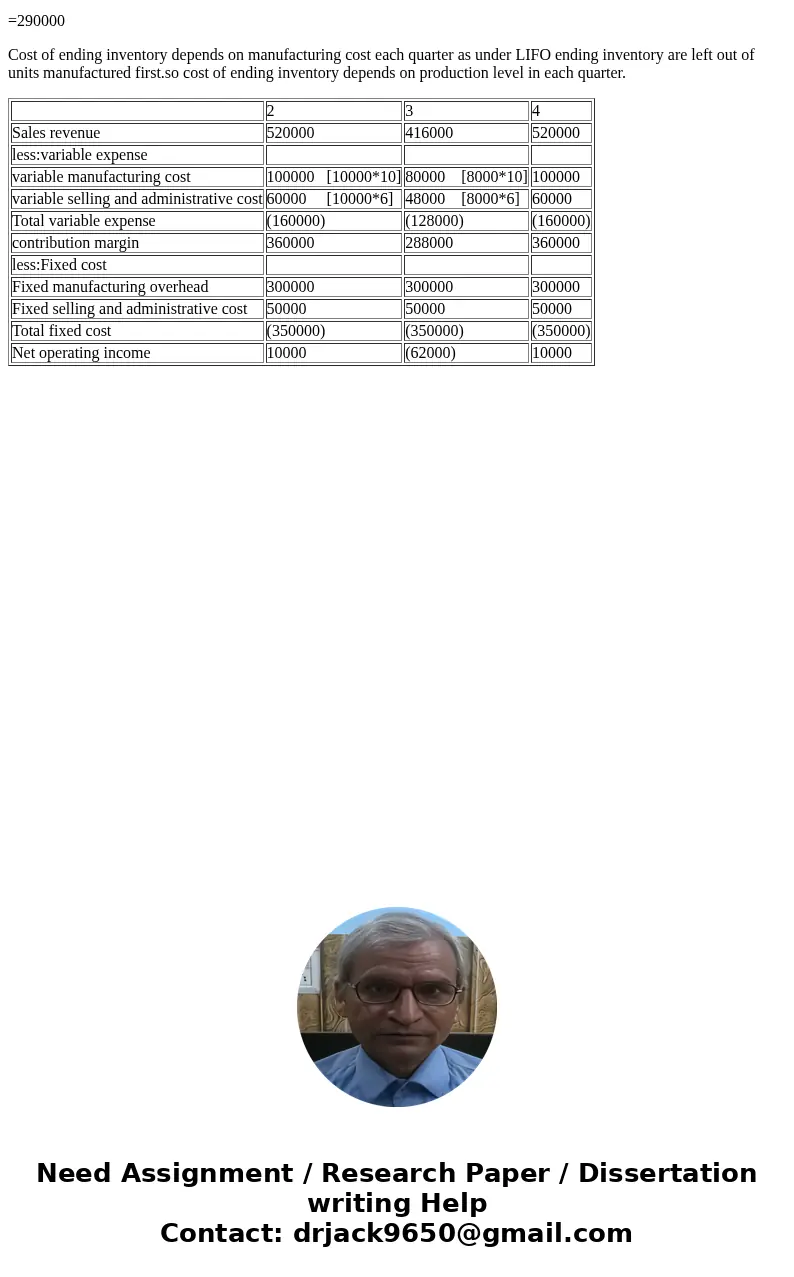

Cost of ending inventory depends on manufacturing cost each quarter as under LIFO ending inventory are left out of units manufactured first.so cost of ending inventory depends on production level in each quarter.

| 2 | 3 | 4 | |

| Sales revenue | 520000 | 416000 | 520000 |

| less:variable expense | |||

| variable manufacturing cost | 100000 [10000*10] | 80000 [8000*10] | 100000 |

| variable selling and administrative cost | 60000 [10000*6] | 48000 [8000*6] | 60000 |

| Total variable expense | (160000) | (128000) | (160000) |

| contribution margin | 360000 | 288000 | 360000 |

| less:Fixed cost | |||

| Fixed manufacturing overhead | 300000 | 300000 | 300000 |

| Fixed selling and administrative cost | 50000 | 50000 | 50000 |

| Total fixed cost | (350000) | (350000) | (350000) |

| Net operating income | 10000 | (62000) | 10000 |

Homework Sourse

Homework Sourse