Company AIBM has debt with a market value of 2500000 and equ

Company “AIBM” has debt with a market value of £2,500,000 and equity with a market value of £5,500,000. The financial management estimates that the company’s shares have a beta of 1.85. The risk premium on the market is 8%, and the current Treasury bill rate is 5%. Debt is risk-free, and company “AIBM” has a corporate tax rate of 35%. Company “AIBM” is now considering whether investing in two new independent projects X and Y. Each project has an expected life of 6 years. Project X requires an initial cash outflow of £100,000, and subsequent annual cash inflows of £50,000 (year 1), £60,000 (year 2), £50,000 (year 3), £60,000 (year 4), £100,000 (year 5), and £50,000 (year 6). Project Y requires an initial cash outflow of £100,000, and subsequent annual cash inflows of £40,000 (year 1), £100,000 (year 2), £30,000 (year 3), £50,000 (year 4), £50,000 (year 5), and £50,000 (year 6). Both projects X and Y are similar to the company’s existing operations.

Required:

A. Calculate the beta of the assets of company “AIBM”. [5 marks]

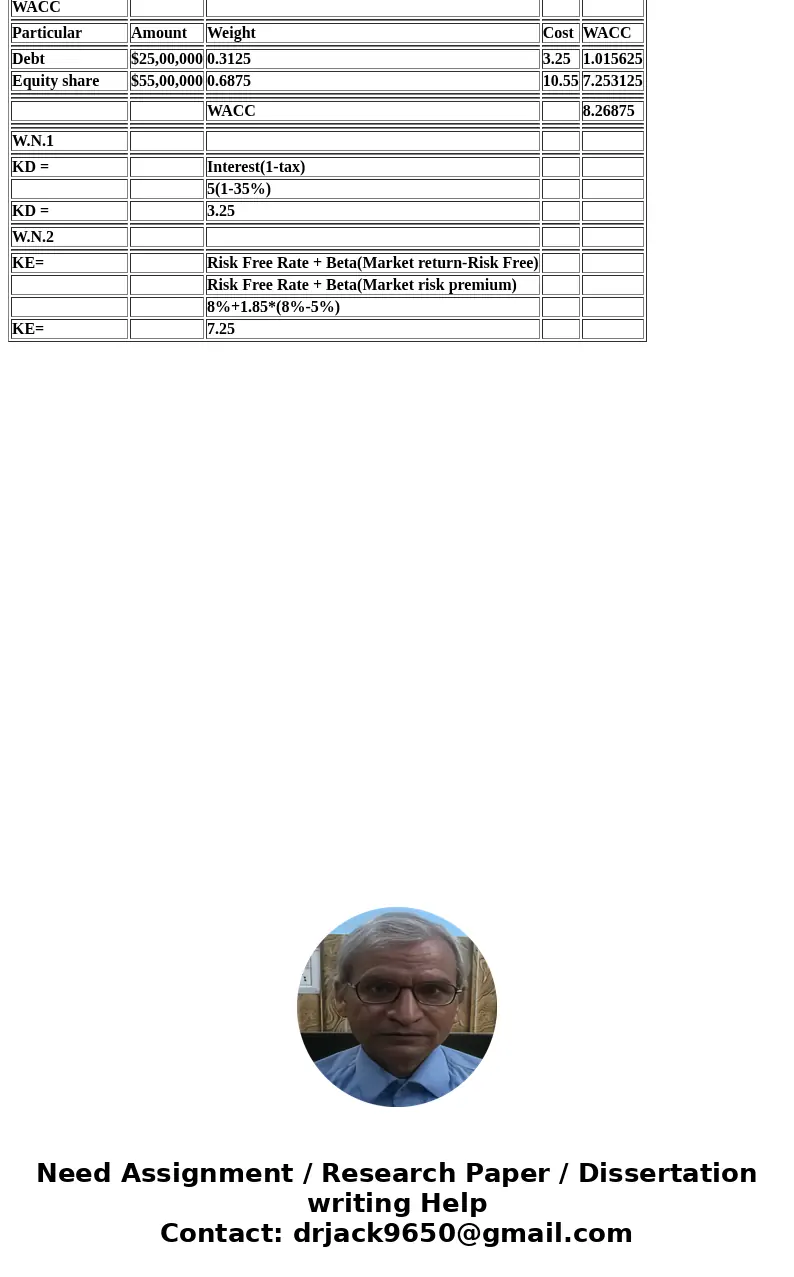

B. Calculate the cost of equity capital and the weighted average cost of capital (WACC) after tax of company “AIBM”, assuming validity of the capital asset pricing model (CAPM). [8 marks]

C. Calculate the net present value (NPV) of projects X and Y, and discuss which project(s) should be accepted according to the NPV method. [10 marks]

D. Calculate the profitability index (PI) of projects X and Y. Which project(s) should be accepted according to the PI method? [5 marks]

E. Introduce the notion of “average accounting return” (AAR) and illustrate strengths and weaknesses of the AAR method within the framework of strategic investment appraisal decisions.

Solution

A. Asset beta is also known as Unlevered Beta.

Asset Beta = Equity Beta + [1+(1-tax rate)(debt/Equity)]

Let Equity Beta is assumed in given question i.e. 1.85

Then,

= 1.85 + [1+(1-35%)(25,00,000/55,00,000)]

=3.145

B.

C. NPV of the Projects-

So, In this case Project X is beneficial for the Company because its give higher return.

Profitability Index-

Project X-

Npv/Initial Investment

=163903/100000

=1.64

Project Y-

Npv/Initial Investment

=134968/100000

=1.35

| WACC | ||||

| Particular | Amount | Weight | Cost | WACC |

| Debt | $25,00,000 | 0.3125 | 3.25 | 1.015625 |

| Equity share | $55,00,000 | 0.6875 | 10.55 | 7.253125 |

| WACC | 8.26875 | |||

| W.N.1 | ||||

| KD = | Interest(1-tax) | |||

| 5(1-35%) | ||||

| KD = | 3.25 | |||

| W.N.2 | ||||

| KE= | Risk Free Rate + Beta(Market return-Risk Free) | |||

| Risk Free Rate + Beta(Market risk premium) | ||||

| 8%+1.85*(8%-5%) | ||||

| KE= | 7.25 |

Homework Sourse

Homework Sourse