Expenses 3 Using the data presented below prepare an income

Expenses 3. Using the data presented below, prepare an, income statement, balance sheet and equity statement. Make any necessary assumptions Accumulated depreciation $12 50 16 32 Cost of goods manufactured Common stock Current assets... Depreciation expense Dividends Ending inventory Equipment Income tax expense Liabilities Operating expenses Retained earnings Sales 20 50 30 90

Solution

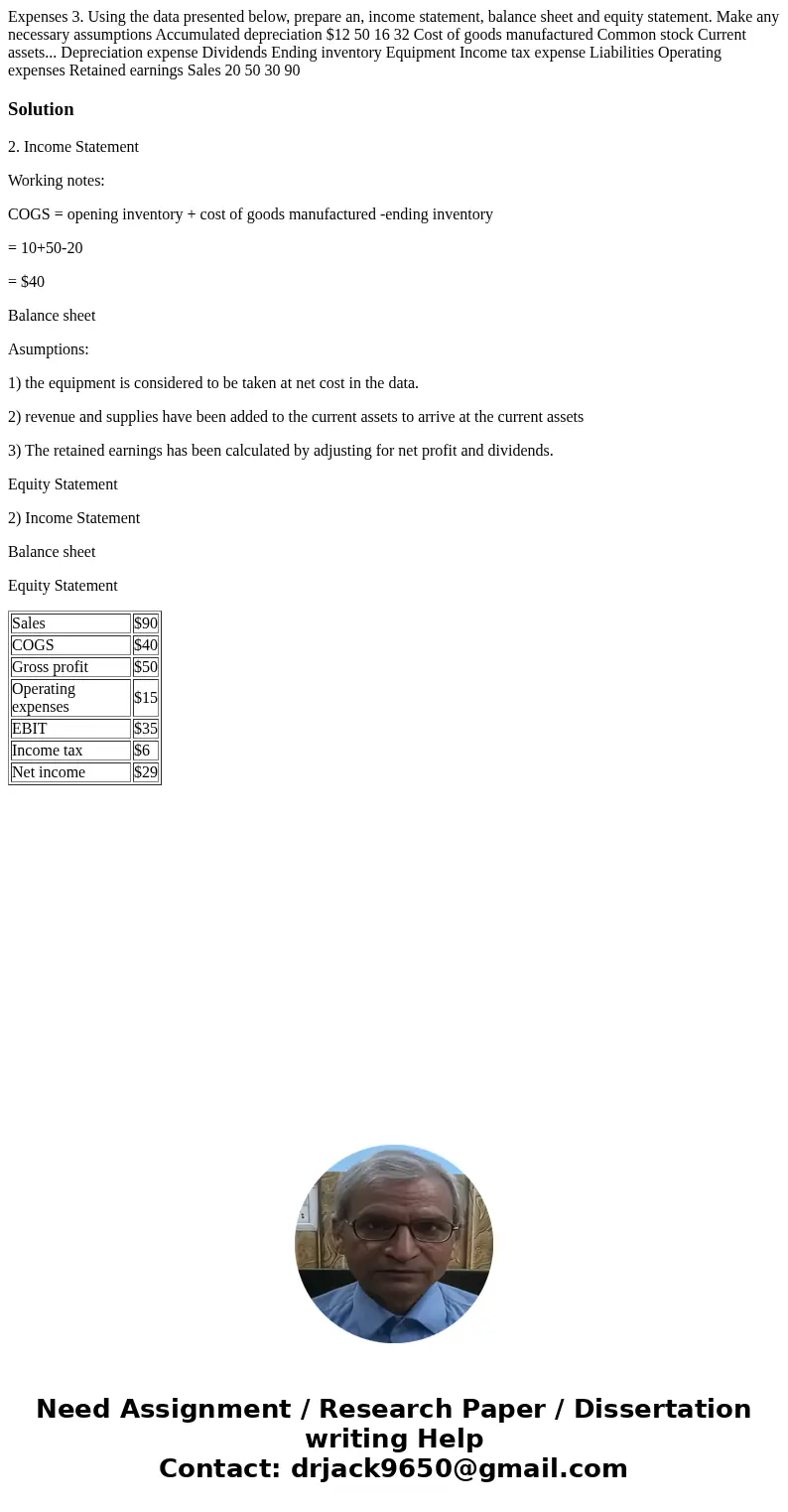

2. Income Statement

Working notes:

COGS = opening inventory + cost of goods manufactured -ending inventory

= 10+50-20

= $40

Balance sheet

Asumptions:

1) the equipment is considered to be taken at net cost in the data.

2) revenue and supplies have been added to the current assets to arrive at the current assets

3) The retained earnings has been calculated by adjusting for net profit and dividends.

Equity Statement

2) Income Statement

Balance sheet

Equity Statement

| Sales | $90 |

| COGS | $40 |

| Gross profit | $50 |

| Operating expenses | $15 |

| EBIT | $35 |

| Income tax | $6 |

| Net income | $29 |

Homework Sourse

Homework Sourse