Equipment Accounts Recelvable Accounts Payable Cost of Goods

Equipment Accounts Recelvable Accounts Payable Cost of Goods Sold Utilities Expense Depreclation Expense Insurance Expense Common Stock Dividends Rent Expense Note $100,000 12,000 9,000 72,000 11,000 17,000 9,000 200 12,000 3,000 Expenso 14,000 17,000 44,000 Prepaid Insurance Accumulated Depreciation Salarics Expense Salaries Payable Nct sales 4,000 5,000 Instructions (show your work) (a) Calculate the net income. (18 points) (b) Calculate the balance of Retainedamings that would appear on a balance sheet at December 31, 2012. (7 points) (e) Caleulate the gross profit percentage. (5 paints)

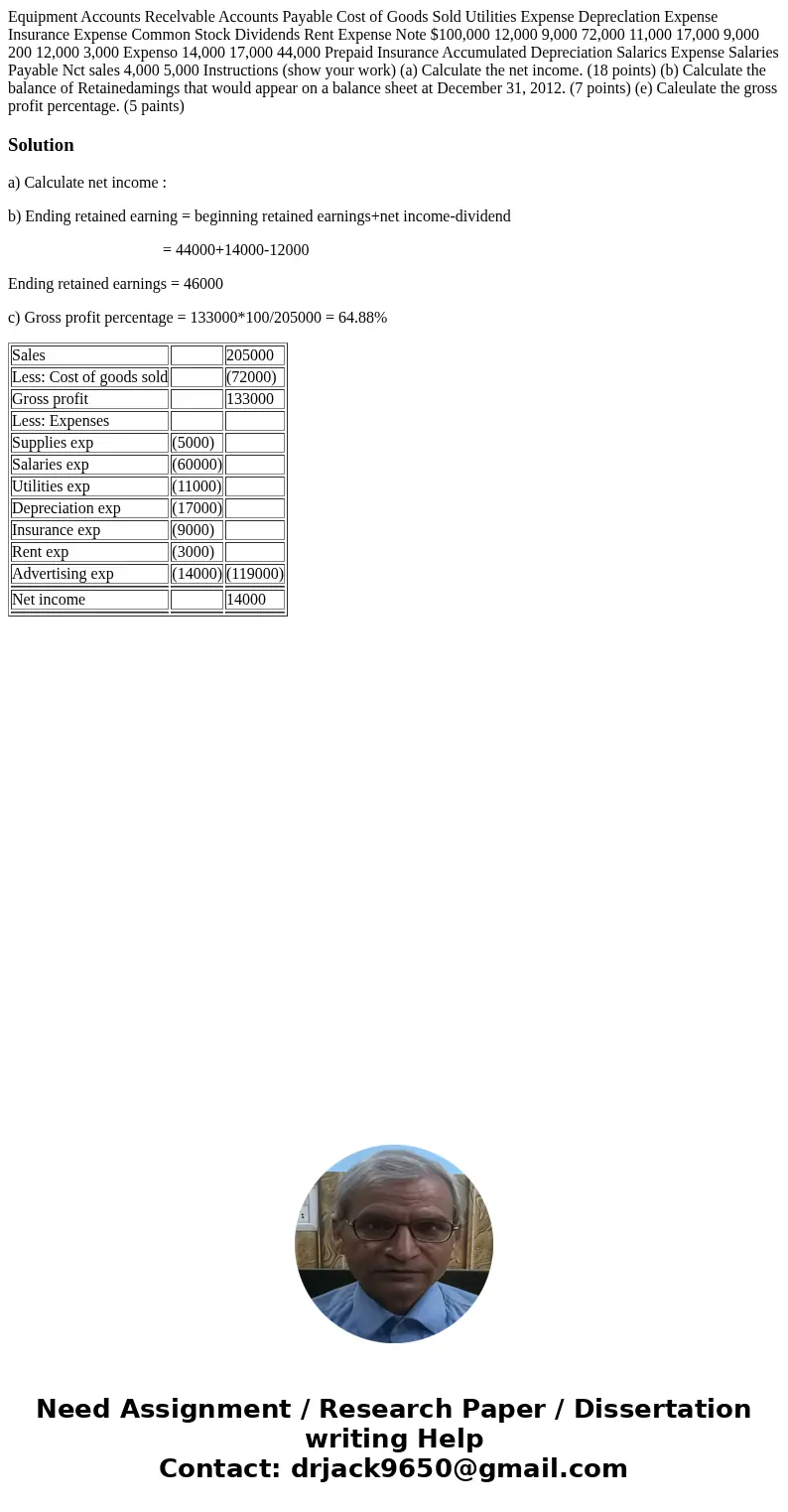

Solution

a) Calculate net income :

b) Ending retained earning = beginning retained earnings+net income-dividend

= 44000+14000-12000

Ending retained earnings = 46000

c) Gross profit percentage = 133000*100/205000 = 64.88%

| Sales | 205000 | |

| Less: Cost of goods sold | (72000) | |

| Gross profit | 133000 | |

| Less: Expenses | ||

| Supplies exp | (5000) | |

| Salaries exp | (60000) | |

| Utilities exp | (11000) | |

| Depreciation exp | (17000) | |

| Insurance exp | (9000) | |

| Rent exp | (3000) | |

| Advertising exp | (14000) | (119000) |

| Net income | 14000 | |

Homework Sourse

Homework Sourse