Sheridan Company shows the following balances in selected ac

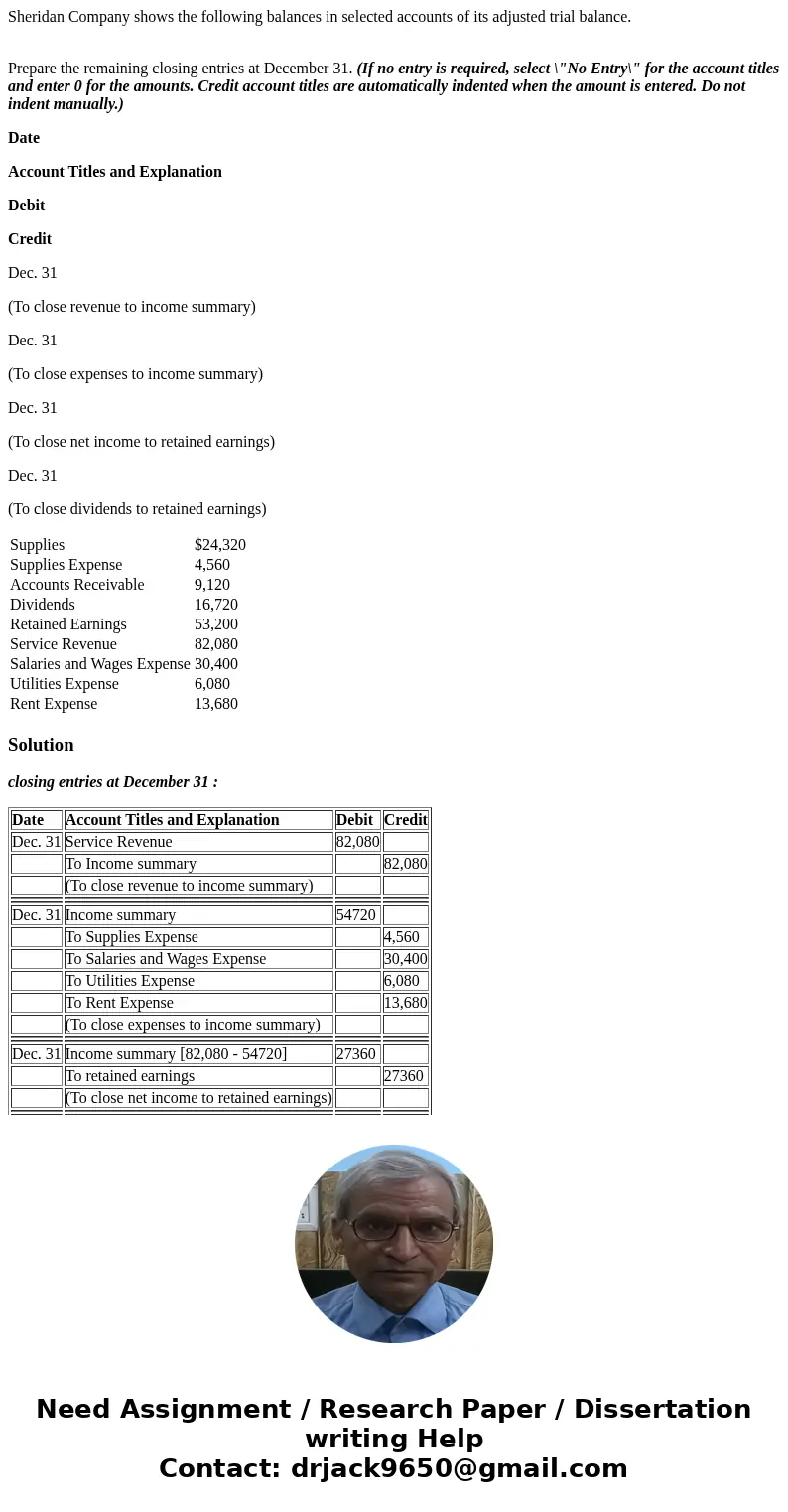

Sheridan Company shows the following balances in selected accounts of its adjusted trial balance.

Prepare the remaining closing entries at December 31. (If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

Dec. 31

(To close revenue to income summary)

Dec. 31

(To close expenses to income summary)

Dec. 31

(To close net income to retained earnings)

Dec. 31

(To close dividends to retained earnings)

| Supplies | $24,320 | |

| Supplies Expense | 4,560 | |

| Accounts Receivable | 9,120 | |

| Dividends | 16,720 | |

| Retained Earnings | 53,200 | |

| Service Revenue | 82,080 | |

| Salaries and Wages Expense | 30,400 | |

| Utilities Expense | 6,080 | |

| Rent Expense | 13,680 |

Solution

closing entries at December 31 :

| Date | Account Titles and Explanation | Debit | Credit |

| Dec. 31 | Service Revenue | 82,080 | |

| To Income summary | 82,080 | ||

| (To close revenue to income summary) | |||

| Dec. 31 | Income summary | 54720 | |

| To Supplies Expense | 4,560 | ||

| To Salaries and Wages Expense | 30,400 | ||

| To Utilities Expense | 6,080 | ||

| To Rent Expense | 13,680 | ||

| (To close expenses to income summary) | |||

| Dec. 31 | Income summary [82,080 - 54720] | 27360 | |

| To retained earnings | 27360 | ||

| (To close net income to retained earnings) | |||

| Dec. 31 | Retained earnings | 16,720 | |

| To Dividends | 16,720 | ||

| (To close dividends to retained earnings) | |||

Homework Sourse

Homework Sourse