3 You realize that you have a 5000 balance on your credit ca

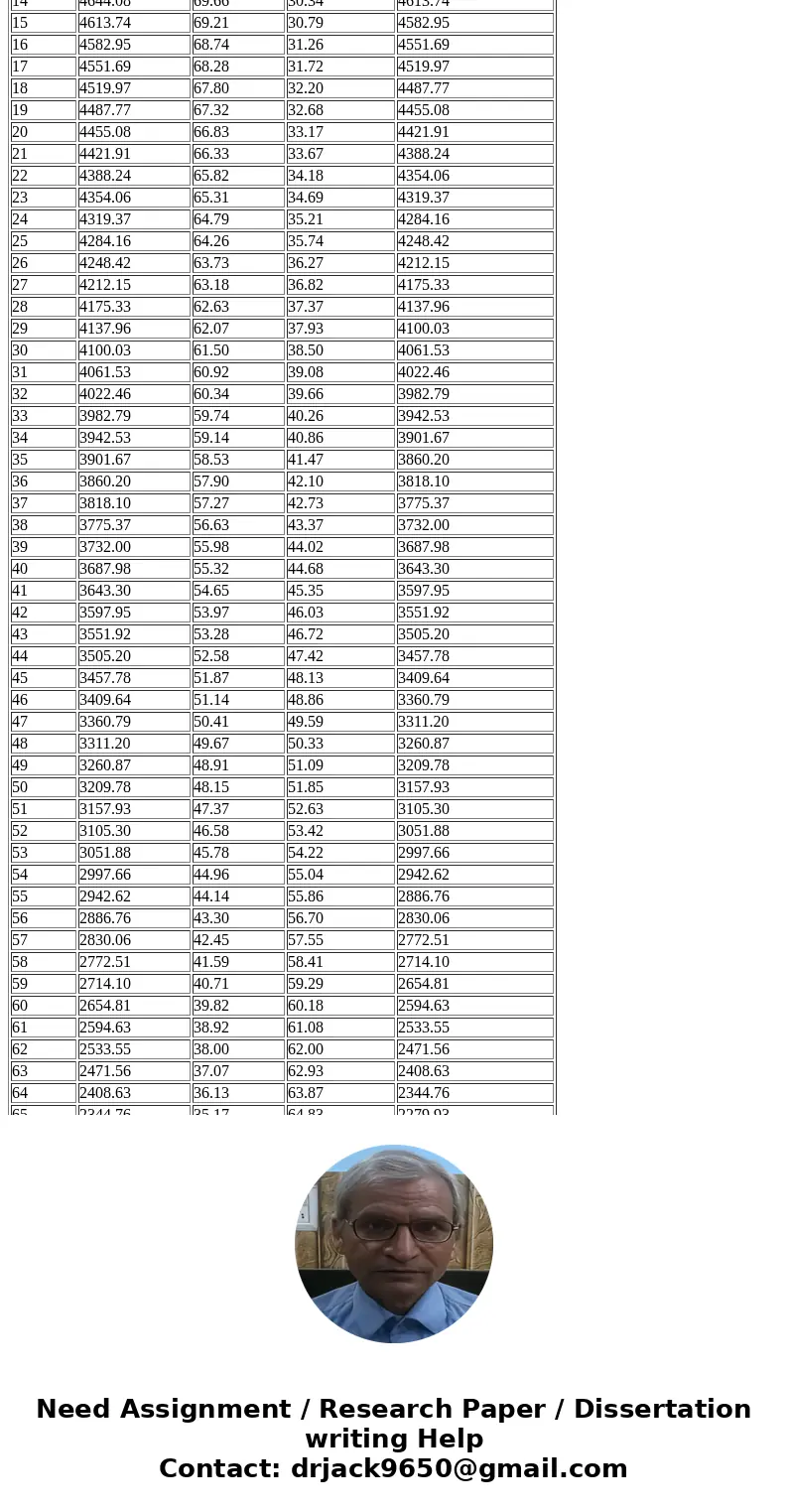

3. You realize that you have a $5000 balance on your credit card, which is being assessed 18% yearly interest. If you cut the credit card up and make $100 payments every month on it, how many years until you’ve paid it off?

Solution

Balance on credit card = $ 5,000

Interest rate = 18 % p.a. or 0.18/12 = 0.015 p.m.

Monthly interest amount = 0.15 x $ 5,000 = $ 75

Amount goes to principal = $ 100 - $ 75 = $ 25

Amortization schedule:

Month

Total Principal (P)

Interest(I)

Principal Paid (p = P - I)

Balance Principal

(P - p)

1

5000.00

75.00

25.00

4975.00

2

4975.00

74.63

25.38

4949.63

3

4949.63

74.24

25.76

4923.87

4

4923.87

73.86

26.14

4897.73

5

4897.73

73.47

26.53

4871.19

6

4871.19

73.07

26.93

4844.26

7

4844.26

72.66

27.34

4816.93

8

4816.93

72.25

27.75

4789.18

9

4789.18

71.84

28.16

4761.02

10

4761.02

71.42

28.58

4732.43

11

4732.43

70.99

29.01

4703.42

12

4703.42

70.55

29.45

4673.97

13

4673.97

70.11

29.89

4644.08

14

4644.08

69.66

30.34

4613.74

15

4613.74

69.21

30.79

4582.95

16

4582.95

68.74

31.26

4551.69

17

4551.69

68.28

31.72

4519.97

18

4519.97

67.80

32.20

4487.77

19

4487.77

67.32

32.68

4455.08

20

4455.08

66.83

33.17

4421.91

21

4421.91

66.33

33.67

4388.24

22

4388.24

65.82

34.18

4354.06

23

4354.06

65.31

34.69

4319.37

24

4319.37

64.79

35.21

4284.16

25

4284.16

64.26

35.74

4248.42

26

4248.42

63.73

36.27

4212.15

27

4212.15

63.18

36.82

4175.33

28

4175.33

62.63

37.37

4137.96

29

4137.96

62.07

37.93

4100.03

30

4100.03

61.50

38.50

4061.53

31

4061.53

60.92

39.08

4022.46

32

4022.46

60.34

39.66

3982.79

33

3982.79

59.74

40.26

3942.53

34

3942.53

59.14

40.86

3901.67

35

3901.67

58.53

41.47

3860.20

36

3860.20

57.90

42.10

3818.10

37

3818.10

57.27

42.73

3775.37

38

3775.37

56.63

43.37

3732.00

39

3732.00

55.98

44.02

3687.98

40

3687.98

55.32

44.68

3643.30

41

3643.30

54.65

45.35

3597.95

42

3597.95

53.97

46.03

3551.92

43

3551.92

53.28

46.72

3505.20

44

3505.20

52.58

47.42

3457.78

45

3457.78

51.87

48.13

3409.64

46

3409.64

51.14

48.86

3360.79

47

3360.79

50.41

49.59

3311.20

48

3311.20

49.67

50.33

3260.87

49

3260.87

48.91

51.09

3209.78

50

3209.78

48.15

51.85

3157.93

51

3157.93

47.37

52.63

3105.30

52

3105.30

46.58

53.42

3051.88

53

3051.88

45.78

54.22

2997.66

54

2997.66

44.96

55.04

2942.62

55

2942.62

44.14

55.86

2886.76

56

2886.76

43.30

56.70

2830.06

57

2830.06

42.45

57.55

2772.51

58

2772.51

41.59

58.41

2714.10

59

2714.10

40.71

59.29

2654.81

60

2654.81

39.82

60.18

2594.63

61

2594.63

38.92

61.08

2533.55

62

2533.55

38.00

62.00

2471.56

63

2471.56

37.07

62.93

2408.63

64

2408.63

36.13

63.87

2344.76

65

2344.76

35.17

64.83

2279.93

66

2279.93

34.20

65.80

2214.13

67

2214.13

33.21

66.79

2147.34

68

2147.34

32.21

67.79

2079.55

69

2079.55

31.19

68.81

2010.75

70

2010.75

30.16

69.84

1940.91

71

1940.91

29.11

70.89

1870.02

72

1870.02

28.05

71.95

1798.07

73

1798.07

26.97

73.03

1725.04

74

1725.04

25.88

74.12

1650.92

75

1650.92

24.76

75.24

1575.68

76

1575.68

23.64

76.36

1499.32

77

1499.32

22.49

77.51

1421.81

78

1421.81

21.33

78.67

1343.13

79

1343.13

20.15

79.85

1263.28

80

1263.28

18.95

81.05

1182.23

81

1182.23

17.73

82.27

1099.96

82

1099.96

16.50

83.50

1016.46

83

1016.46

15.25

84.75

931.71

84

931.71

13.98

86.02

845.68

85

845.68

12.69

87.31

758.37

86

758.37

11.38

88.62

669.74

87

669.74

10.05

89.95

579.79

88

579.79

8.70

91.30

488.49

89

488.49

7.33

92.67

395.82

90

395.82

5.94

94.06

301.75

91

301.75

4.53

95.47

206.28

92

206.28

3.09

96.91

109.37

93

109.37

1.64

98.36

11.01

94

11.01

0.17

99.83

-88.82

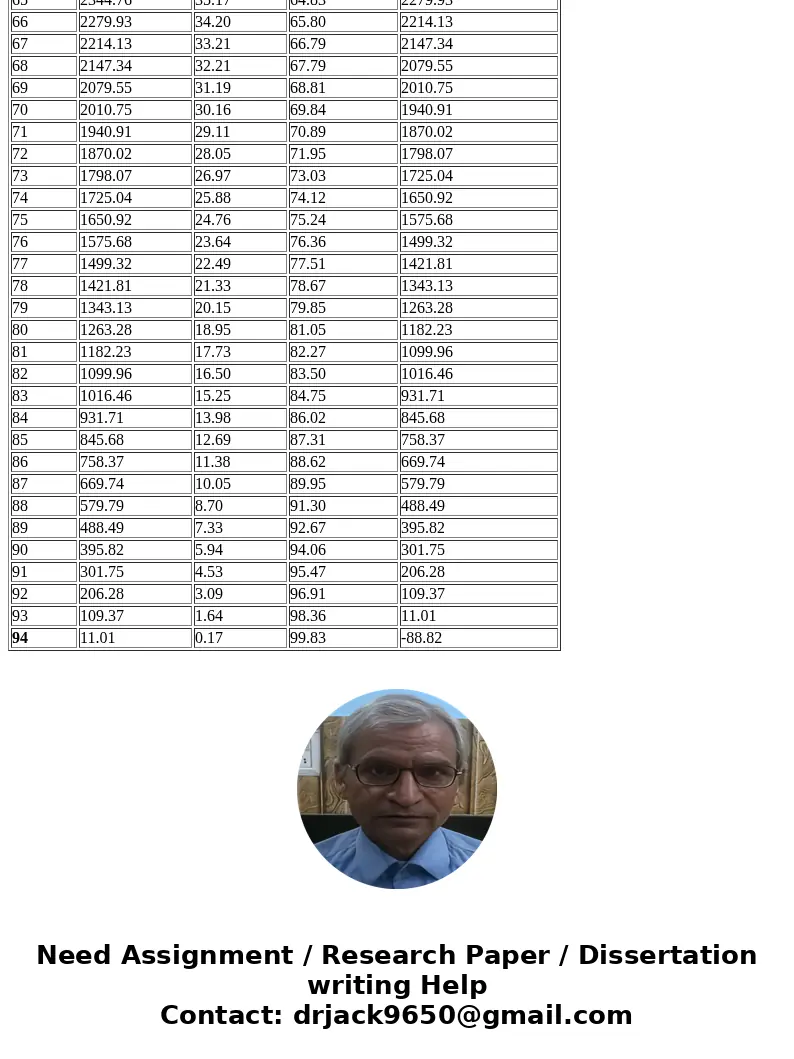

Hence it will take 94 months or 94/12 = 7.8 years to pay off the loan.

| Month | Total Principal (P) | Interest(I) | Principal Paid (p = P - I) | Balance Principal (P - p) |

| 1 | 5000.00 | 75.00 | 25.00 | 4975.00 |

| 2 | 4975.00 | 74.63 | 25.38 | 4949.63 |

| 3 | 4949.63 | 74.24 | 25.76 | 4923.87 |

| 4 | 4923.87 | 73.86 | 26.14 | 4897.73 |

| 5 | 4897.73 | 73.47 | 26.53 | 4871.19 |

| 6 | 4871.19 | 73.07 | 26.93 | 4844.26 |

| 7 | 4844.26 | 72.66 | 27.34 | 4816.93 |

| 8 | 4816.93 | 72.25 | 27.75 | 4789.18 |

| 9 | 4789.18 | 71.84 | 28.16 | 4761.02 |

| 10 | 4761.02 | 71.42 | 28.58 | 4732.43 |

| 11 | 4732.43 | 70.99 | 29.01 | 4703.42 |

| 12 | 4703.42 | 70.55 | 29.45 | 4673.97 |

| 13 | 4673.97 | 70.11 | 29.89 | 4644.08 |

| 14 | 4644.08 | 69.66 | 30.34 | 4613.74 |

| 15 | 4613.74 | 69.21 | 30.79 | 4582.95 |

| 16 | 4582.95 | 68.74 | 31.26 | 4551.69 |

| 17 | 4551.69 | 68.28 | 31.72 | 4519.97 |

| 18 | 4519.97 | 67.80 | 32.20 | 4487.77 |

| 19 | 4487.77 | 67.32 | 32.68 | 4455.08 |

| 20 | 4455.08 | 66.83 | 33.17 | 4421.91 |

| 21 | 4421.91 | 66.33 | 33.67 | 4388.24 |

| 22 | 4388.24 | 65.82 | 34.18 | 4354.06 |

| 23 | 4354.06 | 65.31 | 34.69 | 4319.37 |

| 24 | 4319.37 | 64.79 | 35.21 | 4284.16 |

| 25 | 4284.16 | 64.26 | 35.74 | 4248.42 |

| 26 | 4248.42 | 63.73 | 36.27 | 4212.15 |

| 27 | 4212.15 | 63.18 | 36.82 | 4175.33 |

| 28 | 4175.33 | 62.63 | 37.37 | 4137.96 |

| 29 | 4137.96 | 62.07 | 37.93 | 4100.03 |

| 30 | 4100.03 | 61.50 | 38.50 | 4061.53 |

| 31 | 4061.53 | 60.92 | 39.08 | 4022.46 |

| 32 | 4022.46 | 60.34 | 39.66 | 3982.79 |

| 33 | 3982.79 | 59.74 | 40.26 | 3942.53 |

| 34 | 3942.53 | 59.14 | 40.86 | 3901.67 |

| 35 | 3901.67 | 58.53 | 41.47 | 3860.20 |

| 36 | 3860.20 | 57.90 | 42.10 | 3818.10 |

| 37 | 3818.10 | 57.27 | 42.73 | 3775.37 |

| 38 | 3775.37 | 56.63 | 43.37 | 3732.00 |

| 39 | 3732.00 | 55.98 | 44.02 | 3687.98 |

| 40 | 3687.98 | 55.32 | 44.68 | 3643.30 |

| 41 | 3643.30 | 54.65 | 45.35 | 3597.95 |

| 42 | 3597.95 | 53.97 | 46.03 | 3551.92 |

| 43 | 3551.92 | 53.28 | 46.72 | 3505.20 |

| 44 | 3505.20 | 52.58 | 47.42 | 3457.78 |

| 45 | 3457.78 | 51.87 | 48.13 | 3409.64 |

| 46 | 3409.64 | 51.14 | 48.86 | 3360.79 |

| 47 | 3360.79 | 50.41 | 49.59 | 3311.20 |

| 48 | 3311.20 | 49.67 | 50.33 | 3260.87 |

| 49 | 3260.87 | 48.91 | 51.09 | 3209.78 |

| 50 | 3209.78 | 48.15 | 51.85 | 3157.93 |

| 51 | 3157.93 | 47.37 | 52.63 | 3105.30 |

| 52 | 3105.30 | 46.58 | 53.42 | 3051.88 |

| 53 | 3051.88 | 45.78 | 54.22 | 2997.66 |

| 54 | 2997.66 | 44.96 | 55.04 | 2942.62 |

| 55 | 2942.62 | 44.14 | 55.86 | 2886.76 |

| 56 | 2886.76 | 43.30 | 56.70 | 2830.06 |

| 57 | 2830.06 | 42.45 | 57.55 | 2772.51 |

| 58 | 2772.51 | 41.59 | 58.41 | 2714.10 |

| 59 | 2714.10 | 40.71 | 59.29 | 2654.81 |

| 60 | 2654.81 | 39.82 | 60.18 | 2594.63 |

| 61 | 2594.63 | 38.92 | 61.08 | 2533.55 |

| 62 | 2533.55 | 38.00 | 62.00 | 2471.56 |

| 63 | 2471.56 | 37.07 | 62.93 | 2408.63 |

| 64 | 2408.63 | 36.13 | 63.87 | 2344.76 |

| 65 | 2344.76 | 35.17 | 64.83 | 2279.93 |

| 66 | 2279.93 | 34.20 | 65.80 | 2214.13 |

| 67 | 2214.13 | 33.21 | 66.79 | 2147.34 |

| 68 | 2147.34 | 32.21 | 67.79 | 2079.55 |

| 69 | 2079.55 | 31.19 | 68.81 | 2010.75 |

| 70 | 2010.75 | 30.16 | 69.84 | 1940.91 |

| 71 | 1940.91 | 29.11 | 70.89 | 1870.02 |

| 72 | 1870.02 | 28.05 | 71.95 | 1798.07 |

| 73 | 1798.07 | 26.97 | 73.03 | 1725.04 |

| 74 | 1725.04 | 25.88 | 74.12 | 1650.92 |

| 75 | 1650.92 | 24.76 | 75.24 | 1575.68 |

| 76 | 1575.68 | 23.64 | 76.36 | 1499.32 |

| 77 | 1499.32 | 22.49 | 77.51 | 1421.81 |

| 78 | 1421.81 | 21.33 | 78.67 | 1343.13 |

| 79 | 1343.13 | 20.15 | 79.85 | 1263.28 |

| 80 | 1263.28 | 18.95 | 81.05 | 1182.23 |

| 81 | 1182.23 | 17.73 | 82.27 | 1099.96 |

| 82 | 1099.96 | 16.50 | 83.50 | 1016.46 |

| 83 | 1016.46 | 15.25 | 84.75 | 931.71 |

| 84 | 931.71 | 13.98 | 86.02 | 845.68 |

| 85 | 845.68 | 12.69 | 87.31 | 758.37 |

| 86 | 758.37 | 11.38 | 88.62 | 669.74 |

| 87 | 669.74 | 10.05 | 89.95 | 579.79 |

| 88 | 579.79 | 8.70 | 91.30 | 488.49 |

| 89 | 488.49 | 7.33 | 92.67 | 395.82 |

| 90 | 395.82 | 5.94 | 94.06 | 301.75 |

| 91 | 301.75 | 4.53 | 95.47 | 206.28 |

| 92 | 206.28 | 3.09 | 96.91 | 109.37 |

| 93 | 109.37 | 1.64 | 98.36 | 11.01 |

| 94 | 11.01 | 0.17 | 99.83 | -88.82 |

Homework Sourse

Homework Sourse