The Empire Company issues 3 million in bonds on January 1 Ye

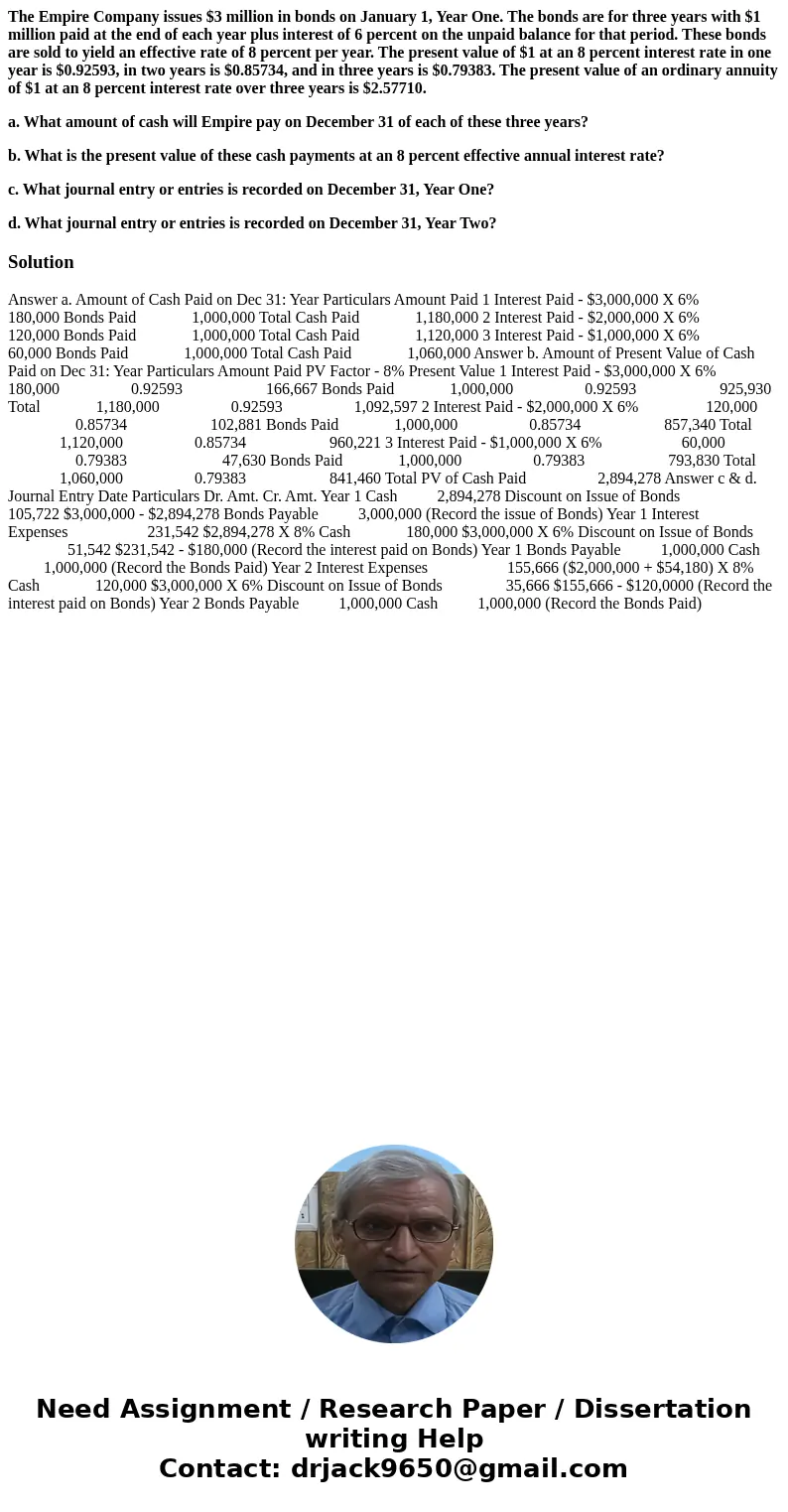

The Empire Company issues $3 million in bonds on January 1, Year One. The bonds are for three years with $1 million paid at the end of each year plus interest of 6 percent on the unpaid balance for that period. These bonds are sold to yield an effective rate of 8 percent per year. The present value of $1 at an 8 percent interest rate in one year is $0.92593, in two years is $0.85734, and in three years is $0.79383. The present value of an ordinary annuity of $1 at an 8 percent interest rate over three years is $2.57710.

a. What amount of cash will Empire pay on December 31 of each of these three years?

b. What is the present value of these cash payments at an 8 percent effective annual interest rate?

c. What journal entry or entries is recorded on December 31, Year One?

d. What journal entry or entries is recorded on December 31, Year Two?

Solution

Answer a. Amount of Cash Paid on Dec 31: Year Particulars Amount Paid 1 Interest Paid - $3,000,000 X 6% 180,000 Bonds Paid 1,000,000 Total Cash Paid 1,180,000 2 Interest Paid - $2,000,000 X 6% 120,000 Bonds Paid 1,000,000 Total Cash Paid 1,120,000 3 Interest Paid - $1,000,000 X 6% 60,000 Bonds Paid 1,000,000 Total Cash Paid 1,060,000 Answer b. Amount of Present Value of Cash Paid on Dec 31: Year Particulars Amount Paid PV Factor - 8% Present Value 1 Interest Paid - $3,000,000 X 6% 180,000 0.92593 166,667 Bonds Paid 1,000,000 0.92593 925,930 Total 1,180,000 0.92593 1,092,597 2 Interest Paid - $2,000,000 X 6% 120,000 0.85734 102,881 Bonds Paid 1,000,000 0.85734 857,340 Total 1,120,000 0.85734 960,221 3 Interest Paid - $1,000,000 X 6% 60,000 0.79383 47,630 Bonds Paid 1,000,000 0.79383 793,830 Total 1,060,000 0.79383 841,460 Total PV of Cash Paid 2,894,278 Answer c & d. Journal Entry Date Particulars Dr. Amt. Cr. Amt. Year 1 Cash 2,894,278 Discount on Issue of Bonds 105,722 $3,000,000 - $2,894,278 Bonds Payable 3,000,000 (Record the issue of Bonds) Year 1 Interest Expenses 231,542 $2,894,278 X 8% Cash 180,000 $3,000,000 X 6% Discount on Issue of Bonds 51,542 $231,542 - $180,000 (Record the interest paid on Bonds) Year 1 Bonds Payable 1,000,000 Cash 1,000,000 (Record the Bonds Paid) Year 2 Interest Expenses 155,666 ($2,000,000 + $54,180) X 8% Cash 120,000 $3,000,000 X 6% Discount on Issue of Bonds 35,666 $155,666 - $120,0000 (Record the interest paid on Bonds) Year 2 Bonds Payable 1,000,000 Cash 1,000,000 (Record the Bonds Paid)

Homework Sourse

Homework Sourse