Hello I need some assistance trying to understand these prac

Hello! I need some assistance, trying to understand these practice help and what i have on my notebook Im not sure is correct

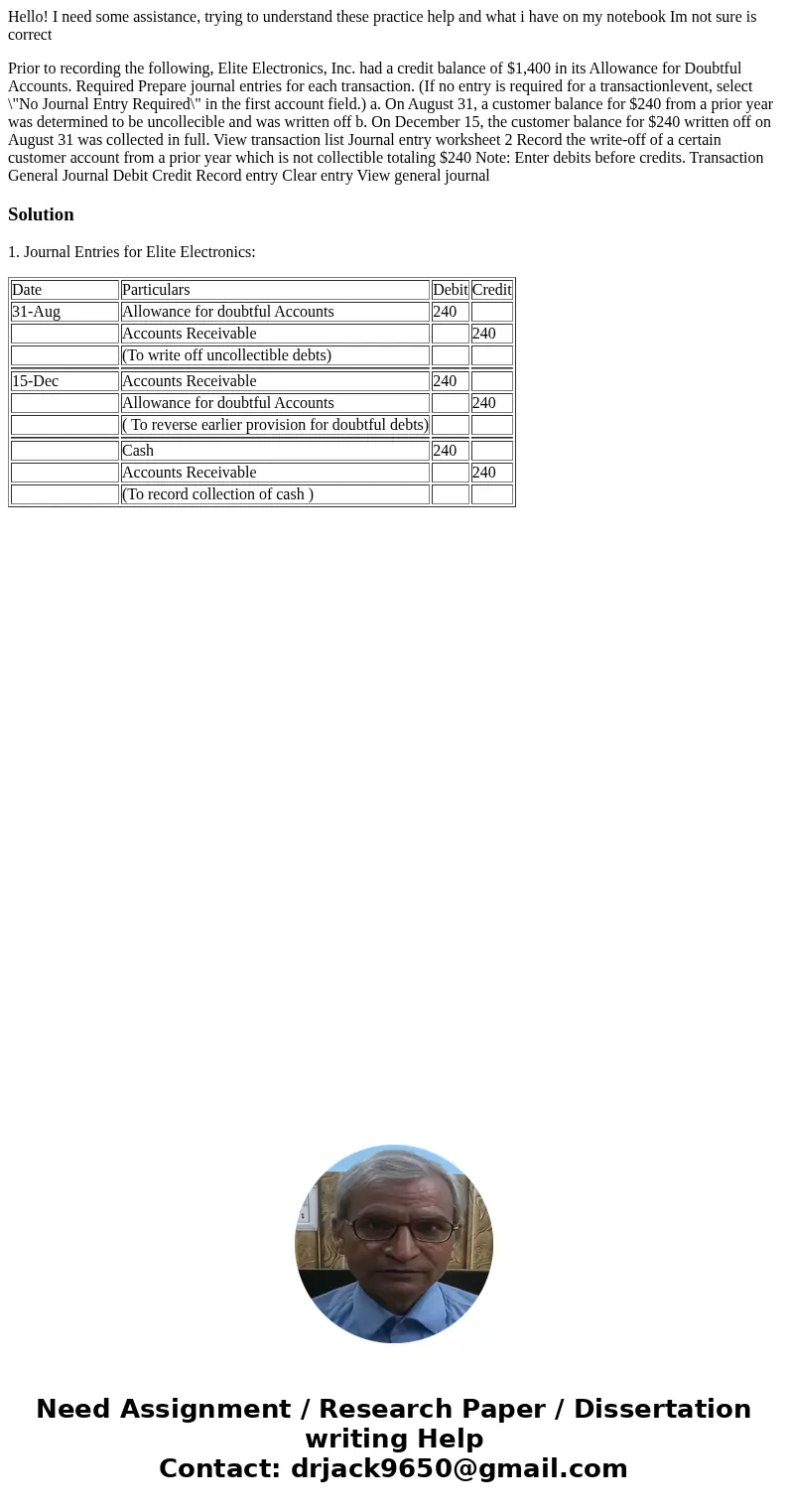

Prior to recording the following, Elite Electronics, Inc. had a credit balance of $1,400 in its Allowance for Doubtful Accounts. Required Prepare journal entries for each transaction. (If no entry is required for a transactionlevent, select \"No Journal Entry Required\" in the first account field.) a. On August 31, a customer balance for $240 from a prior year was determined to be uncollecible and was written off b. On December 15, the customer balance for $240 written off on August 31 was collected in full. View transaction list Journal entry worksheet 2 Record the write-off of a certain customer account from a prior year which is not collectible totaling $240 Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journalSolution

1. Journal Entries for Elite Electronics:

| Date | Particulars | Debit | Credit |

| 31-Aug | Allowance for doubtful Accounts | 240 | |

| Accounts Receivable | 240 | ||

| (To write off uncollectible debts) | |||

| 15-Dec | Accounts Receivable | 240 | |

| Allowance for doubtful Accounts | 240 | ||

| ( To reverse earlier provision for doubtful debts) | |||

| Cash | 240 | ||

| Accounts Receivable | 240 | ||

| (To record collection of cash ) |

Homework Sourse

Homework Sourse