Final Exam 07022018 3 When a bonds yield to maturity is less

Final Exam (07/02/2018) 3. When a bond\'s yield to maturity is less than the bond\'s coupon rate, the bond A. had to be recently issued is selling at a premium. C. has reached its maturity date. D. is priced at par. E. is selling at a discount. 5 percent bond of ABCO has a yield to maturity of 6.82 percent. The bond matures in seven years, has a face value of $1,000, and pays semiannual interest payments. What is the amount of each coupon payment? A. $30.00 B. $32.50 C. $68.20 D. $34.10 E. $65.00 t bond of JL Motoes has a face value of $1,000, a maturity of 7 years, semiannual S. The 4.5 percent interest payments, and a yield to maturity of 6.25 percent. What is the current market price of the bond? A. $945.08 B. $947.21 C. S903.05 D. $959.60 E. 5912.40

Solution

3) Bond is said to be at premium if bonds yTM is lower than coupon rate. this is because the reason of YTM lower than coupon rate is because of the negative yield due topremium price of the bonds which reduces the YTM of the bond as compared to coupon rate.

4) the face value of the bond is 1000$, the annual interest rate is 6.5%, hence semmiannual interest payment is 6.5/2 = 3.25%.

hence the semmiannual interest is equal to 3.25% *1000 = 32.5$

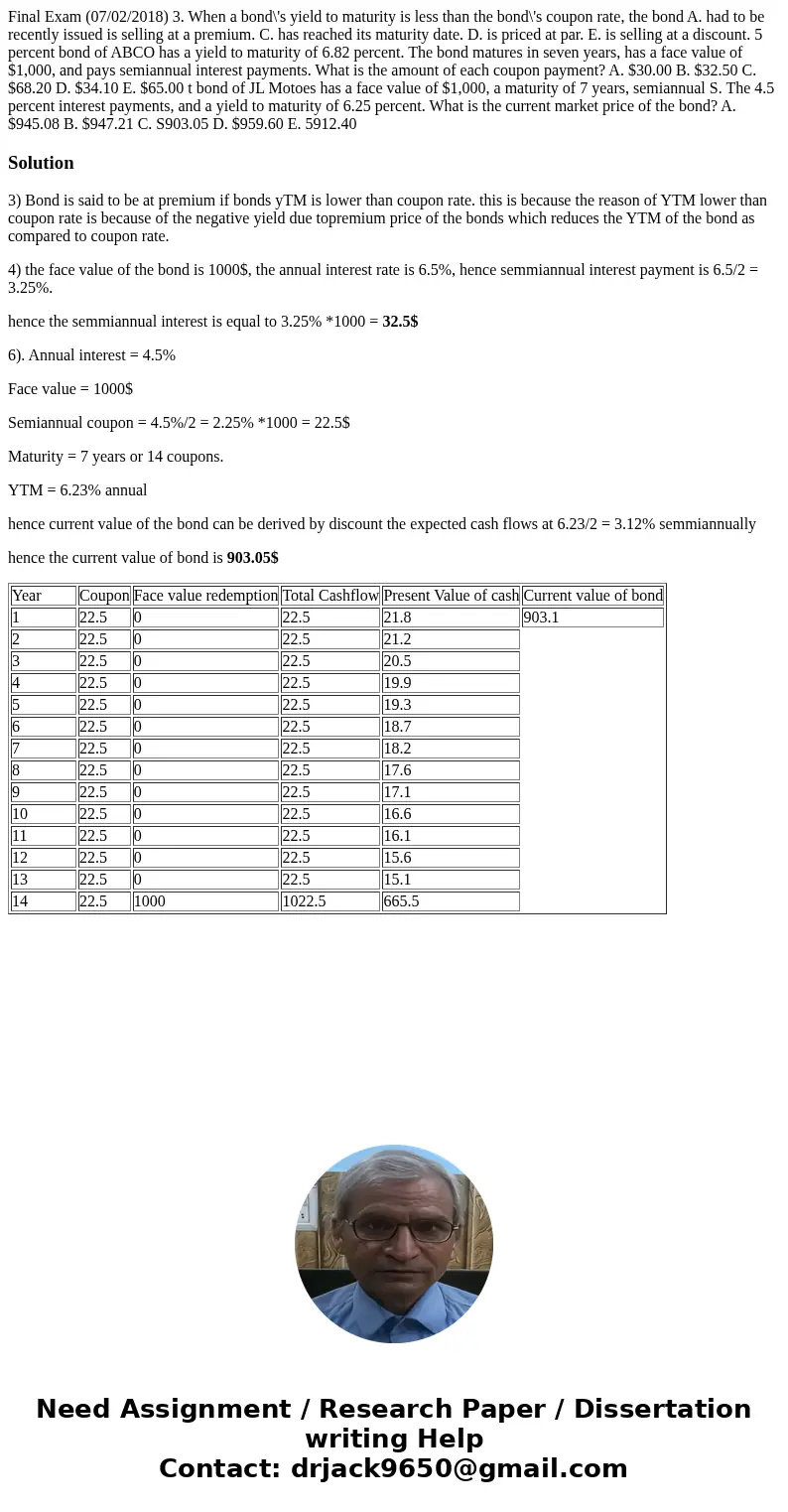

6). Annual interest = 4.5%

Face value = 1000$

Semiannual coupon = 4.5%/2 = 2.25% *1000 = 22.5$

Maturity = 7 years or 14 coupons.

YTM = 6.23% annual

hence current value of the bond can be derived by discount the expected cash flows at 6.23/2 = 3.12% semmiannually

hence the current value of bond is 903.05$

| Year | Coupon | Face value redemption | Total Cashflow | Present Value of cash | Current value of bond |

| 1 | 22.5 | 0 | 22.5 | 21.8 | 903.1 |

| 2 | 22.5 | 0 | 22.5 | 21.2 | |

| 3 | 22.5 | 0 | 22.5 | 20.5 | |

| 4 | 22.5 | 0 | 22.5 | 19.9 | |

| 5 | 22.5 | 0 | 22.5 | 19.3 | |

| 6 | 22.5 | 0 | 22.5 | 18.7 | |

| 7 | 22.5 | 0 | 22.5 | 18.2 | |

| 8 | 22.5 | 0 | 22.5 | 17.6 | |

| 9 | 22.5 | 0 | 22.5 | 17.1 | |

| 10 | 22.5 | 0 | 22.5 | 16.6 | |

| 11 | 22.5 | 0 | 22.5 | 16.1 | |

| 12 | 22.5 | 0 | 22.5 | 15.6 | |

| 13 | 22.5 | 0 | 22.5 | 15.1 | |

| 14 | 22.5 | 1000 | 1022.5 | 665.5 |

Homework Sourse

Homework Sourse