head but wants to convert John Corporation uses a traditiona

head but wants to convert John Corporation uses a traditional costing method to allocate over to activity-based costing. John produces Product X and Product Y. Produet hours of direct labor and Product Y requires 1 direct labor hour to produce a sing company has provided the following data concerning a activity-based costing systeni- requires 1.75 Total Cost Activity Cost Pools (and Activity Measures) $231 ,000 / tco Batch setup (setups) General factory (direct labor-hours).. $339,000 / 100cc: S193,200 4OB.6 Total Activity Product Y 7,000 6,000 10,500 Product X Total 10,000 10,000 14,000 Activity Cost Pools Machine related (machine hours)... 3,000 4,000 General factory (direct-labor hours).. 3,500 Batch setup (number of setups). 24. The predetermined overhcad rate per direct-labor hour under the traditional costing system is closest to: A)S 42.30 B) S 109.03 C)S 54.51 D) None of the above. 25. The predetermined overhead rate for machine related cost group under activity based costing system is: A) $23.10 $13.80 C) $33.90 D) None of the above 26. The predetermined overhead rate for batch setup cost group under system is A) $23.10 ) S13.80 $33.90 None of the above.

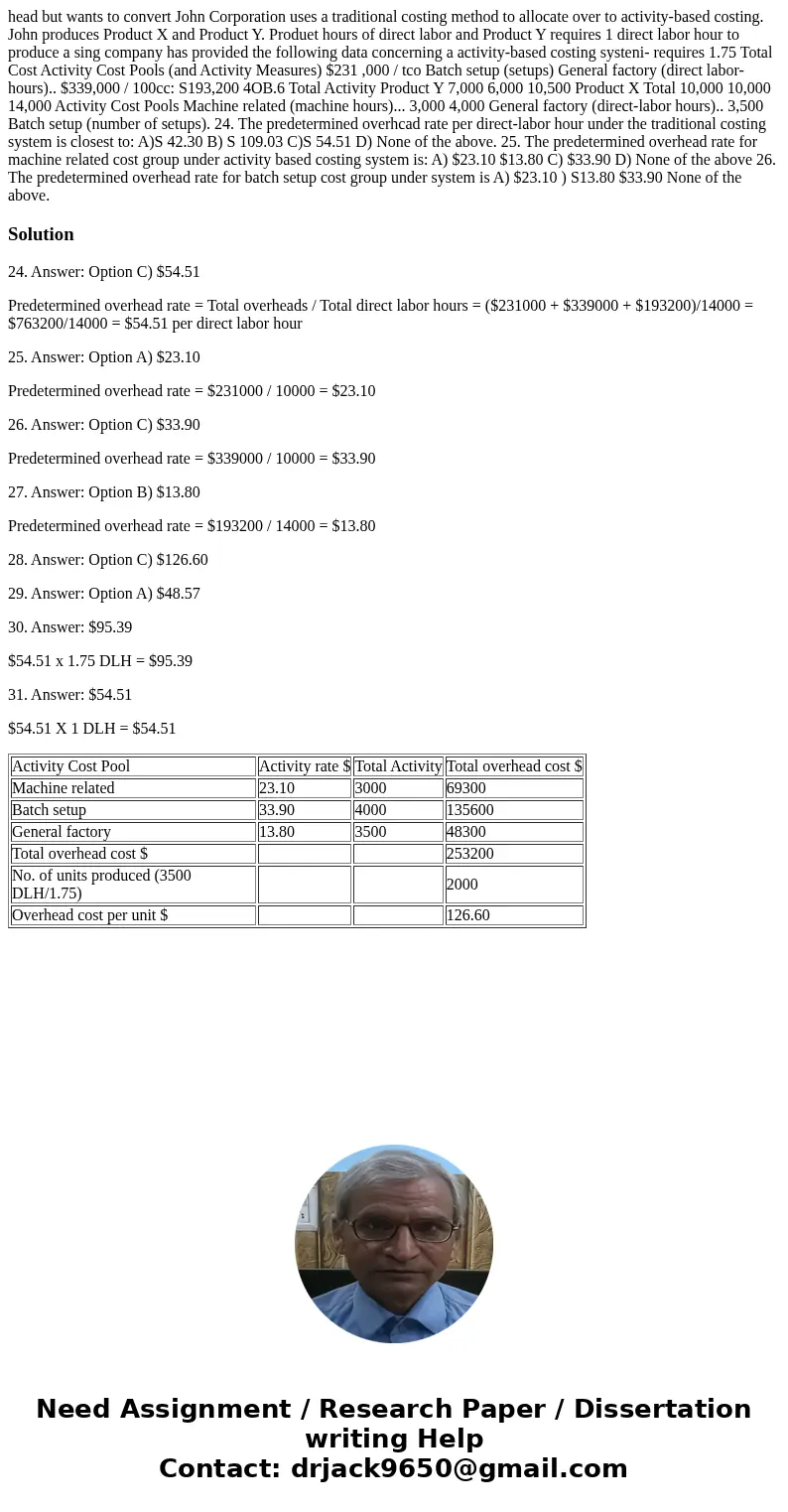

Solution

24. Answer: Option C) $54.51

Predetermined overhead rate = Total overheads / Total direct labor hours = ($231000 + $339000 + $193200)/14000 = $763200/14000 = $54.51 per direct labor hour

25. Answer: Option A) $23.10

Predetermined overhead rate = $231000 / 10000 = $23.10

26. Answer: Option C) $33.90

Predetermined overhead rate = $339000 / 10000 = $33.90

27. Answer: Option B) $13.80

Predetermined overhead rate = $193200 / 14000 = $13.80

28. Answer: Option C) $126.60

29. Answer: Option A) $48.57

30. Answer: $95.39

$54.51 x 1.75 DLH = $95.39

31. Answer: $54.51

$54.51 X 1 DLH = $54.51

| Activity Cost Pool | Activity rate $ | Total Activity | Total overhead cost $ |

| Machine related | 23.10 | 3000 | 69300 |

| Batch setup | 33.90 | 4000 | 135600 |

| General factory | 13.80 | 3500 | 48300 |

| Total overhead cost $ | 253200 | ||

| No. of units produced (3500 DLH/1.75) | 2000 | ||

| Overhead cost per unit $ | 126.60 |

Homework Sourse

Homework Sourse