Complete the below table to calculate the price of a 17 mill

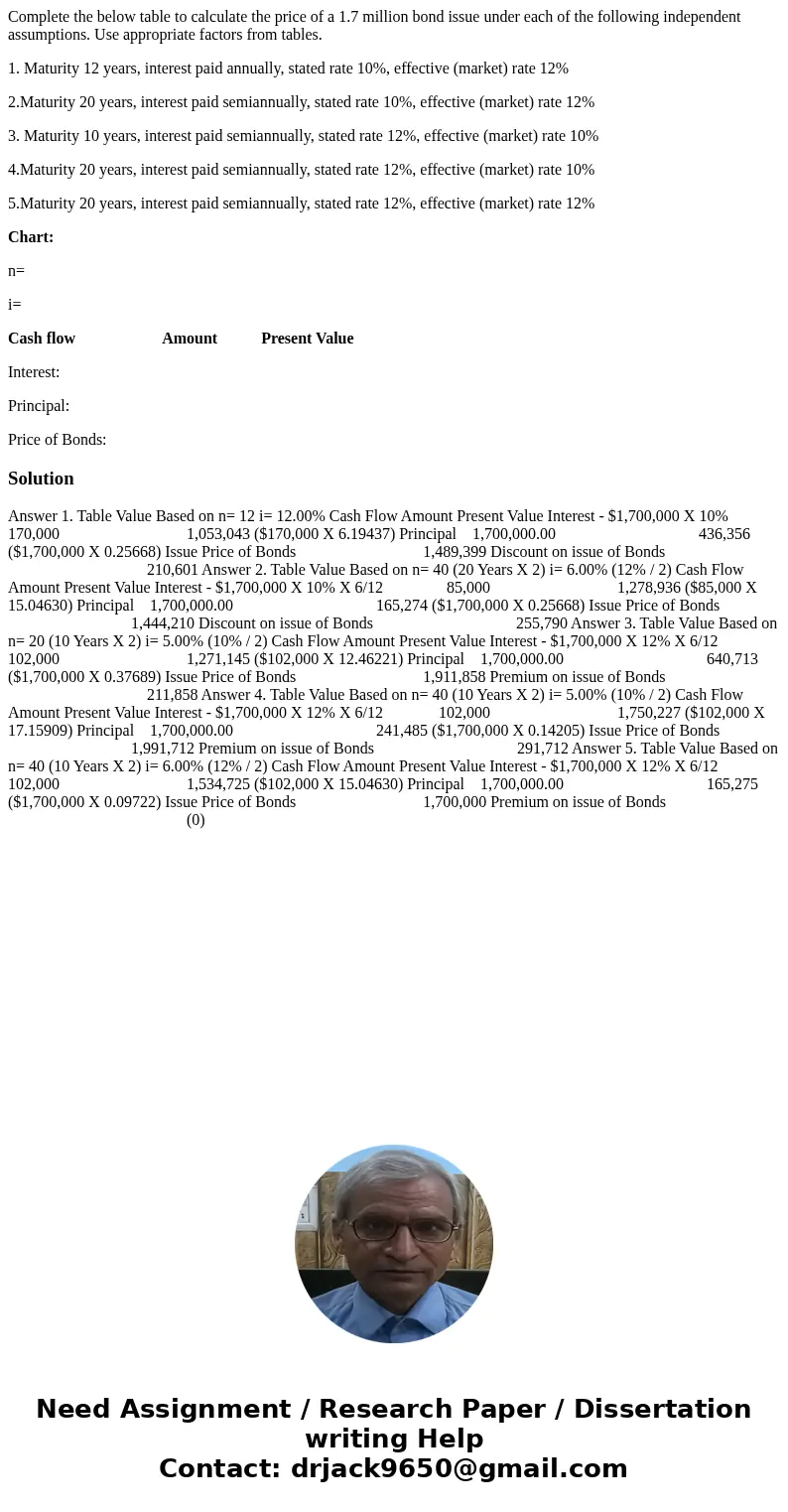

Complete the below table to calculate the price of a 1.7 million bond issue under each of the following independent assumptions. Use appropriate factors from tables.

1. Maturity 12 years, interest paid annually, stated rate 10%, effective (market) rate 12%

2.Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%

3. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%

4.Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%

5.Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%

Chart:

n=

i=

Cash flow Amount Present Value

Interest:

Principal:

Price of Bonds:

Solution

Answer 1. Table Value Based on n= 12 i= 12.00% Cash Flow Amount Present Value Interest - $1,700,000 X 10% 170,000 1,053,043 ($170,000 X 6.19437) Principal 1,700,000.00 436,356 ($1,700,000 X 0.25668) Issue Price of Bonds 1,489,399 Discount on issue of Bonds 210,601 Answer 2. Table Value Based on n= 40 (20 Years X 2) i= 6.00% (12% / 2) Cash Flow Amount Present Value Interest - $1,700,000 X 10% X 6/12 85,000 1,278,936 ($85,000 X 15.04630) Principal 1,700,000.00 165,274 ($1,700,000 X 0.25668) Issue Price of Bonds 1,444,210 Discount on issue of Bonds 255,790 Answer 3. Table Value Based on n= 20 (10 Years X 2) i= 5.00% (10% / 2) Cash Flow Amount Present Value Interest - $1,700,000 X 12% X 6/12 102,000 1,271,145 ($102,000 X 12.46221) Principal 1,700,000.00 640,713 ($1,700,000 X 0.37689) Issue Price of Bonds 1,911,858 Premium on issue of Bonds 211,858 Answer 4. Table Value Based on n= 40 (10 Years X 2) i= 5.00% (10% / 2) Cash Flow Amount Present Value Interest - $1,700,000 X 12% X 6/12 102,000 1,750,227 ($102,000 X 17.15909) Principal 1,700,000.00 241,485 ($1,700,000 X 0.14205) Issue Price of Bonds 1,991,712 Premium on issue of Bonds 291,712 Answer 5. Table Value Based on n= 40 (10 Years X 2) i= 6.00% (12% / 2) Cash Flow Amount Present Value Interest - $1,700,000 X 12% X 6/12 102,000 1,534,725 ($102,000 X 15.04630) Principal 1,700,000.00 165,275 ($1,700,000 X 0.09722) Issue Price of Bonds 1,700,000 Premium on issue of Bonds (0)

Homework Sourse

Homework Sourse