A company can sell 25000 tarts at 450 and 225000 doughnuts a

A company can sell 25,000 tarts at $4.50 and 225,000 doughnuts at $1. What\'s the break-even point in unit and sales dollars for each? Fixed costs are $125,000. Variable costs are .40 for doughnuts and $1.80 for tarts.

Solution

Answer

Tarts

Doughnuts

Sale Price

4.5

1

Variable cost

1.8

0.4

Contribution Margin

2.7

0.6

Units [total = 250000]

25000

225000

% of total mix of 250000 units

10%

90%

Tarts

Doughnuts

Total

Units

25000

225000

250000

Total contribution margin

[25000 x 2.7] 67500

[225000 x 0.6] 135000

202500

Total contribution

202500

Total units

250000

Weighted Average contribution margin per unit

0.81

A

Total Fixed Cost

125000

B

Weighted Average contribution margin

0.81

C=A/B

Break Even point in Units

154321

D=10% of C

Tarts 10%

15432

E=90% of C

Doughnuts 90%

138889

Break Even units (A)

Sale Price (B)

Break Even in Sales Dollars (A x B)

Tarts

15432

4.5

69444

Doughnuts

138889

1

138889

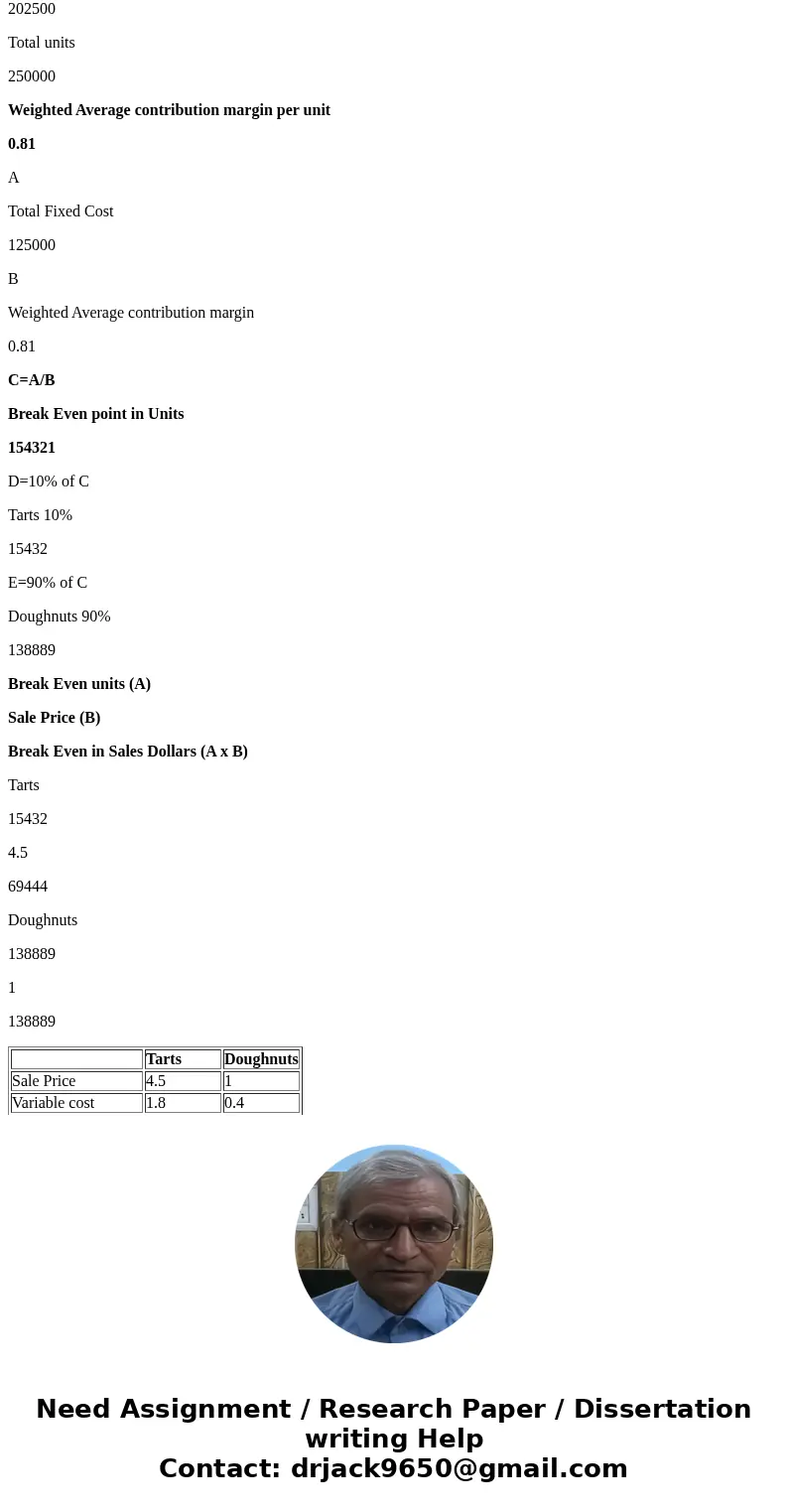

| Tarts | Doughnuts | |

| Sale Price | 4.5 | 1 |

| Variable cost | 1.8 | 0.4 |

| Contribution Margin | 2.7 | 0.6 |

| Units [total = 250000] | 25000 | 225000 |

| % of total mix of 250000 units | 10% | 90% |

Homework Sourse

Homework Sourse