In his business John uses accrual accounting He provides you

In his business John uses accrual accounting. He provides you with the following information for the year ended 30/6/2017. SailAway is not a small business. All amounts exclude GST Receipts 127,0 Cash sales of boats and fittings Debtors from the sale of new and second-hand boats 338,00 7,0 13,00 Insurance proceeds: storm damage to boats and sails storm damage to broken windows and carpets Bank loan to enable repairs to be made to a number of boats recently traded-in (Funds were borrowed on 1/10/2016. The loan, at 4.99%, is due for repayment on 30/9/2021 Bad debt recovered (debt written off in 2014/15 11,0 4,0 Payments Advertising (Note 1 Cash drawings Cash purchases of trading stock Council rates business Creditors from purchase of trading stock Entertainment of suppliers and high-end customers Income tax instalments for the business Legal expenses in relation to the bank loan Motor vehicle expenses (Note 2) Repairs to storm damage Staff wages Superannuation for staff Repairs to boats traded-in (Note 3 6,5 90,00 78,0 6,0 138,00 15,6 41,50 20 6,40 18,5 80,00 7,60 15,00

Solution

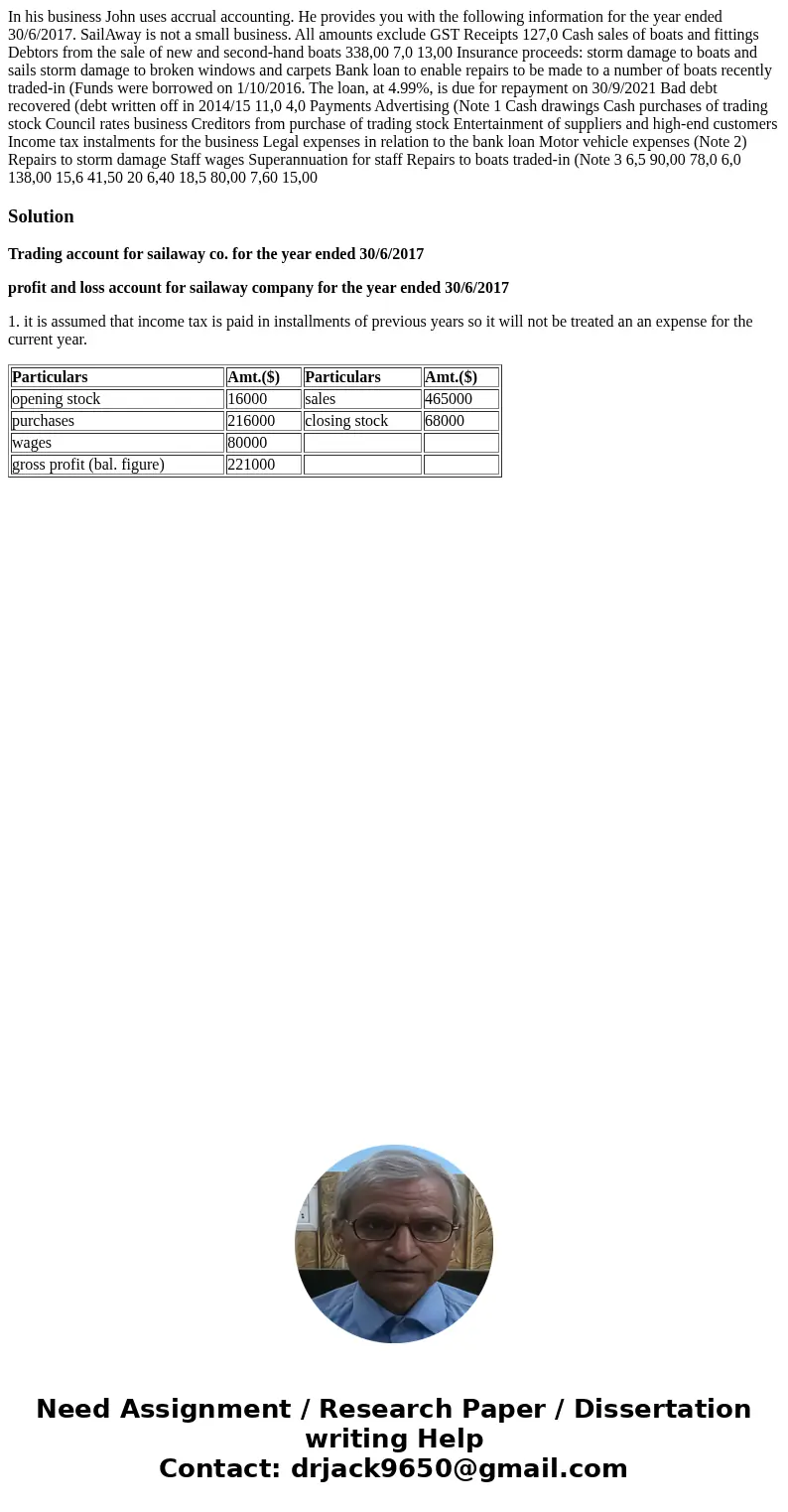

Trading account for sailaway co. for the year ended 30/6/2017

profit and loss account for sailaway company for the year ended 30/6/2017

1. it is assumed that income tax is paid in installments of previous years so it will not be treated an an expense for the current year.

| Particulars | Amt.($) | Particulars | Amt.($) |

| opening stock | 16000 | sales | 465000 |

| purchases | 216000 | closing stock | 68000 |

| wages | 80000 | ||

| gross profit (bal. figure) | 221000 |

Homework Sourse

Homework Sourse