Accruals Deferrals and the Worksheet Balance Sheet McCormick

Accruals, Deferrals, and the Worksheet Balance Sheet McCormick and Company, Incorporated reported the following in its 2012 Annu 434 CHAPTER 12 al Report a. The an b. Rent Consolidated Balance Sheet 6. There is 2012 only on 2011 Answers f 1. The A 2. The Assets $ 79.0 465.9 615.0 125.5 S 53.9 427.0 613.7 128.3 1,222.9 523.1 1,285.4 Total current assets Property, plant, and equipment, net 547.3 Analyze: d. 1. Based on the information presented above, which categories might require adjusting djusting entries a the end of an operating period? 3. 2. List the potential adjusting entries. Disregard dollar amounts. 3. By what percentage did McCormick\'s cash and cash equivalents increase from 201 l to 201 5. 6. Both Sellers and Servers Adjust Accruals and deferrals can vary for each company. The adjusting entries for a service company will differ from those of a merchandising company. Brainstorm the adjusting entries similarities and dif ferences for a service company and a merchandising company. TEAMWORK There Is Help for Preparing a Trial Balance The trial balance worksheet is an organizational tool to view the accruals and deferrals on one pice Internet CONNECTION of paper. Use your search engine to search for Trial Balance Worksheet Templates. Download sev- eral different forms of worksheets and notice the number of helpful Excel templates available to download. Answers to Self Reviews

Solution

1. Following Categories require might require adjusting entries are Trade account receivables, Prepaid Expenses and Property Plant and Equipment.

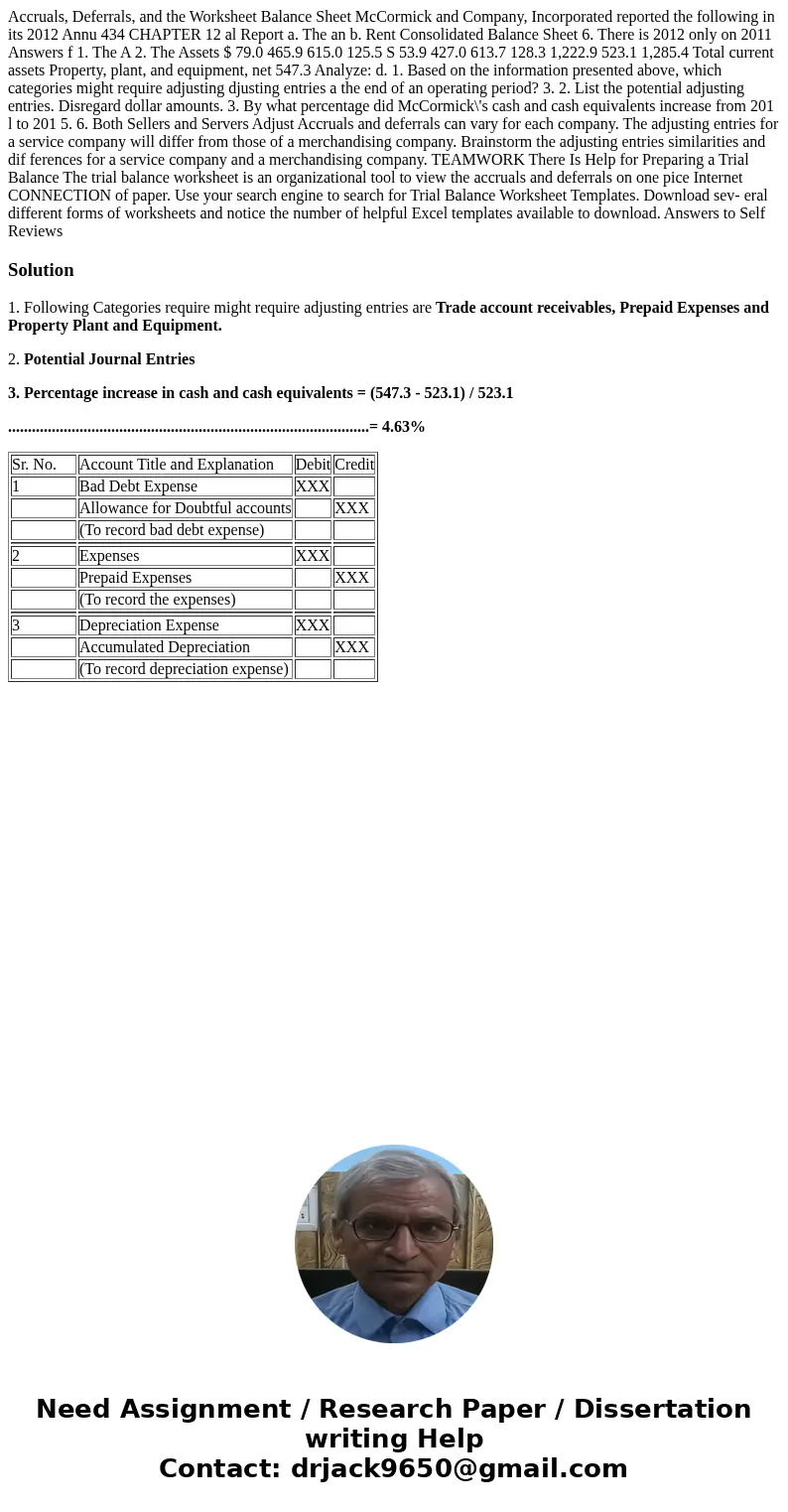

2. Potential Journal Entries

3. Percentage increase in cash and cash equivalents = (547.3 - 523.1) / 523.1

...........................................................................................= 4.63%

| Sr. No. | Account Title and Explanation | Debit | Credit |

| 1 | Bad Debt Expense | XXX | |

| Allowance for Doubtful accounts | XXX | ||

| (To record bad debt expense) | |||

| 2 | Expenses | XXX | |

| Prepaid Expenses | XXX | ||

| (To record the expenses) | |||

| 3 | Depreciation Expense | XXX | |

| Accumulated Depreciation | XXX | ||

| (To record depreciation expense) |

Homework Sourse

Homework Sourse