Your pension plan is an annuity with a guaranteed return of

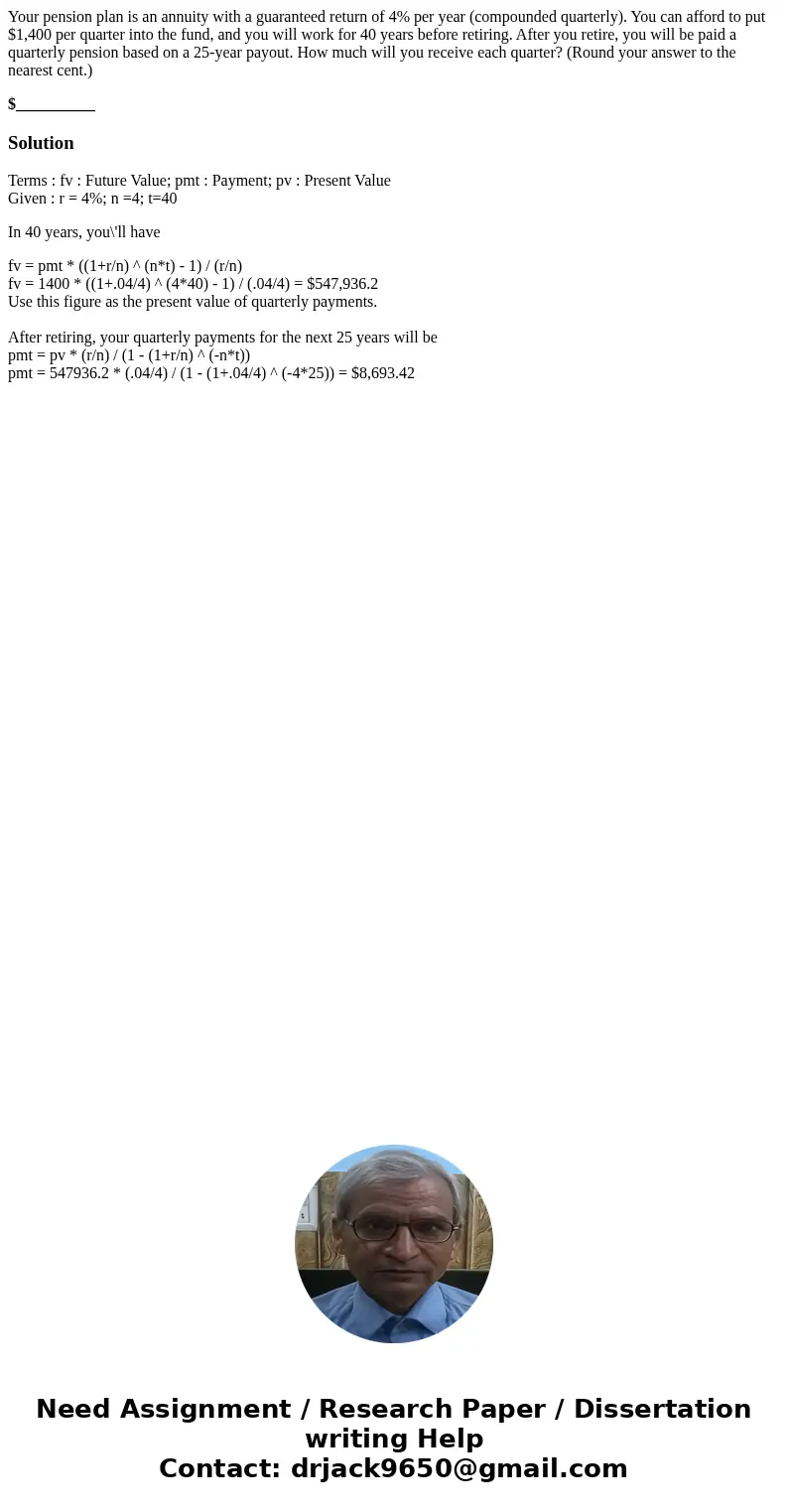

Your pension plan is an annuity with a guaranteed return of 4% per year (compounded quarterly). You can afford to put $1,400 per quarter into the fund, and you will work for 40 years before retiring. After you retire, you will be paid a quarterly pension based on a 25-year payout. How much will you receive each quarter? (Round your answer to the nearest cent.)

$__________

Solution

Terms : fv : Future Value; pmt : Payment; pv : Present Value

Given : r = 4%; n =4; t=40

In 40 years, you\'ll have

fv = pmt * ((1+r/n) ^ (n*t) - 1) / (r/n)

fv = 1400 * ((1+.04/4) ^ (4*40) - 1) / (.04/4) = $547,936.2

Use this figure as the present value of quarterly payments.

After retiring, your quarterly payments for the next 25 years will be

pmt = pv * (r/n) / (1 - (1+r/n) ^ (-n*t))

pmt = 547936.2 * (.04/4) / (1 - (1+.04/4) ^ (-4*25)) = $8,693.42

Homework Sourse

Homework Sourse