PR 132A Statement of cash flowsindirect method and The compa

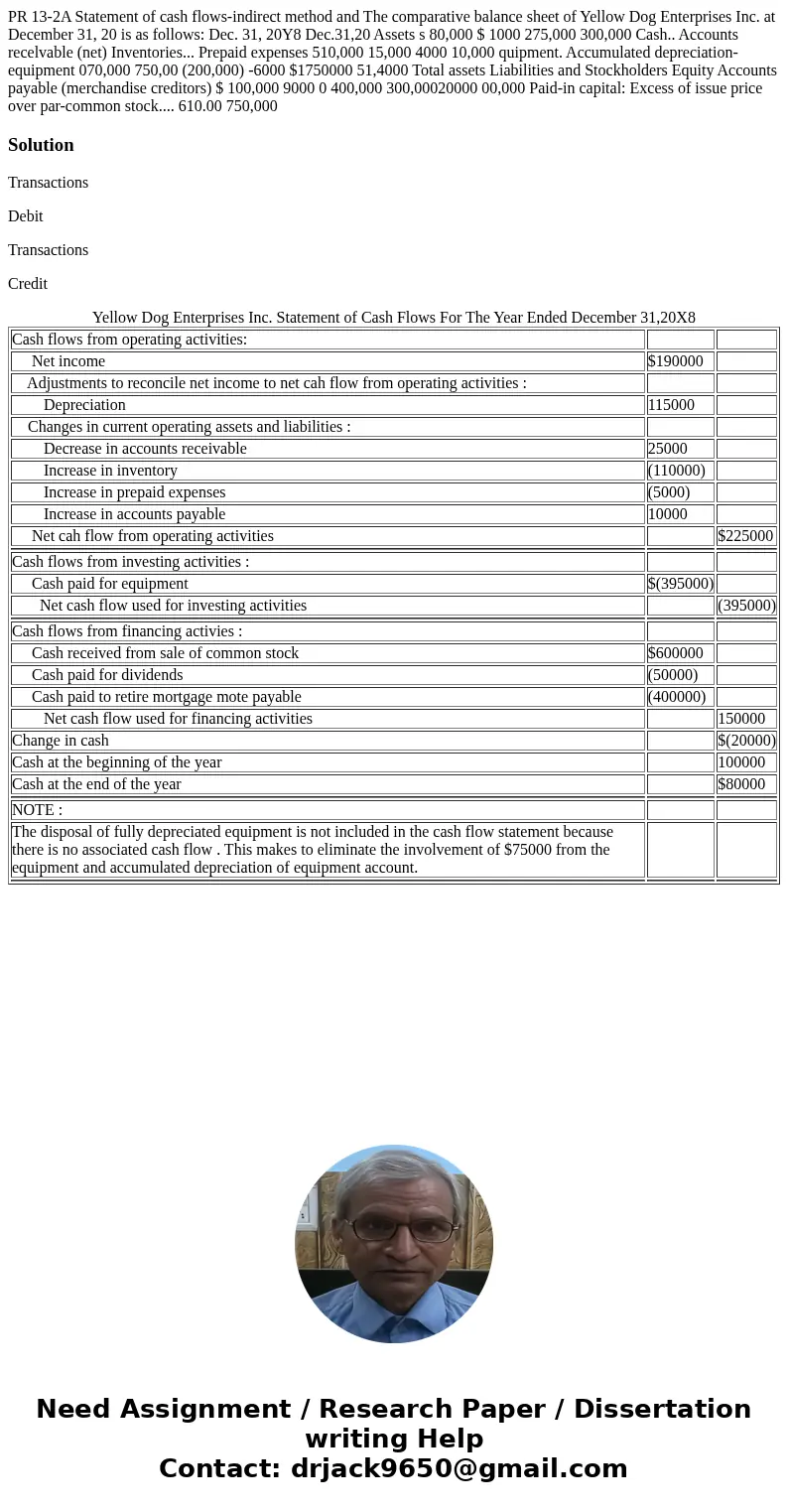

PR 13-2A Statement of cash flows-indirect method and The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20 is as follows: Dec. 31, 20Y8 Dec.31,20 Assets s 80,000 $ 1000 275,000 300,000 Cash.. Accounts recelvable (net) Inventories... Prepaid expenses 510,000 15,000 4000 10,000 quipment. Accumulated depreciation-equipment 070,000 750,00 (200,000) -6000 $1750000 51,4000 Total assets Liabilities and Stockholders Equity Accounts payable (merchandise creditors) $ 100,000 9000 0 400,000 300,00020000 00,000 Paid-in capital: Excess of issue price over par-common stock.... 610.00 750,000

Solution

Transactions

Debit

Transactions

Credit

| Cash flows from operating activities: | ||

| Net income | $190000 | |

| Adjustments to reconcile net income to net cah flow from operating activities : | ||

| Depreciation | 115000 | |

| Changes in current operating assets and liabilities : | ||

| Decrease in accounts receivable | 25000 | |

| Increase in inventory | (110000) | |

| Increase in prepaid expenses | (5000) | |

| Increase in accounts payable | 10000 | |

| Net cah flow from operating activities | $225000 | |

| Cash flows from investing activities : | ||

| Cash paid for equipment | $(395000) | |

| Net cash flow used for investing activities | (395000) | |

| Cash flows from financing activies : | ||

| Cash received from sale of common stock | $600000 | |

| Cash paid for dividends | (50000) | |

| Cash paid to retire mortgage mote payable | (400000) | |

| Net cash flow used for financing activities | 150000 | |

| Change in cash | $(20000) | |

| Cash at the beginning of the year | 100000 | |

| Cash at the end of the year | $80000 | |

| NOTE : | ||

| The disposal of fully depreciated equipment is not included in the cash flow statement because there is no associated cash flow . This makes to eliminate the involvement of $75000 from the equipment and accumulated depreciation of equipment account. | ||

Homework Sourse

Homework Sourse