Your company is considering a 4year expansion project that r

Your company is considering a 4-year expansion project that requires an initial fixed asset investment of $157,000. The fixed asset will be depreciated straight-line to zero over its 4-year life. The project is estimated to generate $150,000 in annual sales, with costs of $52,000. The project requires an initial investment in net working capital of $15,000, and the fixed asset will be sold for $13,000 at the end of the project. The tax rate is 25%, and the required return is 11%. Find the NPV of the project. Round your answer to the nearest dollar, for example 10789.

Solution

1.Straight Line Depreciation = $36,000 per year

Straight Line Depreciation for each year

= [ Cost of the machine – Salvage Value ] / Useful life

= [$157000-13000 ] / 4 Years

= $36,000 per year

2.Expected Net Income and Net cash Flow

EXPECTED NET INCOME

Revenues

Sales

1,50,000

Expenses

Cost

52,000

Straight Line Depreciation

36,000

88,000

Income Before Taxes

62,000

Income Tax Expense@25%

$15,500

Net Income

$ 46,500

EXPECTED CASH FLOW

Net Income

$ 46500

Straight Line Depreciation

$36000

Expected Cash Flow

$82500

Chart values are based on

N=

11%

I=

4 Years

Cash flow

Select chart

Amount

PV Factor

Present Value

Annual cash flow

Present value of annuity of $1

$82500

3.1024

$2,55,952

Residual Value

Present Value of $1

$13,000+15000=28000

0.6587

$18,444

Present Value of cash inflows

$2,74,396

Present Value of cash outflows

157,000+15000=172000

$172000

Net Present Value

$1,02,396

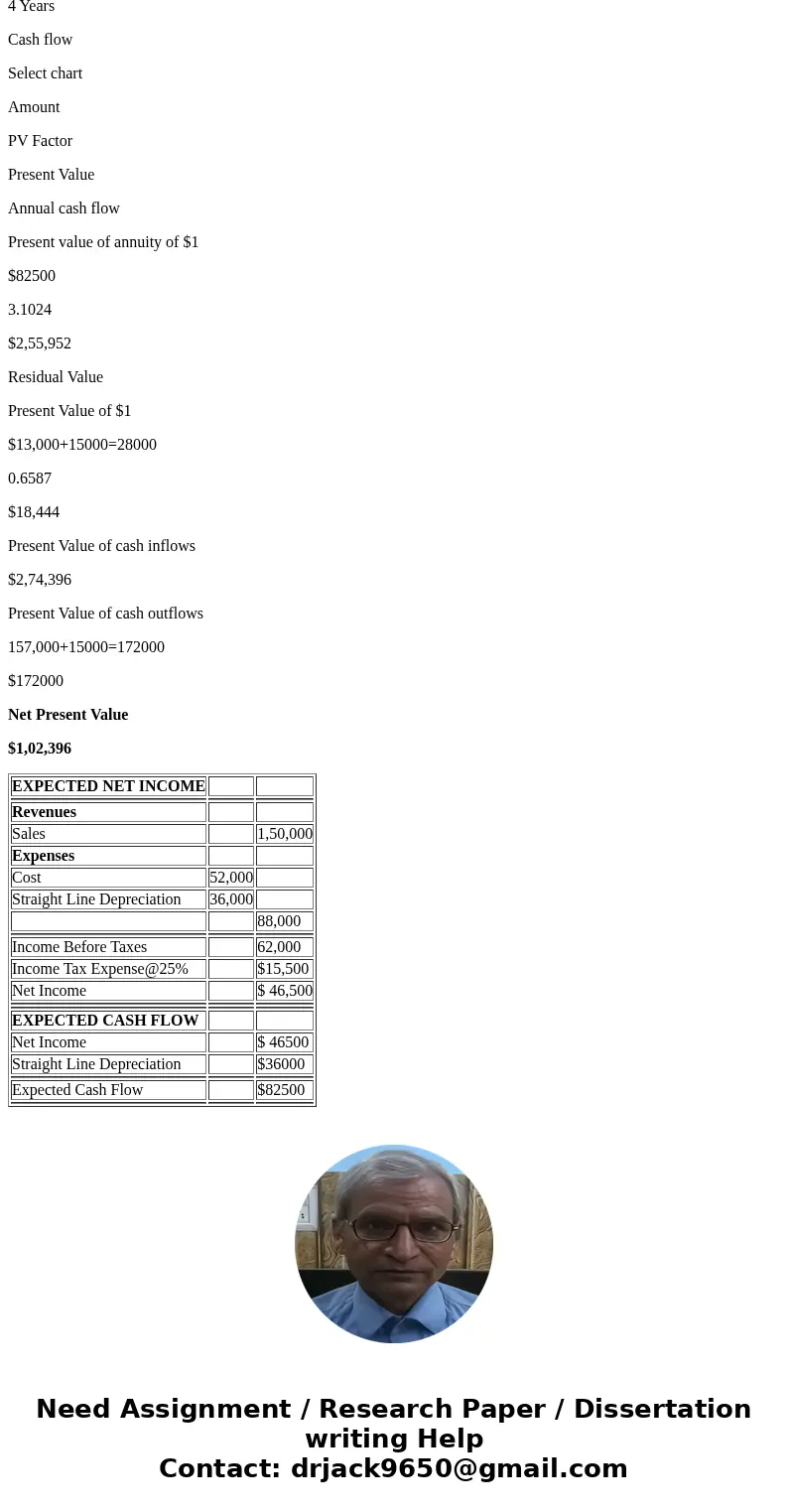

| EXPECTED NET INCOME | ||

| Revenues | ||

| Sales | 1,50,000 | |

| Expenses | ||

| Cost | 52,000 | |

| Straight Line Depreciation | 36,000 | |

| 88,000 | ||

| Income Before Taxes | 62,000 | |

| Income Tax Expense@25% | $15,500 | |

| Net Income | $ 46,500 | |

| EXPECTED CASH FLOW | ||

| Net Income | $ 46500 | |

| Straight Line Depreciation | $36000 | |

| Expected Cash Flow | $82500 | |

Homework Sourse

Homework Sourse